The mistake that a few thousand TSP participants make every year

Each year, thousands of Thrift Savings Plan participants max out their annual contributions too early and miss out on their agency's matching contribution.

A group of “a few thousand” participants in the Thrift Savings Plan have reached their annual contribution limit before the end of the year and will likely miss out on the full matching contribution from their agencies.

The Federal Retirement Thrift Investment Board, the agency that administers the TSP, said this is typical, and it’s trying to find a way to specifically communicate to those participants to tell them how to correct their actions for the future.

About 77.4 percent of Federal Employee Retirement System (FERS) participants contributed 5 percent or more of their income toward the TSP in the fourth quarter of 2017, the FRTIB said. That’s slightly less than the 77.6 percent of FERS participants who contributed enough to earn the full matching contribution from their agencies during the previous quarter.

“This was a seasonal trend that was not unexpected,” said Geof Nieboer, FRTIB chief of business intelligence, at the agency’s November board meeting. “A closer statistical look confirmed that the primary cause for these late year declines that we commonly see in participation rates are a group of participants who are contributing a high percentage of income and are reaching their annual contribution limit well before the end of the year. While certainly this is well-intentioned, these participants may not understand that by stopping contributions early, they will no longer receive agency matching contributions and thus may actually be losing money.”

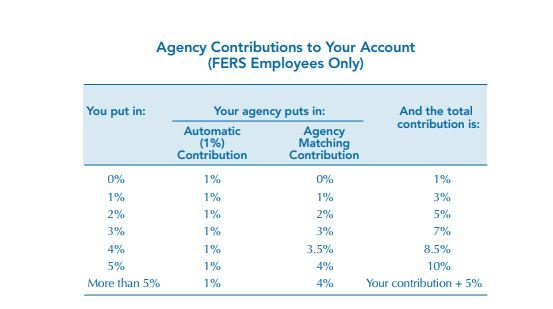

TSP participants can choose how much of their income they’d like to contribute during a given, biweekly pay period. FERS participants will receive a matching contribution from their agencies on the first 5 percent of pay they set aside during a pay period.

But FERS participants should be careful not to contribute too much too early in the year. The FRTIB hopes 80 percent of its participants will contribute enough to receive an agency matching contribution, but like in 2017, the agency acknowledged that it typically sees a drop-off in participation toward the end of the year.

TSP participants can better plan their contributions using the agency’s contribution calculator.

In addition, agency payroll centers often advise employees about the number of payroll periods during each year to ensure that TSP participants have enough time to adjust their contributions accordingly. For example, the Interior Business Center has advised its employees that there will be 27 pay periods in 2018, up from 26 in 2017.

For now, the FRTIB isn’t sending personalized messages to a few thousand participants who reached their maximum contribution limit too early. But next year, the agency will focus on sending targeted messages to their participants with information and solutions specific to their individual needs, said Jim Courtney, the agency’s communications director.

“It’s that one to many message,” he said. “The way to really address the few thousand people … is to do that personalized message.”

The agency has been slowly collecting email addresses from TSP participants over the past two years or so. The FRTIB has email contact information for about 3 million, or half, of TSP participants.

Currently, the TSP doesn’t require its participants or new enrollees to report their email addresses to the agency.

To reach its participants, the TSP agency issues news bulletins or broad announcements when it adds a new feature to its website or relaxes certain withdrawal rules, but it doesn’t send targeted messages to a specific portion of the population.

Meanwhile, the FRTIB is projecting fewer overall hardship withdrawals in 2017 compared to the previous years.

The FRTIB processed 607 hardship withdrawals related to Hurricane Harvey, 1,136 withdrawals for Hurricane Irma and 179 for Hurricane Maria in October.

Still, the agency predicts hardship withdrawal requests will be 4 percent lower in 2017 compared to the previous year. Loan requests are expected to drop by 8 percent this year.

For the FRTIB, it’s unclear why fewer TSP participants have taken hardship or loan withdrawals this year, even as several hurricanes and severe wildfires in California have prompted the agency to relax its rules.

“I could hazard some guesses,” Tee Ramos, director of participant services, said of the lower numbers. “The economy has been strong, things like that. But there’s really no data that’s pointing to specific trends.”

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED

Related Stories