Exclusive

OMB requires updated EIS transition plan in IT passback guidance

Vendors on the Enterprise Infrastructure Solutions program say solicitations and awards picked up pace over the last few months, but some are taking much longer...

Final results aren’t in yet, but in all likelihood, agencies missed another deadline under the Enterprise Infrastructure Solutions (EIS) telecommunications and network modernization program.

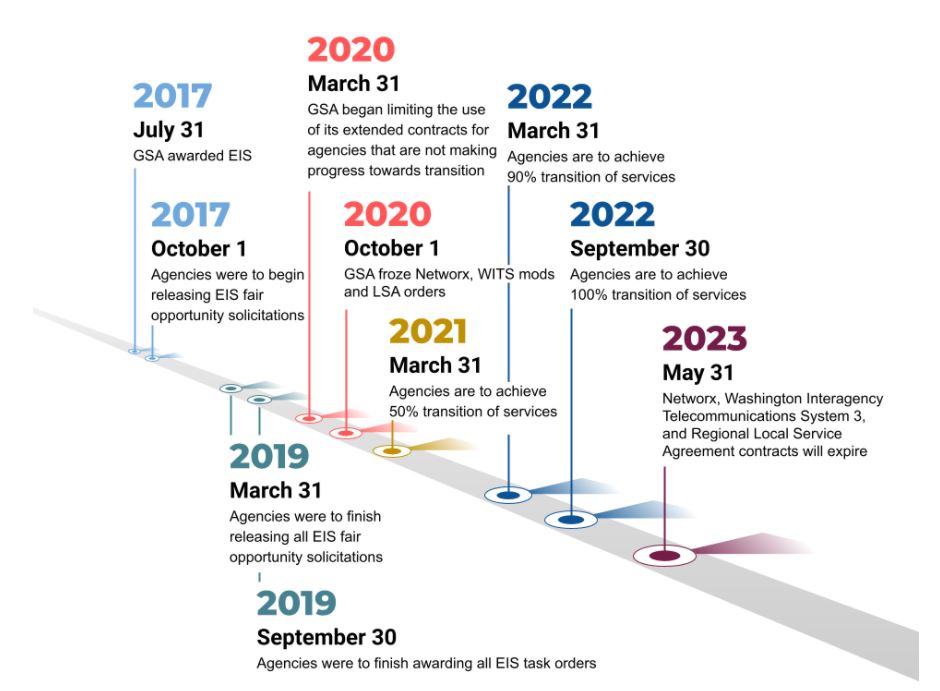

The General Services Administration set a March 31 deadline for agencies to transition at least 50% of all services to the new contract from the Networx program.

But this deadline, unlike the previous ones, will have consequences.

The Office of Management and Budget is requiring a report from each agency by July 1 on its EIS progress.

In its budget passback guidance, which Federal News Network obtained, OMB told agencies to submit a report detailing “how it will make progress on past-due milestones and actions it will take to complete the transition before the legacy contracts expire on May 31, 2023.”

While it’s unclear if this is the first time OMB mentioned EIS in the passback, the fact they are doing it now and combined with the pressure from House Oversight and Reform Committee members through the Federal IT Acquisition Reform Act (FITARA) scorecard, agencies may be feeling a little more pressure than normal.

“I do believe with the new administration coming in the focus on security and the need to secure our national data, the emphasis is not just to get to the cloud, but how we get it to our customers and in our users. The combination of the passback is one influencer, in addition to FITARA,” said Allen Hill, the deputy assistant commissioner for category management in the Office of the IT Category (ITC) in GSA’s Federal Acquisition Service, in an interview with Federal News Network. “But more so what I consider most important is getting outdated technology off the infrastructure, it can’t do zero trust architecture. For you to get there, you have to eliminate that technology. It’s not just about saving money, it’s also about securing that national security interest, and you can’t have access to the cloud without the network, you can’t get that information to your end device without the network. You have to have security built into it from end to end, and that’s where zero trust architecture comes into play. It’s important for agencies to say ‘what is that North Star that we’re going to?’ The zero trust architecture is that, and where we can be able to work in a mobile environment because of what’s happened with the pandemic, but do it securely.”

The House committee added EIS transition as a grading factor in the 11th version of the scorecard that came out in December. The General Services Administration, the United States Agency for International Development, the Commerce Department and the Small Business Administration also saw whole letter grade drops because of their lack of progress with EIS. Five agencies — Commerce, the Department of Homeland Security, NASA, SBA and the Office of Personnel Management — received Fs on their EIS transition progress. GSA and the departments of State and Defense received D grades.

Hill said GSA will not know whether agencies met the March 31 deadline until the May timeframe when the new EIS data comes in. But even then GSA’s insight into the progress is limited.

“In terms of where agencies are, it’s hard to gauge all the agencies and where they’re at because we don’t necessarily get to see that information. We can only see it purely from an inventory perspective,” Hill said. “I do think that this is not something that is going to happen where you see steady decline of inventory. You’ll see bulk changes and inventory has been reduced as they do the necessary infrastructure updates for their network and move over to the new technologies.”

The Labor Department is one of the outliers with EIS among large agencies. It says in an April 5 tweet that it transitioned 70% of its telecom network circuits to the new contract, easily besting GSA’s goal.

Hill said the Social Security Administration is another large agency that has made significant progress in moving to EIS.

But Hill and EIS vendors acknowledge there is still a lot of work to do between now and September 2022 — agencies next deadline to move 100% of their network inventory to EIS.

