TSP tips: When safe is sorry

What happens if you outlive your money? Senior Correspondent says most federal retirees are safe, but there are ways to avoid being sorry.

With a guaranteed inflation-protected annuity for life, most federal workers don’t need to worry about being broke when they retire. But when it comes to pensions, not all feds were created equal. Most people who retire under the old CSRS system after a full career get a starting monthly benefit equal to anywhere from 50 percent to 80 percent of their final salary. And that benefit is adjusted each year if inflation goes up. For CSRS workers and retirees, the federal Thrift Savings Plan is a nice option, but not necessarily a must-do investment.

But the majority of people still in government are under the newer FERS retirement program. Under it, they qualify (and pay into) Social Security. And they get a government match of up to 5 percent to their TSP accounts. Their civil service retirement benefit is much less generous than the CSRS program, and they don’t get full cost-of-living adjustments. That means that over time — a long retirement — inflation can eat into their government benefit. For FERS employees, investing in the TSP is a must.

If the TSP is critical to your retirement, should you play it safe like the TSP’s Treasury-securities G fund, or the F-fund (bonds)? Or should they invest in higher risk, higher reward options like the C, S and I stock funds. Or the self-adjusting Lifecycle (L) funds that are heavily into stocks?

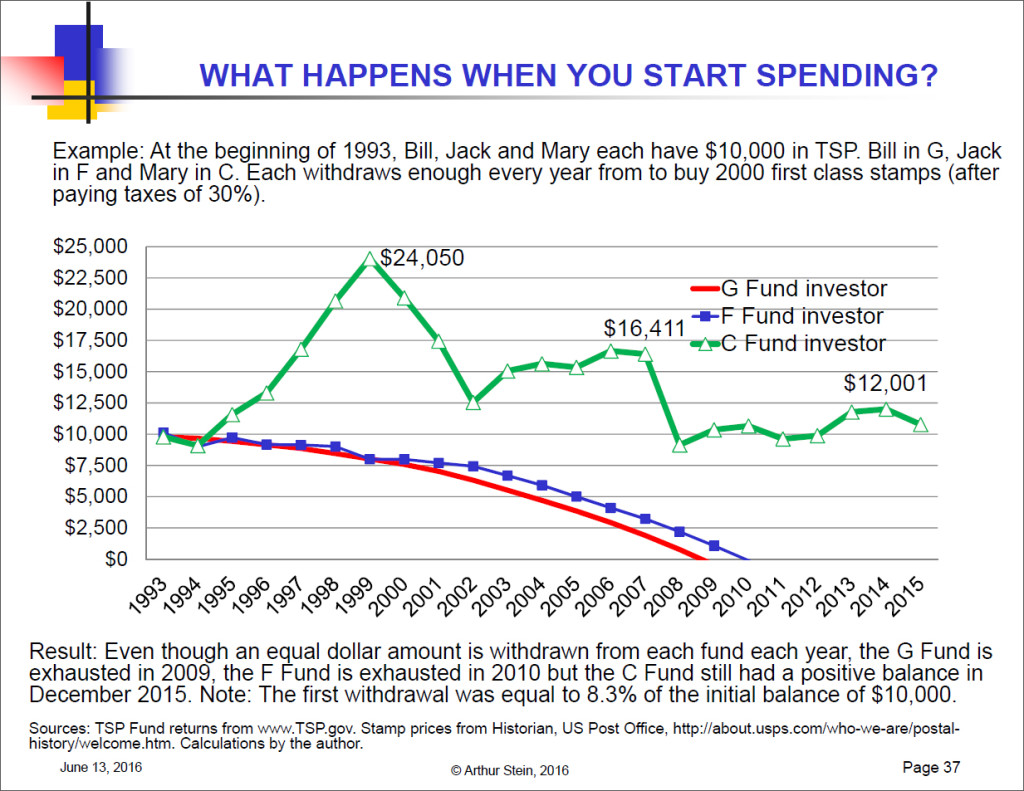

Arthur Stein, a Bethesda-based financial planner, urges his federal clients to avoid being too conservative and to invest for the long-haul. To illustrate what he’s talking about, he gives this example, which assumes people are investing the same amount each year in U.S. postage stamps. Here’s the example he shows clients:

”Here’s a hypothetical example that shows that G and F fund investments may not be as safe as you think. At the beginning of 1993, Bill, Jack, and Mary each have $10,000 in the TSP. Bill allocates all his money to the G fund, Jack allocates all of his to the F fund and Mary allocates all of hers to the C fund.

“Every year they withdraw enough to buy 2000 First Class stamps after paying taxes of 30 percent. The question is which of the three funds will last longer?

“Why use First Class stamps? Stamps offer the same value every year. In 1950, a First Class stamp would pay to mail a letter anywhere in the U.S. Today’s more costly First Class stamp will do the same.

“Bill, Jack and Mary are withdrawing the same dollar amount from the TSP but the results are very different. Bull’s G funds investment is exhausted in 2009. Jack’s F Fund investment is exhausted by 2010. Mary’s C Fund investment is worth more at end of 2015 than when she started in 1993.”

Note: Past performance is no guarantee of future performance. The fund returns are from the TSP.gov, the stamp prices are from the U.S. Post Office’s website, and the calculations are by the Arthur Stein.

Nearly Useless Factoid

By Michael O’Connell

The price of a First Class Stamp in 1950 was 3 cents.

Source: USPS

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED