TSP’s G-fund: Nag or derby winner?

Each time there is an economic bump in the road, and this one is more like a sink hole, some people panic. Which is where the super-safe, never-has-a-bad-day G fund...

With inflation running at 8.3% year-to-year many federal-military Thrift Savings Plan investors are looking for a safer haven both for their current account balance and future purchases.

After a record long run, the stock market has been acting funny. A European war, worldwide pandemic and broken supply chain will do that. Both to stock markets and our mental wellness.

The price-at-the-pump, which the media and politicians love to track, has never been higher. And an 80-1 odds late starter won the Kentucky Derby. Go figure!

Each time there is an economic bump in the road, and this one is more like a sink hole, some people panic. And feel they need to do something. Anything, but something. And sometimes they are correct. Which is where the super-safe, never-has-a-bad-day G fund comes in. Of all the options in the TSP, it is the only one that doesn’t have a government guarantee that it will not lose money. While stock indexed funds like the C, S and I options have by far the best track record, they can and do tank — and currently have. So in that sense the G fund (even with its 0.65% return) looks good. Low as that is, it’s the highest in decades. So it fits the definition of a safe haven. But not by much…

Many financial planners say that depends on what the definition of safe is. If it’s not losing money, bingo! But if it is also not keeping pace with inflation that also means that overtime your nest egg will shrink in value. A 3% return, over time, isn’t much comfort if your available funds shrink in value. Federal CSRS retirees get full inflation adjustments each January, like Social Security. But for FERS retirees, which includes most current workers, there is a diet COLA feature. Over times of high (3% or more) inflation that diet offset can reduce the buying power of retirees dramatically. So I asked Arthur Stein, a well-known Washington area financial planner for his thoughts on the G-fund. Most of his clients are active or retired feds. Several are TSP millionaires. And he’s a frequent guest on FNNs Your Turn radio show on Wednesdays. Here’s what he said:

There are two advantages to the G Fund: Zero volatility and all holdings are guaranteed by the government.

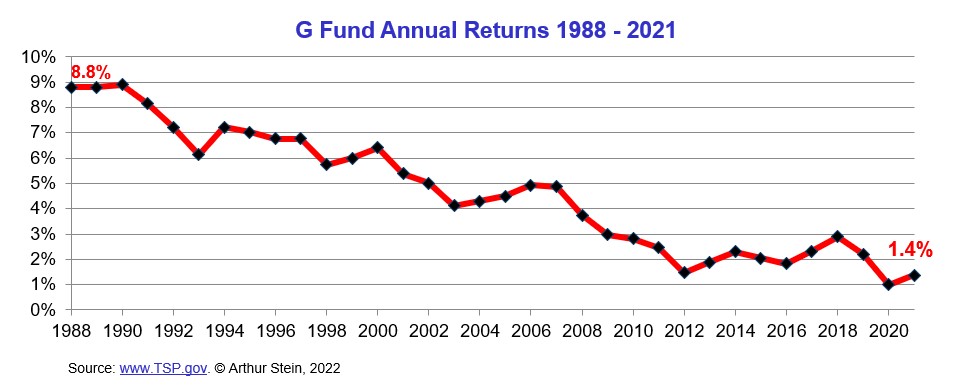

However, G (and F) Fund investors need to recognize that, historically, long-term investments in the G and F Funds lost purchasing power. G Fund annual returns have gradually declined since it was introduced in April of 1987. In 2021, the return was 1.4%, 84% lower than in 1988. The cost of living (inflation) more than doubled over this period.

That leaves TSP participants with a dilemma. Should they invest for:

- The lower volatility and lower chance of losing principal (“safety”) offered by the G and F (bond) Funds and accept the higher chance of declines in purchasing power; or

- The higher potential growth historically offered by the stock funds, accepting higher volatility and market declines for the opportunity to increase purchasing power.

Nearly Useless Factoid

Surgeons perform better when listening to music; in one study, AC/DC led to better performance than the Beatles.

Source: National Library of Medicine

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED

Related Stories