For many federal employees, health and retirement benefits are what’s keeping them on the job

Employees overwhelmingly see the importance and value in existing federal health and retirement benefits, and in many cases, these programs are a top recruitmen...

Existing health and retirement benefits are a significant incentive for employees to take or keep a job in the federal government, according to the latest survey results from the Office of Personnel Management.

About 70% of those who took OPM’s 2019 benefits survey said the ability to receive insurance through the Federal Employee Health Benefits Program influenced their decision to a “great or moderate” extent to take a job in government, while 80% said the program influenced their decision to keep their jobs.

Federal retirement programs had a similar impact on recruitment and retention efforts.

The Thrift Savings Plan influenced 69% of employees to take a position in the federal government and 82% of respondents to keep their jobs. The availability of a retirement annuity influenced 79% of employees to take a job in the federal government and 89% of respondents to keep that job.

The Federal Employee Benefits Survey, which OPM conducts on a biannual basis, is designed to solicit feedback on employee health, retirement, life insurance and other benefits programs among a sampling of the workforce.

The agency made the 2019 results available this week.

“OPM is dedicated to providing the best possible benefits to employees across the federal government,” Michael Rigas, the agency’s acting director, said in a statement. “Feedback from federal workers provided through the Federal Employee Benefits Survey is crucial to helping us achieve this goal, as well as providing insight that allows us to continuously improve our services and operations.”

Employees rated the Thrift Savings Plan most highly, with 96% of respondents describing the plan as “extremely important” or “important.”

The federal retirement annuity and retiree health benefits were ranked second and third among respondents.

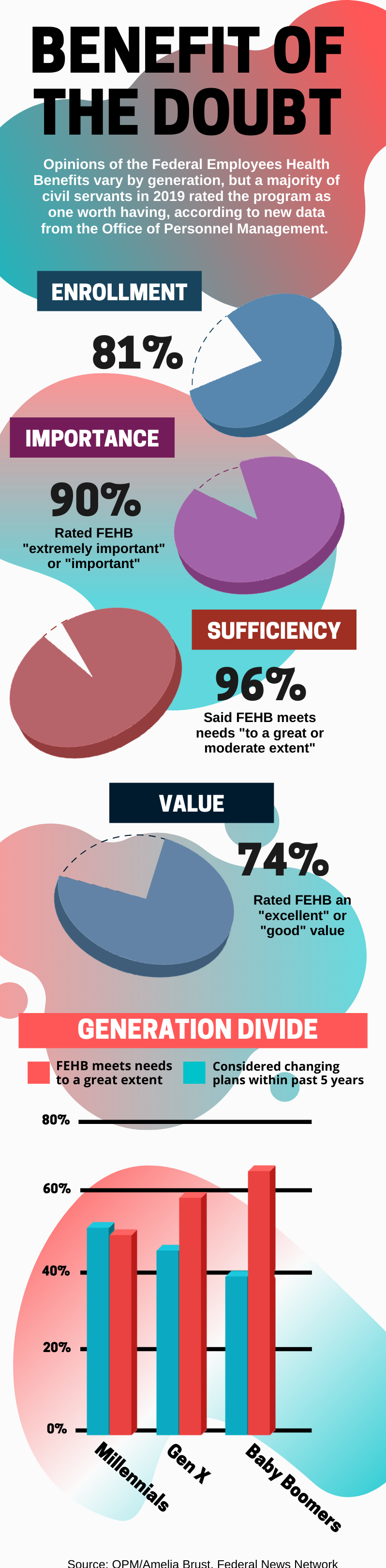

About 90% of employees said the Federal Employee Health Benefits Program (FEHBP) was important, and 96% said the program met their needs to a great or moderate extent.

OPM noted some generational differences in how employees view their health insurance program. For 70% of baby boomers, the FEHB meets their needs to a “great extent.” But 63% of Generation X and 53% of millennials said the health program greatly meets their needs.

Millennials are also more likely to consider switching their FEHB plans, with 55% having considered a change within the last five years, compared to 42% of baby boomers and 49% of Generation X. Few federal employees change plans during any given year, but OPM has consistently said more actually can and should consider other options.

Employees ranked the TSP as having the best bang for their buck, with 88% of respondents describing the plan as having excellent or good value. Both the FEHB and the Federal Employees Dental and Vision Insurance Program tied for second in value.

Other benefit programs hold less meaning and importance, and far fewer employees are enrolled in them.

Just 9% of respondents are enrolled in the Federal Long Term Care Insurance Program (FLTCIP), though the numbers are consistent with industry trends, OPM noted.

Employee perceptions of the program are mixed, with 67% respondents describing it as a good or excellent value for the money.

And though the Federal Flexible Spending Account Program (FSAFEDS) has relatively low enrollment, more than 90% said it met their needs to a moderate or great extent.

Employees said they lack information and awareness of FSAFEDS and the long-term care programs, meaning they’re less likely to enroll.

OPM also gauged employees’ interest in a variety of other benefits not currently available to the federal workforce.

A majority of respondents, some 48%, said they were most interested in a short-term disability insurance program, which would protect their full or partial wages in the event they became sick or injured and couldn’t work.

Unsurprisingly, millennials favored other benefits options. Roughly 35% of millennials ranked emergency child and dependent care as their top interest among a list of other benefits not currently available to the federal workforce. Some agencies already offer such programs.

Millennials and Generation X employees, 18% and 15%, respectively, were also more interested in student loan programs, compared to 9% of baby boomers.

According to the survey, employees offered a mixed assessment of their financial readiness ahead of retirement.

Though 55% of employees knew how much money they’d need to maintain a comfortable lifestyle in retirement, respondents were less confident in their ability to plan and save for basic expenses and medical costs later in life.

About 54% said they were confident they’d have enough savings to care of their basic expenses in retirement, but 42% expressed a degree of certainty in their ability to save for future medical costs.

Baby boomers are more likely to understand and feel confident in their retirement benefits compared to millennial and Generation X employees, according to OPM. About 65% of baby boomers said they knew how much money they’d need to live comfortably in retirement, while 44% of millennials and 53% of Generation X respondents agreed with that statement.

The National Active and Retired Federal Employees (NARFE) Association said the survey results were encouraging, especially with a majority of respondents indicating that those benefits were an incentive to take or keep a job in the federal government.

“However, federal employees aren’t the only individuals who rely on those benefits,” Jessica Klement, NARFE’s staff vice president for policy and programs, said in a statement to Federal News Network. “With over 2.7 million federal retirees who, along with their spouses, receive health insurance coverage, their perspectives on and experiences with this benefit are critical to maintaining program integrity and providing options that appeal to all recipients. NARFE continues to encourage OPM to find a way to include the views on federal retirees in its benefits survey.”

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED