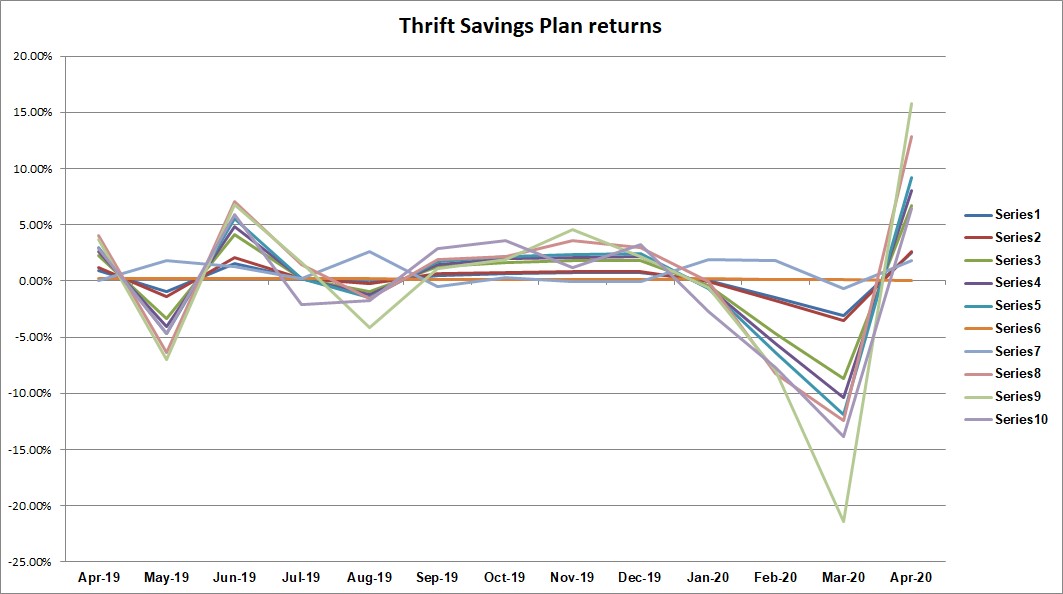

TSP funds rebound after dismal March

Most of the TSP funds turned in their highest performance in the past 12 months.

Thrift Savings Plan participants who stayed the course through the March downturn should feel vindicated at the end of April, as every fund rose except for the G fund. In fact, most of the funds turned in their highest performance in the past 12 months.

The real standout was the small capitalization stock index S fund, which increased by 37.21%, skyrocketing from -21.40% to 15.81%, giving it the best performance of the month. That said, it will take some time to fully recover from its dismal performance in the first quarter; its year-to-date performance is -16.78%, and its performance over the last 12 months is -11.46%.

The common stock index investment C fund wasn’t far behind, as it went up by 25.21%, climbing from -12.40% to 12.81%. That still leaves its year-to-date performance at -9.35% due to some disappointing yields in the first quarter of 2020, but it did manage to drag its overall performance over the last 12 months back into the black, at 0.77%.

The international stock index I fund also turned in a strong performance, rising 20.29% since March for a return of 6.42% in April.

The Lifecycle funds also leapt into the black, landing at 2.52% on the low end with the L Income Fund, and 9.16% on the high end from the L 2050, an impressive 21.46% climb from its March low of -11.90.

The only two funds that didn’t post record highs from the last twelve months were the fixed income investment F fund and the government securities investment G fund. The F fund still rose out of the red with a return of 1.78%, and actually has the highest returns for year-to-date and over the last 12 months, at 4.94% and 10.76%, respectively.

The G fund is the only one that actually dropped in April, posting its lowest return in three years for the third month in a row. It dropped from 0.11% to 0.07%.

| Thrift Savings Plan — March 2020 Returns | |||

| Fund | April | Year-to-Date | Last 12 Months |

| G fund | 0.07% | 0.47% | 1.83% |

| F fund | 1.78% | 4.94% | 10.76% |

| C fund | 12.81% | -9.35% | 0.77% |

| S fund | 15.81% | -16.78% | -11.46% |

| I fund | 6.42% | -17.74% | -11.09% |

| L Income | 2.52% | -2.15% | 1.13% |

| L 2020 | 2.61% | -2.76% | 0.86% |

| L 2030 | 6.71% | -7.54% | -1.47% |

| L 2040 | 8.02% | -9.17% | -2.37% |

| L 2050 | 9.16% | -10.63% | -3.25% |

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Daisy Thornton is Federal News Network’s digital managing editor. In addition to her editing responsibilities, she covers federal management, workforce and technology issues. She is also the commentary editor; email her your letters to the editor and pitches for contributed bylines.

Follow @dthorntonWFED