OPM renews contract for administration of benefits

The Office of Personnel Management renewed its contract with LTC Partners to provide services for BENEFEDS, the enrollment and administration program for the...

The Office of Personnel Management renewed its contract with Long Term Care Partners to provide services for BENEFEDS, the enrollment and administration program for the Federal Employees Dental and Vision Program (FEDVIP) and other federal benefits.

Under the contract, LTCP runs the online exchange, administers enrollments and changes for FEDVIP, collects premiums and provides a customer service call center, among other services.

“LTC Partners strives to consistently meet high levels of customer service, and, in particular, places a focus on making business easy to transact,” said Kevin Hill, LTC Partners’ chief operating officer.

LTCP has been administering the BENEFEDS contract for more than 10 years, beginning with its inception in 2006.

LTCP also provides these services under the BENEFEDS contract for the Federal Long Term Care Insurance Program (FLTCIP) and FSAFEDS, the federal flexible spending account.

The FLTCIP was at the center of an uproar last summer when OPM announced that John Hancock, LTC Partners’ parent company, would be raising premiums for long-term care by up to 126 percent. John Hancock was the only bidder to provide long-term care insurance services to the federal market.

The premium hikes were expected to affect 264,000 active and retired federal employees, who are expected to pay an average of $111 more per month for the same coverage they have now.

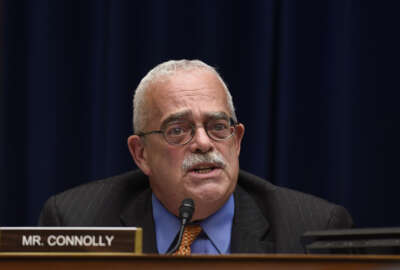

Numerous Washington, D.C.-area lawmakers have expressed outrage in letters and hearings on the subject, but so far there have been no concrete solutions to fix the issue.

First, John Hancock estimates about the program’s expected costs and returns changed twice as the company reviewed the FLTCIP. The company’s actuaries and OPM itself reviewed the data.

“We had the confluence of two unfortunate factors,” said Mike Doughty, president and director of John Hancock Insurance. “We had higher long-term projection costs and we had lower long-term projected returns.”

Without a premium change, the long-term care fund itself would be in the red sometime by 2035 to 2040, Doughty said.

Second, older participants were submitting more claims, which lasted longer than John Hancock expected. As the company continued to review the data, it found that more people required long-term care for longer periods of time.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Daisy Thornton is Federal News Network’s digital managing editor. In addition to her editing responsibilities, she covers federal management, workforce and technology issues. She is also the commentary editor; email her your letters to the editor and pitches for contributed bylines.

Follow @dthorntonWFED