As of Jan. 31, Hill said out of the 212 fair opportunity solicitations expected, agencies have released 164 to industry. Of those 164, agencies have awarded 93 task orders and 48 still need to be released.

Additionally, 9 of 17 large agencies and 11 of the 25 medium agencies have awarded all of their task orders.

Hill added agencies under EIS have awarded about $14.5 billion in task orders over the last few years, and eight of the nine vendors have won some form of work under the program.

Award decisions taking too long

Vendors supporting the EIS program said the release of solicitations and corresponding awards picked up steam over the last three to six months. But, at the same time, the program continues to be a slog.

Several vendors said some agencies are sitting on proposals for more than a year, calling into question whether the government is missing out on cost savings and better services.

“The elongation of the award cycle is brutal. We’ve submitted bids over a year ago on some solicitations that haven’ been awarded. It makes us wonder that when the government finally does make the award, are they getting today’s technology and the appropriate cost structure?” said David Young, the senior vice president of public sector at Lumen. “We’ve attempted a couple of times on some of the more lengthy awards to ask for best and final offer, but we haven’t achieved that. If the government has a desire to get a lower cost structure, they are missing because of elongated award cycles.”

Young said in his 30-years in the federal telecommunications market, he’s doesn’t remember seeing timelines to award being this long. He said the fact the government isn’t asking for best-and-final offers is frustrating and surprising.

Tony Wellen, the president at BT Federal, added that when agencies are making awards, their transition schedules are aggressive.

“The fast response times are not an indictment of the process, but just fact. Agencies have a short fuse for when we are to respond to questions, and depending on the nature of the questions, it can make it difficult to get it done on time to meet deadline for bid,” he said. “The short timelines seem to benefit the incumbent contractors too.”

Young, Wellen and others say they have brought the elongated schedules to GSA’s attention.

Time to relook at strategies

Hill said GSA is in regular contact with agencies that haven’t awarded or released their solicitations.

“We talked about the remaining inventory that’s left for them to understand the complexity of their transition. But if they have a solicitation that has not been awarded, we especially have been reaching out, and we do suggest that they go back and update since it’s been a while,” Hill said. “The vendors have communicated to me too that they are getting better prices, understanding things a lot better and being more innovative. The competition is really good with the vendors, and it’s not just from the pricing perspective, but they’re being very innovative with what they’re offering in terms of modern solutions to eliminate the legacy technology and help us move to where we can better secure our information that is going through those circuitries.”

While vendors are offering innovation, some say agencies are not always taking full advantage of it.

Chris Smith, AT&T’s vice president for civilian and shared services, said agencies are trying to find the right balance between moving existing technologies and circuits — known as “like-for-like” — and implementing new technologies like software-defined networking (SD-WAN).

“A majority of the bids we are looking at are asking for SD-WAN and other newer technologies. We still are early on implementation, but SD-WAN is mainstream now,” he said. “Cybersecurity advanced solutions has always been something individual agencies are looking at, and with the SolarWinds hack, and that incident doesn’t stand alone, we are seeing the demand for newer cybersecurity solutions as well as solutions around mobility and 5G.”

Hill said several agencies are planning for innovation over the medium term, but following the like-for-like approach more immediately. But he said the term “like-for-like” is a bit of a misnomer.

“There are some agencies that are saying ‘let’s just start out with modernization,’ while other agencies are saying, ‘let’s get it moved over, and then let’s rebaseline of what we modernize in a more sequence fashion.’ I understand that approach too because if you take a moving from a legacy voice system to a modernized voice system, you don’t want your phone not working. You want to make sure that it’s updated,” he said. “If you’re taking voice and data circuits and collapsing them where they’re being leveraged, there’s a lot of tweaking that has to be done to make sure that the Voice Over IP (VOIP) works the way it’s supposed to, and making sure you have a good quality of service. Agencies are going out and asking for software defined wide area network solutions, but they may not move to it immediately because there’s a lot of infrastructure for you to move to a software defined wide area network. In addition, working with CISA and TIC 3.0 guidance also is helping to drive how Trusted Internet Connections (TIC) is being done to support the past, but also the support the new the zero trust network architectures that are needed.”

Procurement innovation happening

Robert Dapkiewicz, senior vice president and general manager for MetTel Federal, said some of the more recent task orders have asked for more transformational technology, but not at the expense of mission effectiveness.

“With one customer, they wrote their solicitation as a like-for-like transition with the understanding that they will transform at a later date. But coming out of the gate during the pandemic, they started to move to SD-WAN right away,” he said.

BT Federal’s Wellen added agencies have been more open to new or different acquisition strategies, such as splitting up large task orders into smaller ones in order to work with multiple vendors as well as asking for managed security and network services.

Dapkiewicz pointed to the Department of Homeland Security as an example of an agency taking the smaller bit approach.

Lumen’s Young and several others continued to express concerns about solicitations, particularly large RFPs, either favoring incumbents or agencies awarding incumbents follow-ons.

“EIS is packed with opportunities for agencies and GSA did an incredible job in putting the vehicle together so if an organization isn’t moving along fast enough, they should reach out to vendors or other agencies for help. And if you put together your procurement or plan a while ago, you need to look out over the horizon about what capabilities are available today and tomorrow, and how you can make the best investment in security, resilience and increase productivity and collaboration,” AT&T’s Smith said.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED

Related Stories

Lacking teeth, GSA creates alliances to spur transition to new telecommunications program