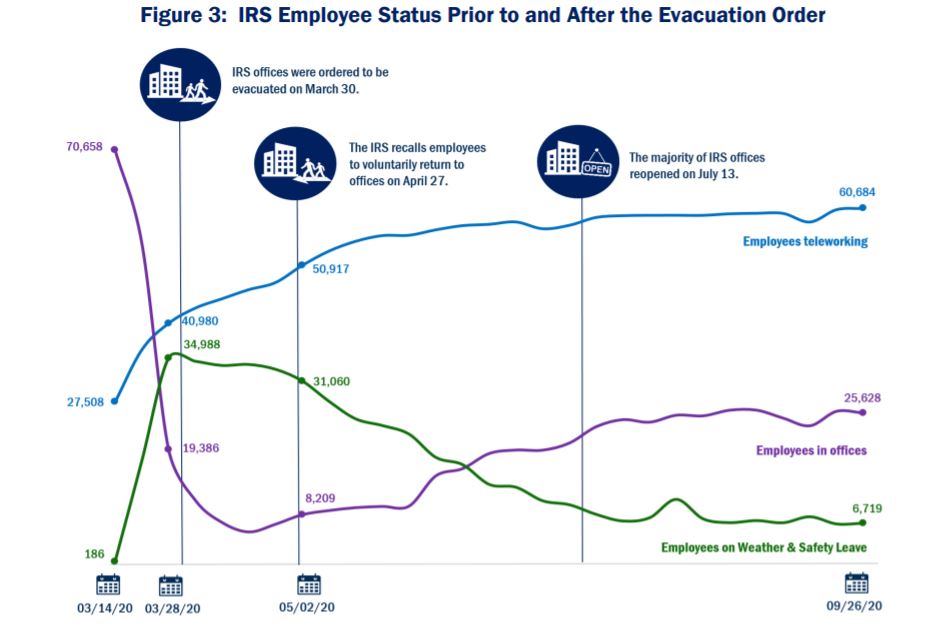

By the end of September, nearly 60,700 IRS employees reported spending at least some time teleworking — a 134% increase from the weekly average before the pan...

The IRS more than doubled the number of employees teleworking between the start of the COVID-19 pandemic and the end of fiscal 2020, an audit from its inspector general shows.

IRS Commissioner Chuck Rettig has told multiple congressional committees over the past year how the agency ramped up its telework capacity after issuing its mandatory evacuation order at the end of March.

The interim report from the Treasury Inspector General for Tax Administration, however, gives added context to how the IRS built up its capacity for employees to telework, even after a majority of its offices reopened last summer.

By the end of September, nearly 60,700 IRS employees reported spending at least some time teleworking — a 134% increase from the weekly average before the pandemic.

The IRS reported only 3% of its customer service representatives were telework-eligible before the pandemic, but all of them could work remotely by October 2020.

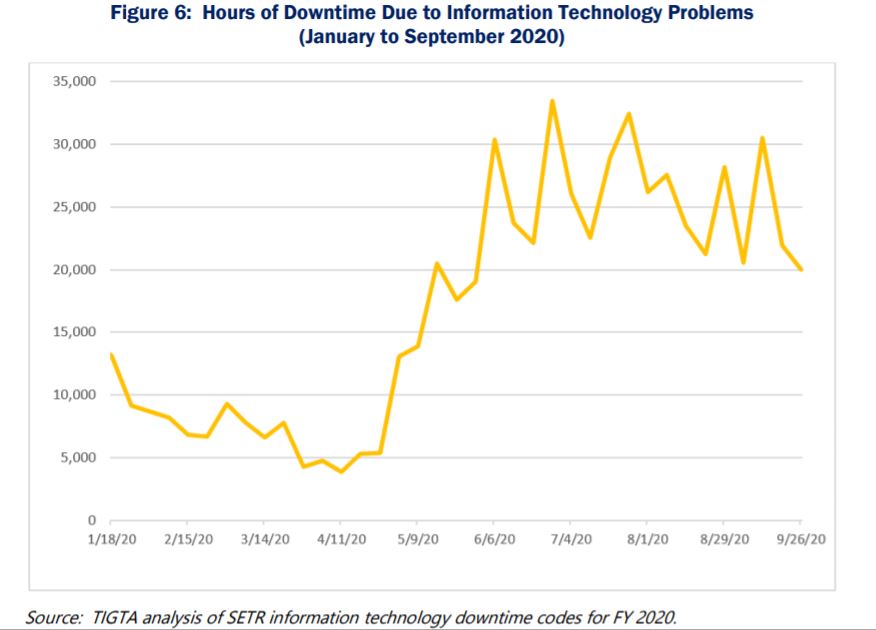

That progress, however, came with a few hiccups. The TIGTA report shows the amount of employee downtime from IT problems double or tripled between May and September, compared to the baseline the agency reported before the pandemic.

TIGTA auditors, speaking to IRS managers, found delays at the IT helpdesk, issues logging in through the VPN and other equipment problems contributed to employee downtime.

Between March and October 2020, the IRS issued 18,600 laptops to enable employees to telework. Supervisors in each business unit identified which employees had portable work and needed a laptop, and determined the priority order for employees to receive the equipment they’d need to telework.

The TIGTA report said the IRS’s ability to prioritize, and issue laptops and other information technology equipment was a “limiting factor” in getting its workforce telework-ready.

TIGTA found that under its Continuity of Operations plan, the IRS assumed up to 40% of its employees would not be able to work during a pandemic.

“In this scenario, the IRS assumed absences would occur in ‘waves’ with employees becoming ill, recovering, and returning to work, as other employees contracted the disease and followed the same pattern,” auditors wrote.

The IRS’s COOP plans also didn’t anticipate a scenario where a pandemic would force the agency to simultaneously close all its facilities at once,” resulting in the inability of tens of thousands of employees to perform their jobs,” the report stated.

The IRS had nearly 35,000 employees on weather and safety leave in mid-March. Despite waiving some of its previous requirements for telework eligibility, the IRS still had 6,719 still taking on weather and safety leave in September 2020.

That figure fell to 4,600 by mid-December, after the IRS Chief Human Capital Officer required employees to provide medical documentation to remain on weather and safety leave.

Before this, under guidance from the Office of Management and Budget, employees could self-identify as having a high-risk condition to take weather and safety leave.

Congress mandated TIGTA conduct its report as part of the fiscal 2021 spending bill. Deputy Inspector General for Audit Michael McKenney said the IG office will issue a follow-up report later this year.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jory Heckman is a reporter at Federal News Network covering U.S. Postal Service, IRS, big data and technology issues.

Follow @jheckmanWFED