Internal Revenue Service enforcement operations brought in $2.6 billion more in 2017 than in 2016, despite a continually shrinking staff. But that doesn’t...

Internal Revenue Service enforcement operations brought in $2.6 billion more in 2017 than in 2016, despite a continually shrinking staff. But that doesn’t necessarily mean the IRS is getting better at doing more with less. Rather, a new report from the Treasury Inspector General for Tax Administration said that increase was largely due to a small number of large corporate cases.

The IRS lost 642 employees in Examination Enforcement between 2016 and 2017, and 4,933 since 2010. That’s made it more difficult for the IRS to conduct examinations. The report said examinations by the Small Business/Self Employed Division have declined by 38 percent since 2013. Examinations by the Large Business and International Division declined 41 percent over the same period, falling by 8 percent since 2016 alone.

In fact, the report said less than 1 percent of returns were actually examined in 2017.

“The IRS’s trends continue to show that reductions in staff affect the number of examinations that the IRS is capable of conducting each year,” the report said.

Meanwhile, the number of full-time equivalent employees in Collections has declined from 11,503 in 2013 to 9,856 in 2017, an overall 14 percent drop. A 2015 realignment of Collections folded 385 FTEs into the Collections headquarters, as Collection Policy, Collection Inventory Delivery and Selection, and Collection Quality and Technical Support were organized into headquarters. But campus and field FTEs have declined by 24 and 42 percent, respectively since 2013.

Over the same period of time, the inventory of taxpayer delinquent accounts (TDAs) has increased by 400,000, reaching a total of 8.1 million, the highest it’s been in 15 years.

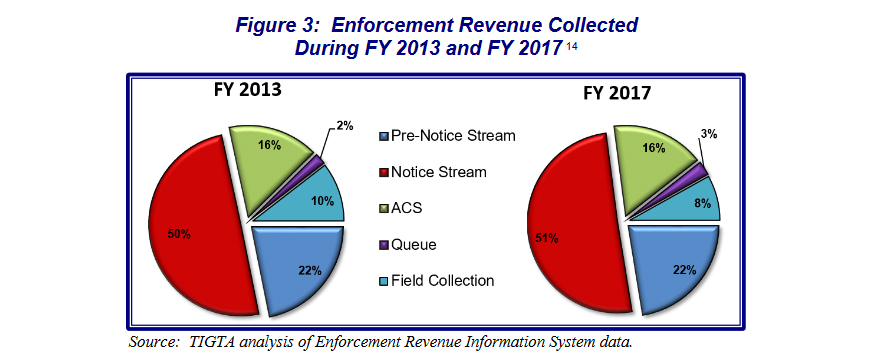

This inventory of TDAs follows a path through the collections system. They start in the notice stream, where the IRS sends notices of delinquency to the taxpayer in order to prompt payment. In 2017, 51 percent of enforcement revenue came from the notice stream. That’s up from 50 percent in 2013.

TDAs then enter the Automated Collections System, where they’re worked via telephone and systemic actions like levies and notices of liens. If an account is not resolved in the ACS, it moves into the queue to be assigned to revenue officers. But the amount of revenue collected by field employees has dropped along with the numbers of FTEs, from 10 percent in 2013 to 8 percent in 2017.

At the end of 2017, the queue held 859,745 TDAs, down 8 percent from 2016. Those TDAs have a total value of $44.7 billion. TDAs that sit in the queue for 52 weeks without being assigned are systematically reviewed, and annual notices are sent.

Eventually, lower priority TDAs get “shelved,” or designated inactive, if they go too long without getting worked. And that’s where major reductions in delinquent accounts have occurred. In 2017, the ACS began shelving TDAs at a much higher rate than before – 1.8 million compared to 2016’s 320,000. That’s a total of $4.8 billion the IRS has had to give up on collecting in 2017 alone. Meanwhile, another 820,196 TDAs were shelved from the queue in 2017.

Those increases, TIGTA found, correlate with April 2017, which is when IRS began providing information on these shelved TDAs to private collection agencies, per the Fixing America’s Surface Transportation Act. The IRS said that as of May 2018, it had provided 432,000 TDAs to PCAs, totaling about $3.6 billion.

TIGTA made no recommendations as a result of the report, which is an annual review.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Daisy Thornton is Federal News Network’s digital managing editor. In addition to her editing responsibilities, she covers federal management, workforce and technology issues. She is also the commentary editor; email her your letters to the editor and pitches for contributed bylines.

Follow @dthorntonWFED