Federal long term care insurance premiums to increase by as much as 86%, data shows

It’s the first time in seven years that the roughly 267,000 FLTCIP enrollees, who are civilian federal employees and military members, will see a premium rate...

Enrollees in the Federal Long-Term Care Insurance Program (FLTCIP) are bracing for another big premium increase starting in 2024.

The Office of Personnel Management, which runs the federal insurance program, announced plans to hike up premium rates for current enrollees. The changes will take effect on Jan. 1.

Unlike the averages offered in past years, OPM declined to share an average percentage increase for FLTCIP premiums. An agency spokesperson said the percentage increases for enrollees were too variable for an average to accurately depict how much the rates are rising.

But anecdotal experiences from program participants who spoke with Federal News Network and who shared their premium notification letters with the National Active and Retired Federal Employees Association (NARFE) show the increases are as large as 86%, if the enrollees choose to stick with their same coverage options. In a few other instances, enrollees received notice from OPM that their premiums will go up 77% and 49%, according to NARFE.

Enrollees “may be facing a choice between unaffordable premiums or inadequate coverage and have lost the time and opportunity to forge an alternative plan for future long-term care costs,” NARFE National President William Shackelford said in a Sept. 12 statement. “The scenario resembles a classic bait-and-switch scheme, as FLTCIP enrollees took the bait when they purchased insurance at lower-quoted price, and now are forced to switch to a higher cost product or lose their investment.”

It’s the first time in seven years that the roughly 267,000 FLTCIP enrollees, who are civilian federal employees and military members, will see a premium rate increase.

The big premium hike “is going to be very difficult for people to accept,” John Hatton, NARFE’s staff vice president for policy and programs, told The Federal Drive.

OPM said the increase is necessary, based on recent analysis of the program.

“Many factors are considered at the time premium rates are established. Examples include the frequency and duration of claims, expected lifespan of enrollees, length of time an enrollee is expected to keep their coverage, cost of care, estimated returns on investment and overall program expenses,” FLTCIP’s website states. “As the FLTCIP matures, these factors can change over time.”

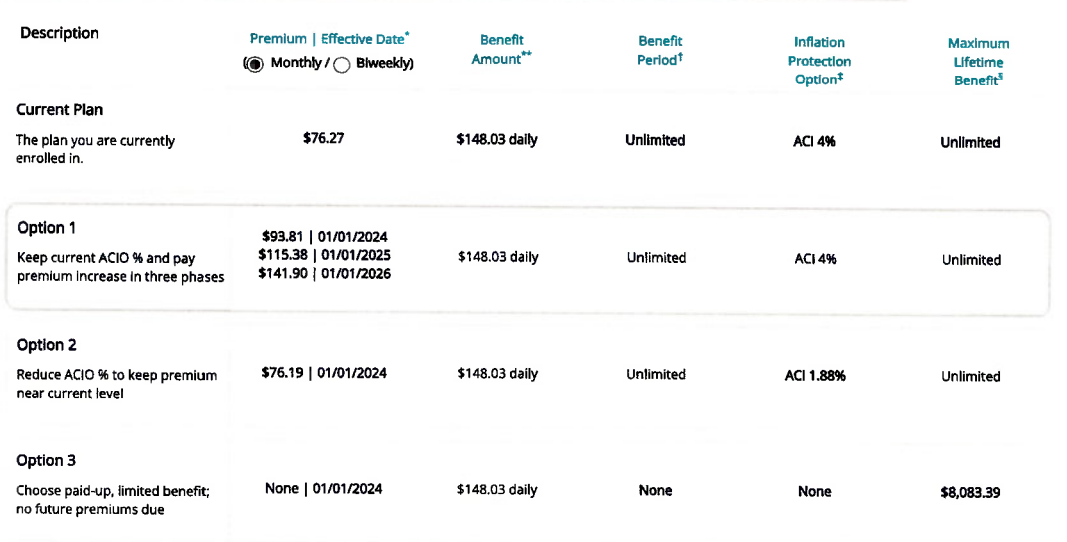

Ahead of the 2024 increase taking effect, OPM sent individualized letters to enrollees detailing their options moving forward. Enrollees can choose to stick with their current insurance plan and take on the larger premium rate. Alternatively, enrollees can opt to reduce their coverage to maintain a rate on par with their prior premium. Or enrollees can move out of the program entirely if they choose.

For at least some enrollees, the premium increases will take place in three phases over the next few years. In one example, a FLTCIP enrollee, speaking anonymously, told Federal News Network that his premiums will increase from $76.27 per month to $141.90 per month by 2026. It’s an increase of 86% over the course of three years.

To maintain the same premium rate, the other option for the enrollee is to accept a reduction in his Automatic Compound Inflation Option (ACI) from 4% to 1.88%. An ACI adds a percentage-based adjustment to the daily benefit amounts for younger FLTCIP enrollees, which helps account for inflation over time.

