More top career employees hit the federal pay ceiling in 2020

Capped pay rates went up in 2020, but salary compression is real for an ever-expanding group of federal employees within certain locality pay areas.

A growing number of top-ranking federal employees will see their salaries compressed by an arbitrary pay cap in 2020.

According to federal statute, salaries for career federal employees on the General Schedule can’t exceed the pay rates for political appointees and others at level IV on the Executive Schedule.

The good news is Congress raised this ceiling for 2020, meaning GS-15s in this situation will receive a maximum of $170,800 this year. The pay cap in 2019 was $166,500.

For now, this highly-nuanced detail of the federal pay and personnel system impacts long-serving and top-ranked GS-15s, whose salaries are technically growing with annual federal pay raises but can’t realize their “full” raises due to a ceiling on their pay.

These caps not only limit an employee’s take home pay during a given year, but they could also cost future annuitants thousands of dollars a year during retirement.

These caps not only limit an employee’s take home pay during a given year, but they could also cost future annuitants thousands of dollars a year during retirement.

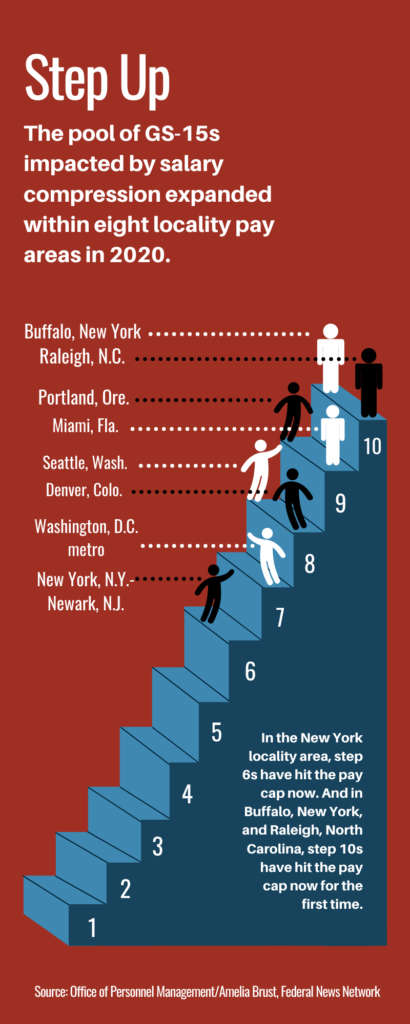

Plus, there are signs pay compression among career GS-15s is slowly worsening. The pool of federal employees whose pay has been capped expanded within eight locality regions in 2020.

In the Washington, D.C., metropolitan area, step 7s are now capped at the federal pay ceiling for 2020, breaking a three-year run where the pay limit reached only to employees at steps 8 through 10.

This year, federal employees in Washington were due pay raises of 3.52%, the largest adjustment of any other locality area.

But for a GS-15, step 10 in Washington, his or her salary should total roughly $185,509 in 2020. But due to the federal pay ceiling, that same GS-15, step 10 in Washington will make the limit of $170,800 this year.

The situation has also worsened in the New York-Newark locality pay area, where the pay cap now extends from step 6s to step 10s.

Meanwhile, employees at step 10 within the Raleigh, North Carolina; and Buffalo, New York, locality regions joined the pay cap club for the first time this year.

As has been the trend for the last several years, federal employees who work in generally high-cost regions of the country appear to be impacted the most by salary compression.

Pay compression is at its worst in the San Francisco, California, locality area where the federal pay ceiling extends all the way down to step 5s within the region.

Pay compression in 2020 will affect federal employees in a total of 25 separate locality pay areas, nearly half of the 53 established regions.

The following chart shows the number of steps within the 15 grade level that are impacted by pay compression over the last five years.

Source: Federal News Network analysis of Office of Personnel Management data

The chart above doesn’t depict the locality pay regions who are blissfully unaffected — at least not yet — by pay compression among GS-15s.

Top-ranking GS-15s within regions like Austin, Texas; St. Louis, Missouri; and Albany, New York, will continue to receive a full pay raise in 2020.

Employees within the six locality pay areas OPM formally established back in 2019 aren’t impacted by the pay cap yet either.

Other regions, however, appear quite close to reaching that ceiling in the near future, especially if Congress doesn’t raise the pay caps next year.

Federal employees at the GS-15, step 10 level in Phoenix, Arizona, are a mere $3 away this year from the current federal pay ceiling of $170,800.

Top-ranking GS-15s in Huntsville Alabama, will make $170,403 in 2020, less than $400 shy of the current pay ceiling.

A similar scenario is true for top-ranking GS-15s in Pittsburgh, Pennsylvania; Dayton, Ohio; and the state of Hawaii.

Pay ceilings could amount to thousands of lost dollars in retirement

Salary compression has a variety of impacts for high-ranking GS-15s. It limits the pay adjustments that top employees would otherwise receive if these salary ceilings didn’t exist.

But pay compression over time could also have impacts on long-serving career employees and their annuities, particularly when calculating the average of their highest three years of salaries.

Related Stories

For the sake of convenience, assume this employee spent the last three years of her career as a GS-15, step 10 in the same locality pay area, and her salaries during those years are the highest of her federal tenure.

Using actual 2018, 2019 and 2020 pay raises to calculate these hypothetical salaries, this employee would have made $174,537 in 2018, $179,201 in 2019 $185,509 in 2020 — if the federal pay ceiling didn’t exist.

The average of those three uncapped salaries equals $179,749, a total that would inform this hypothetical employee’s annuity in retirement.

Instead, this same GS-15, step 10 earned salaries of $164,200 in 2018, $166,500 in 2019 and $170,800 in 2020.

The “high-three” average of those three actual salaries equals $167,166, a $12,583 difference.

This hypothetical employee stands to earn an annuity worth about $55,164 — using the actual “high-three” salary average.

But using a “high-three” average based on non-capped salaries, this employee would receive an annuity worth roughly $59,317 — a $4,153 difference in retirement.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED