Exclusive

Exclusive GSA kicks off two-year effort to innovate service contracting beyond OASIS

The General Services Administration released a request for information to gather feedback on its new services contract called BIC MAC—Best-in-Class Multiple Award...

Let’s get the jokes about the General Services Administration’s working title of its new services governmentwide acquisition contract out of the way. Today it’s known as a BIC MAC—Best-in-Class Multiple Award Contract.

Go ahead have some fun.

It’s a contract brought to you by McDonald’s.

It’s a contract, no it’s a new pen.

April Fool’s Day is coming so Larry Allen, who’s always up for some fun, is probably already hard at work developing some fake press release about how Burger King already submitted a protest over the BIC MAC that he will send out to his friends and colleagues for a good laugh.

Whatever name GSA eventually comes up with that is not BIC MAC, the new approach to services contracting aims to shake things up in a way the federal contacting community hasn’t seen in at least five years.

GSA released the first of at least two requests for information on March 2 seeking industry feedback on some of the basic ideas around the contract like socioeconomic reserves, the initial list of functional domain areas, contract structure and much more. Responses to the 27-page survey are due March 17.

Jill Akridge, the director for Customer Account Management for the Office of Professional Services and Human Capital Categories (PSHC), an office within GSA’s Federal Acquisition Service (FAS), said at a recent ACT-IAC webinar that the goal is to reduce friction in the services market and possible consolidate existing services contracts like the Human Capital and Training Solutions (HCATS) and the Building Maintenance and Operations vehicle to make it easier for customers.

“All of these things are concepts and they are in flux. If feedback shows that we missed the mark, we will come back and say how we pivoted our assumptions. We do want to build this with both industry and customer agencies in mind. That is the approach we will be taking moving forward,” she said. “We are trying to make the future, create better data and we are using this contract to get us there in the world of services.”

Akridge said FAS is just at the beginning of a nearly two-year effort to get new contract in place before the OASIS vehicle sunsets. The next date is April 1 for an industry day. She said FAS will release a second RFI in the May timeframe looking at functional capabilities and source selection criteria. In the meantime, Akridge said FAS will continue with an assortment of industry and agency customer discussions.

She said as of now the schedule is for the final request for proposals would come out in early fiscal 2022 and initial awards would come in early calendar 2023.

The goal of the BIC MAC is to replace the OASIS contract, which is set to expire in 2024.

“It’s both an evolution and a departure from the OASIS contract. It’s an evolution because it’s clearly a follow on contract put out by the same team at GSA that runs OASIS. But it is a departure in that it’s broader in scope, likely include many more vendors than OASIS and is based on less distinct capabilities to let vendors on the vehicle,” said Alan Thomas, the former commissioner of the Federal Acquisition Service at GSA and now chief operating officer at IntelliBridge. “It’s ambitious for sure, but since it’s still early I think GSA is starting by putting everything on the table and as they hear from industry and other customers, they will whittled it down and reduce any potential risks they face.”

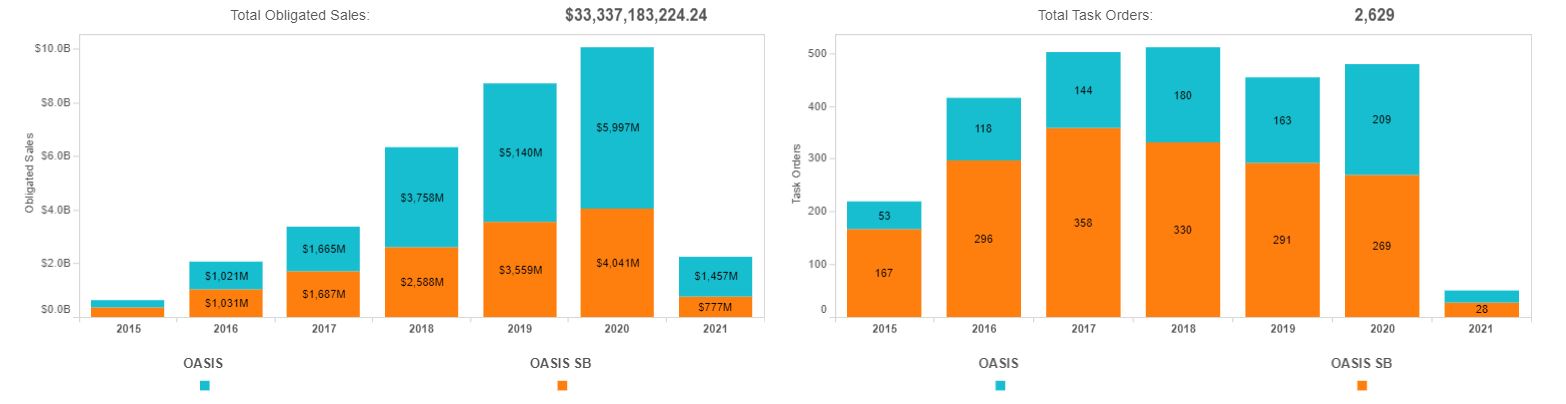

But some wonder if GSA is trying to fix something that isn’t broken. OASIS unrestricted and small business are hugely successful contracts for professional services with more than $10 billion in sales in fiscal 2020 and $9 billion in 2019.

Roger Waldron, the president of the Coalition for Government Procurement, said on his program Off the Shelf on Federal News Network that GSA should consider the impact of making major changes to OASIS as it’s become a strategic contract for many agencies.

