At budget hearing, DeVos gets pushback on Federal Impact Aid cuts proposal

Education Secretary Betsy DeVos defended the Trump administration's plan to cut federal funding to public school districts that include military bases and Native...

Testifying before members of the House Appropriations Committee on Tuesday, Education Secretary Betsy DeVos defended the Trump administration’s plan to cut federal funding to public school districts that include military bases and Native American reservations.

Under President Donald Trump’s budget plan for fiscal 2019, the Education Department would have its overall funding cut by $3.6 billion, or 5 percent from 2017 enacted levels.

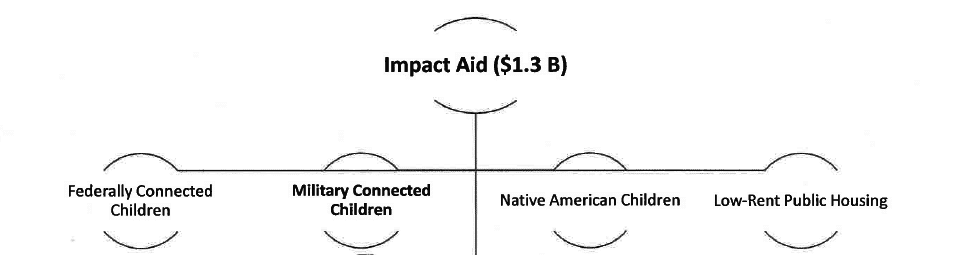

The president’s budget proposal also targets the agency’s Federal Impact Aid, which public school districts receive to make up for property tax revenue not collected on exempt government property, like military bases and Native American reservations.

“We’ve had to work within the framework of a bottom line,” DeVos told lawmakers in explaining cuts to agency programs, adding that the budget request “sharpens and hones the focus of our mission.”

The original Trump budget plan, released last month, would shrink Federal Impact Aid from $1.3 billion to $734 million. However, following a two-year budget deal passed by Congress, the White House proposed giving an extra $525 million back to the fund, for a total of $1.189 billion.

“The addendum allowed us to restore much of that funding, so it’s back to almost what the funding was for the last fiscal year budget proposal,” DeVos said.

Earlier this month, Rep. Jim Banks (R-Ind.) introduced a Heritage Foundation-backed bill that would take funds from Federal Impact Aid and give it to military families to put their children through private school or other alternatives to public school.

Speaking at the Conservative Political Action Conference in February, DeVos said she’d support a school choice program for military families similar to Banks’ legislation, without specifically endorsing the lawmaker’s proposal.

Rep. Tom Cole (R-Okla.), the chairman of the Labor, Health and Human Services, and Education Subcommittee, took issue with the proposed cuts to Federal Impact Aid.

“School districts with high numbers of federally connected children or large amounts of untaxable federal property rely heavily on these resources. And to be perfectly candid, some of these districts are in my home district and my home state,” Cole told Devos.

The lawmaker also said cuts to Impact Aid would disproportionately affect both his district and the entire state of Oklahoma, which contains several large military bases, including Tinker Air Force Base, the state’s largest employer.

“Those populations aren’t there, other than the fact that the federal government is there, providing employment or bringing in military personnel. These are not areas that I would say can afford those kinds of hits,” Cole said.

Of the 39 Native American tribes living on federally owned property in Oklahoma, Cole said 11 of those tribes live in his district.

More than 200 school districts in Oklahoma get some level of impact aid. More than 1,000 districts across the country receive impact aid.

“That aid is an important source of resources for school districts that are financially burdened by a large amount of federal property,” he added.

Under the Obama Administration, the Education Department also sought to reduce Federal Impact Aid, but the cuts never materialized after getting pushback from Congress.

“There’s clearly some thought at the department that this is a good approach, but it’s met with a lot of resistance on the committee,” Cole said.

Cole also asked for further details about the agency’s plans for a “high-quality evaluation” on the effects of federal property on school districts.

“Why would you propose to cut funding before such a study is complete?” Cole asked.

Bill Cordes, the director of the Elementary, Secondary and Vocational Analysis Division of the Education Department’s budget service, said the agency wants to assess whether districts that needed Impact Aid funds decades ago still need them.

“Some of that property is generating income now, and we’d like to be able to be a little more discerning in our proposal by looking at the impact it’s had. In some cases, the federal presence actually generates more revenue. A military base, for example, oftentimes brings a lot of people, a lot of businesses, so we’d like to have the opportunity to do a more in-depth study of maybe a half dozen places.”

Cole pushed back on Cordes’ claims, adding that local business property taxes wouldn’t make up for the tax revenue not collected from military facilities.

“There’s no way the businesses around them make up for that, or come anywhere close to it,” Cole said.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jory Heckman is a reporter at Federal News Network covering U.S. Postal Service, IRS, big data and technology issues.

Follow @jheckmanWFED