DoD says acquisition reforms working, won’t create new policy next year

The Defense Department will not be releasing a Better Buying Power 4.0 and will instead focus on policies from the past five years, which the under secretary for...

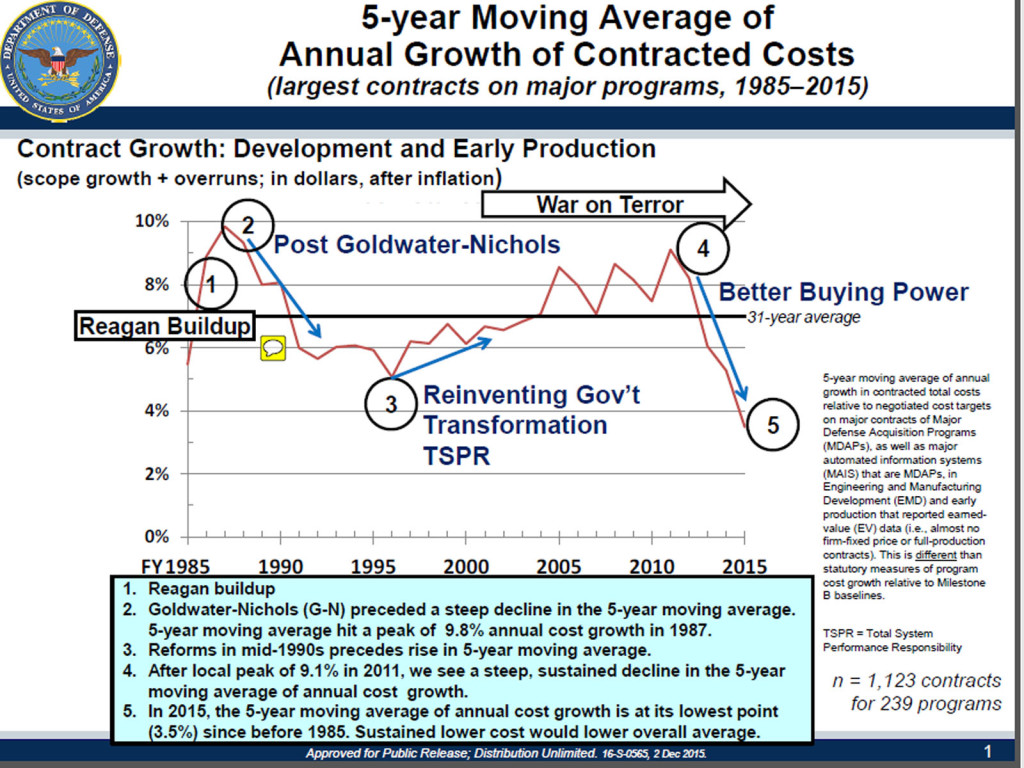

A statistical analysis released by the Defense Department shows that the department’s acquisition reforms have controlled cost growth, said Pentagon acquisition chief Frank Kendall.

Kendall added that he will not release a new iteration of Better Buying Power — DoD’s acquisition reform policy — next year, and instead will focus on the initiatives in the previous versions.

“I plan to keep going with the things we started five years ago and to do more of them and continue the continuous improvement efforts that we started. They are working,” Kendall, DoD’s undersecretary for acquisition, logistics and technology (ATL) said during a speech at the Potomac Officers Club Defense Research and Development Event.

The analysis numbers show a decline in the growth of annual contract costs from about 9 percent in 2010 — when the reforms began — to about 3.5 percent in 2015.

“There is so much noise in the system that it’s very hard to see the results of policy, but there you have it,” Kendall said Dec. 2 in McLean, Va. “I think this is a powerful and compelling piece of data that says we are doing the right things and we need to keep doing them.

The Defense Department has been implementing the Better Buying Power initiative since now-Defense Secretary Ash Carter held Kendall’s position.

The first two versions mostly focused on better management of the acquisition system from a cost perspective.

Better Buying Power 3.0, which was released in April, places more of a premium on specific steps officials believe are needed to drive technical excellence into the systems the military buys.

The latest BBP version also includes several items that Kendall says are designed to give industry additional incentives to innovate.

“We call them formulaic incentives, where possibilities for cost increases or savings are shared between industry and the government, and they are very effective at getting results,” Kendall said last year. “You can set those arrangements up in a wide variety of ways, but these seem to be the best forms of contracting for many of the things we do. And incidentally, it’s true of cost-plus incentive and fixed-price incentive. There’s actually a stronger correlation between using the incentives and our results than there is to whether it’s a cost-plus or a fixed-price contract.”

The analysis looks at cost-plus and fixed-price contracts for development and initial production, Kendall said.

The scale is in program overruns. Basically, the annual cost growth was calculated by dividing all the cost overruns in programs by all the money put into programs.

The analysis looks at data from 1985 to the present. Kendall found that contract cost fell by about half in the years following the Goldwater-Nichols Act, which reformed DoD.

Around 1995, DoD entered an era of “Reinventing Government Transformation.” Kendall said that government took a more “laissez-faire” approach to doing business.

“The theory behind a lot of the things there was industry knows how to do this, the bureaucracy is the problem, get all those regulations out of the way and just give the money to industry and do the better job. You can see the result of that, you can see the cost growth on contract going up,” Kendall said.

Annual contract cost growth rose from about 5 percent in 1995 to 9 percent in 2010.

Former DoD undersecretary for ATL and now Professor Emeritus at the University of Maryland Jacques Gansler said while Kendall’s reforms have made a difference, some of the analysis must be taken with a grain of salt.

“There have been studies separately done that show that the biggest driver of whether you are over running or not is whether you have a lot of money,” Gansler told Federal News Radio. “If the budget is climbing in that time period then people are more likely to take advantage of that and they are not as concern about if they overrun,” there won’t be extra money there.

Defense budgets have been constrained in recent years with the downturn in the economy in 2008, sequestration in 2013 and budget uncertainty in later years. By contrast, years when annual contract costs rose, the economy was booming and defense budgets were increasing in the wake of Sept. 11.

Gansler said what is more important is the leadership, and Kendall and Better Buying Power have been providing that. The policy has created culture change and the recognition for the need for change, Gansler said.

That recognition extends to Congress, which added a number of acquisition reforms into the 2016 defense authorization act, including giving more power to the service chiefs over their acquisition programs.

The Senate Armed Services Committee has also been probing further reforms it can make to better the acquisition process through a series of hearings.

Gansler was one of four experts who testified Dec. 1 before the committee. The witnesses told lawmakers that DoD needed to do a better job of using commercial products and it needed to shy away from large, bulky contracts.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Scott Maucione is a defense reporter for Federal News Network and reports on human capital, workforce and the Defense Department at-large.

Follow @smaucioneWFED

Related Stories