GSA’s new governmentwide contract standardizes use of gig economy for agencies

GSA says its market research identified the need for a streamlined rideshare/ride-hail services acquisition strategy, which would consolidate the government’s...

Ridesharing companies Uber and Lyft, and their drivers particularly, are taking a big financial hit — much as 80% according to some estimates — during the coronavirus pandemic. But when things return to normal, the two gig economy giants are primed to take advantage of a five-year blanket purchase agreement with a $810 million ceiling to transport federal employees.

Uber and Lyft were the two winners of the General Services Administration’s latest contract, which for a 2% fee any agency can use.

“Improving the rideshare reporting process also is a unique opportunity. GSA’s new governmentwide Rideshare/Ride-hail BPAs modernizes official travel and will make it easier, and cheaper, to use rideshare services for official travel. No new apps to download – and no paper receipts to lose. Plus, auto billing to travelers GSA SmartPay travel cards earn agency rebates,” wrote Charlotte Phelan, the Federal Acquisition Service’s assistant commissioner for travel, transportation and logistics, in an April 10 blog post. “Most importantly, it will be easier for agencies to report Transportation Network Companies (TNC) expenses as required by the Modernizing Government Travel Act.”

GSA wouldn’t say if other ridesharing companies bid on the contract due to the award still being within the 10-day protest window. But given GSA blogged about the awards and was happy to provide answers to questions, it would be easy to surmise that it received only two bids.

Congress passed and President Donald Trump signed the “other” MGT Act in May 2017 to give agencies statutory authority to use ridesharing and other gig economy services. It also required GSA to develop regulations and for agencies to report data back to GSA on how much they are using these services.

The bill came nearly a year after GSA had updated the federal travel regulations to give federal employees the needed approval to use Uber or Lyft.

The BPA is the third step in bringing major changes to how GSA and other agencies manage fleets of cars.

A few years ago GSA told me they spent about $1 billion a year on buying and maintaining a fleet of automobiles for secretaries, deputy secretaries and others to use at their beckon call. Phelan, who didn’t put a price tag on managing the fleet, said GSA oversees more than 221,000 cars and trucks.

But connecting the rideshare applications to the government purchase card and to back-end reporting systems may give GSA and other agencies reason to reduce the size of their fleets. Yes, some political appointees will need their own cars for safety and convenience reasons, but the majority of those who enjoy the perks of having a car service may be encouraged to just use the app.

I’ve seen this already starting to happen, sharing taxis or Uber/Lyft with certain CIOs or acquisition executives as we are heading to the same back-to-back events.

There are even some who actually walk from one hotel or conference center to the next, blending into the public with few passersbys knowing the power and authority they hold.

Growth of ridesharing is real

The growth of Uber and Lyft in the federal sector is clear with agencies spending approximately $162 million in fiscal 2018, according to the request for proposals GSA issued in October.

“GSA’s market research identified the need for a streamlined rideshare/ride-hail services acquisition strategy, which would consolidate the government’s purchase instead of one-off purchases by individual agencies,” said a GSA spokesperson in an email to Federal News Network. “This solution supports category management by improving spend under management, policy reporting compliance and leveraging the government’s buying power.”

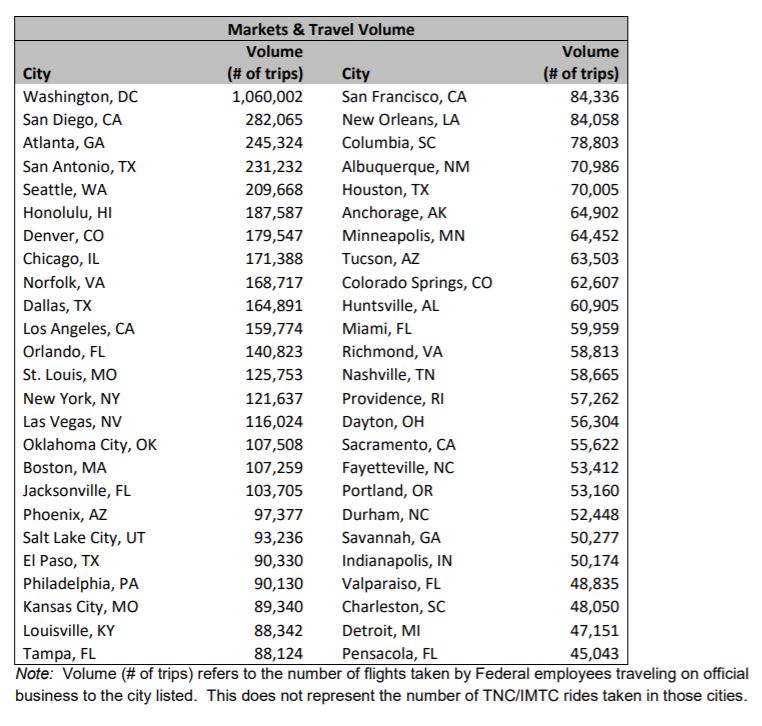

GSA said in the solicitation that in the Washington, D.C. area alone, employees took over 1 million trips using ridesharing applications in 2018, by far the most of any of the top 50 locations where employees travel regularly.

Under the BPA, agencies will receive a 2% to 4% discount from normal pricing as well as the waiving of technology fees charged to use back-office vendor data and reporting capabilities. Whether that is built into the discounts or is on top of the 2% to 4% discount is unclear.

But here’s the rub: GSA is charging a 2% fee to use the BPA, so it’s yet to be determined if agencies are getting that much, if any, of a benefit from using the contract.

GSA says the 2% fee is to provide “a fully commercial and centrally managed capability, as GSA will manage the vendor performance on behalf of all agencies. Federal agencies will use the commercial rideshare/ride-hail apps. Lyft and Uber will have account setup teams to assist with the launch of these programs,” the spokesperson said.

Creating a BPA and dealing with the back office record keeping is a good idea, but there will be some agencies who question whether the discounts are enough to warrant paying for the fee to use the contract. The BPA doesn’t dissuade Uber or Lyft from setting up individual contracts or accounts with agencies, who can then track the use through the government purchase card.

When in-person meetings and conference begin again, it will be interesting to see if GSA’s BPA is more like Alliant 2 or 8(a) Stars, or does it fall into the category of good idea that never worked well like the email-as-a-service or agile multiple award contracts.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED

Related Stories