“The current thinking just raises lots of questions I get from industry partners about the approach. I think GSA is thinking about a larger contract with hundreds if not, 1000s of companies on the contract. It’s thinking about continuous open seasons. It’s would combine the two contracts so rather than have an OASIS small business and OASIS unrestricted, they would have a single contract. I think they’re looking at whether they’re going to have a pool structure or develop some sort of domain structure around NAICS codes and sub NAICS codes around the project. And they’re also looking at using section 876 so the evaluation or price will take place at the task order level rather than at the contract level,” he said. “So the companies are trying to understand what’s the business case for moving to really what is a fundamental different approach than the current OASIS approach.”

Waldron said there are a lot of questions that still need to be answered about how the BIC MAC program will work, including how it will complement the schedules program and the overall management of the contract.

GSA’s Akridge said there are some specific differences between this new vehicle and the schedules, including the initial requirements for vendors to earn a spot on BIC MAC.

“There’s capabilities that we can’t do on schedules and we tried to get authorities for it that we know are needed in the world of services like cost-type contracting, non-commercial services and unpriced aspect,” she said. “There are scope areas that schedules don’t cover as well today. We want to set this up in a way that thinks through contracting from purely a services perspective. Schedules is designed in a way that also has to accommodate products so it has some rules in there that maybe aren’t the best for services acquisitions.”

Changes to the federal sector

She said there are some similarities with the schedules, so FAS wants to take the best of all worlds and bring them into the new vehicle.

Akridge said there already are some discussions about adding an unpriced aspect to schedule contracts.

Intellibridge’s Thomas said he did ask about changing the schedules program to allow for different contract types when he ran FAS.

“It’s a different workforce that manages the schedule contracts than the one that runs OASIS so the skill-sets are different, which may be a challenge for them to manage cost-plus contracts,” he said. “It was a perspective that I hadn’t thought about. Schedule contracting officers have good set of skills that are well established. The schedules program also is based on commercial offerings, while OASIS is not necessarily commercial.”

Tris Carpenter, the director of capture for Red Team Consulting, said with the changing nature of the services market and how it’s becoming more complex, GSA’s thinking for its BIC MAC is an important recognition of the changes that are happening in the federal services sector.

“The right step toward increasing integration, reducing duplication and eliminating the ‘race to qualify’ for sporadic award/on-ramp milestones,” Carpenter said. “Although the claw back of the Alliant 2 Small Business GWAC was a blow to many in the industry, it has also now created the opportunity to synchronize the major GSA GWAC portfolio (including STARS III, Polaris, and BIC MAC) into an integrated federal acquisition approach. However, GSA needs to be continuously aware of the need for transparency and representation across all industry partner types and business sizes. Most firms want to deliver and support agency missions, while growing their profitability and employee base. This includes having a fair opportunity to compete for opportunities in their specialized domain areas at a reasonable price that align with operating market conditions. GSA’s exploration of eliminating price at the master IDIQ level and setting a minimum set of domain award qualifications/criteria is encouraging; however, it must be clearly defined how it will be reliably applied on an ongoing basis.”

3 considerations going forward

Intellibridge’s Thomas added there are three things FAS should consider as they continue to develop the BIC MAC program.

First, he said strong industry engagement must continue.

Second, FAS should continue to talk to agency customers, particularly those who are big users of OASIS and those that haven’t been to find out why and what FAS can do to make BIC MAC more attractive.

Third, Thomas said the most difficult conversations will be internally where they have to deconflict the scope with other contracts, address contract access fees and using common tools so customers receive a standard message about how to work with GSA.

The Coalition’s Waldron added GSA must also consider the impact on small businesses if it decides to go down the path of having one contract. Small firms have thrived under the OASIS small business contract, but would having one contract impact how agencies issue task orders?

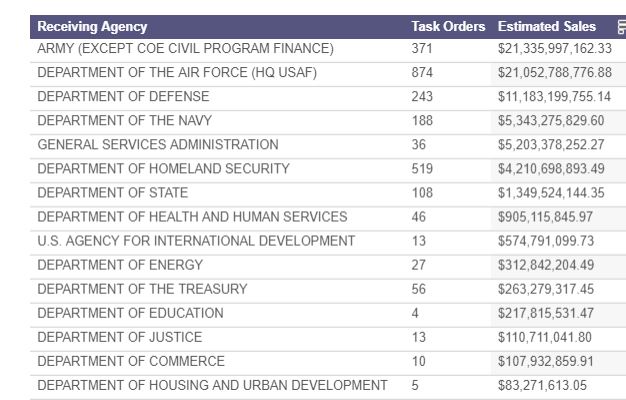

“When you start combining into a single contract, then you get into all the stuff like whether the rule of two applies,” he said. “I think it behooves GSA to provide a clear statement and business case as to what it’s trying to achieve here and how it will meet customer agency missions through this vehicle because OASIS is hugely successful and meeting fundamental requirements for customer agencies like the Air Force every day. Could it be refined and are there other areas where it could be improved? Yeah, absolutely. There’s nothing that’s perfect out there. But BIC MAC seems to be, as we currently understand it, a 180-degree turn to a different approach and that raises questions.”

Questions that GSA will spend much of the next year answering.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED

Related Stories

GSA picks 74 vendors for unrestricted OASIS contract