The enrollee is a somewhat rare case. Many retirement companies recommend enrolling in long term care insurance in your 50s or 60s, but this enrollee joined in 2012 at just 24 years old.

“I enrolled at the time because my landlady, who was also a federal employee said, ‘you’re probably not thinking about this, but look, this is beer money to you. It’s not going to be much. Just think about it — you want to protect yourself later on in life,’” the enrollee said in an interview. “I don’t regret joining the program, but I feel like I’ve been significantly misled. OPM misrepresented all of this.”

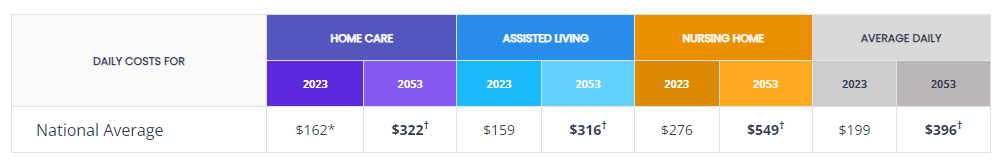

The rising rates or alternative cuts to benefits have compounding effects over time as well. In this example, if the enrollee chose to reduce his benefits to maintain the same premium rate, his daily benefit through FLTCIP would eventually fall well below the average daily cost of long term care.

By OPM’s calculation, the current average cost of long term care is $199 per day. This can include costs associated with home care, assisted living and nursing homes.

By 2053, that daily cost is projected to be $396.

By comparison, this enrollee, who would be in his late 60s in 2053, would have about $480 daily through FLTCIP by that time, if he opted for the higher premium to maintain a 4% ACI.

But if he opted for reduced benefits to 1.88% ACI, that daily amount from FLTCIP in 2053 would be about $249, well below OPM’s estimated cost projection of $396.

“I’m doing everything that the program was intended to do. I don’t want to be a burden to society or to my family or friends,” the enrollee said. “It’s a bait-and-switch. OPM is going to keep increasing these premiums or reduce coverage.”

Premium increases of this magnitude are not new for the program. In 2016, premium rates rose 83% on average, and up to as much as 126% for some enrollees. The average monthly increase amount was $111.

In 2009, FLTCIP enrollees saw their premium rates increase by an average of 17%, and as much as 25% in some cases.

In light of the new premium hike for 2024, it’s not yet clear how many enrollees will choose to reduce their coverage to maintain the same insurance premiums. But as a result of the 2016 increase, just under half, or 96,000 FLTCIP enrollees, chose to keep their premiums the same by reducing their insurance benefits, OPM said in 2016 testimony.

The increase in premiums aligns with the timing that OPM extended its contract for the program for another seven years with John Hancock Life and Health Insurance Company. John Hancock was the only bidder for the contract despite OPM’s solicitations. The insurance company has maintained the contract since FLTCIP was created in 2000.

The contract for the insurance program typically lasts seven years. The program gets a premium hike each time the contract is renewed. The last FLTCIP contract expired on April 30 and was renewed May 1.

“John Hancock proposed significantly higher premiums because recent analysis of the program, using updated assumptions based on identified trends and actual claims experience, indicated that the current FLTCIP premiums would not be sufficient to meet the future, projected costs of the benefits,” FLTCIP’s website states.

To try to hedge against the rising rates, at the end of 2022, OPM suspended new enrollment applications for FLTCIP. OPM said the suspension will give the agency time to try to mitigate the increasing costs of FLTCIP premiums. The suspension will last for two years — with the option for OPM to extend it — and does not affect the coverage of current enrollees.

Up until the suspension, FLTCIP was receiving about 6,000 new enrollees each year. In total, the program insures less than 0.1% of the 11 million eligible individuals.

In another attempt to stabilize premium increases, OPM launched a new plan and rate structure for the program in 2019, called FLTCIP 3.0. The new version of the program included a “premium stabilization feature” intended to help reduce future premium increases in FLTCIP.

Despite these efforts, a September 2022 audit report from OPM’s Office of Inspector General said FLTCIP is not currently funded to handle future anticipated claims at the current premium rates. The report accurately predicted that FLTCIP enrollees would see a high premium hike to offset the deficit.

“We are open to other ideas on how to best stop these actions from reoccurring with each new seven-year contract period,” the report said. “OPM and the contractor are strongly encouraged to research this issue and come up with a better solution that helps mitigate the risk of significant rate increases every seven years.”

For now, enrollees must send their selection — taking the premium increase or reducing benefits — to OPM by Nov. 9. If enrollees don’t take any action, the premium increase will automatically kick in starting in January.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Drew Friedman is a workforce, pay and benefits reporter for Federal News Network.

Follow @dfriedmanWFED