Dark side of TSP’s G fund

Most of the retirement nest-egg money federal investors have socked away is in the super-safe, never-has-a-bad-day Treasury securities G fund. But Senior...

If there was a popularity contest in the government’s in-house 401(k) plan, the clear winner would be the special Treasury securities G fund. Thirty-six percent of all the money active and retired feds have in their TSP accounts is in the G fund. Some have everything in it.

During the Great Recession, hundreds of thousands of active and retired feds fled the falling stock market, moving money from the stock-indexed C fund (S&P 500), S fund (small caps) and I fund (a limited international markets fund) into the G fund.

Many of them also stopped investing in the stock funds that have since recovered big time. Many of them remain in the G fund waiting for the “right” time to come back into the stock market.

Arthur Stein, a Washington-area financial planner, thinks that many feds who fled the stock market for the “safety” of the G fund have never returned to stocks. They missed out on the recordh-high gains the markets have made in recent years. Many investors have moved into the TSP’s millionaire club. The vast majority are long-time TSP investors who stuck with the C and S funds through good times and bad. They enjoyed watching their portfolios grow on paper during good times, like now, and continued to buy stock funds while they were on sale during downturns.

Currently, the G fund has 36 percent of all asset allocations, followed by the C fund (28 percent), the S fund (10 percent), and the F fund (5 percent) and the I fund (4 percent.) Eighteen percent of the TSP’s investments are in one of its Lifecycle target retirement date funds.

The G fund is the favorite because it is considered safe. As in, it never has a bad day. On the other hand, it rarely has a good one. Over the last one, three, five and 10 years, the F, C and S funds outperformed the G fund. But as Stein and others point out, the danger of having all or too much of your money in the G fund is that over a long period of retirement, investments into the G fund won’t increase purchasing power after subtracting out the negative effects of inflation and taxes.

“There are many types of investment risk,” he said. But the only thing provided by the G fund is its total lack of volatility (fluctuations in value) and the guarantee provided by the government. None of the other TSP funds offer those benefits.” But that cuts both ways. Very low risk vs. very low returns. To illustrate it, Stein uses this example with something we can all identify with: U.S. postage stamps.

“Historically, using the G fund as a long-term investment exposed investors to a high risk of losing purchasing power. The rate of return for the G (and F) funds was not sufficient to increase purchasing power after subtracting out taxes on withdrawals and inflation, “ Stein said using this example:

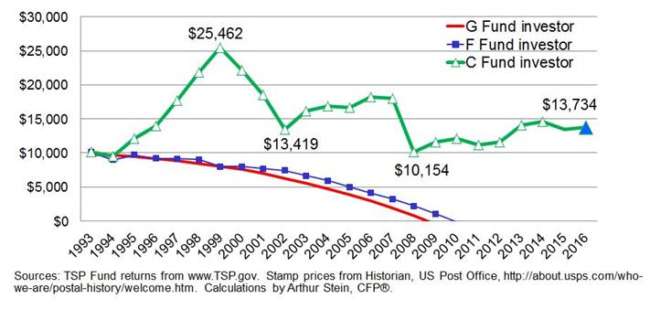

At the beginning of 1993, Bill, Jack and Mary each have $10,000 in the TSP. They invest their $10,000 in one fund:

• Bill in G

• Jack in F

• Mary in C

Each of them withdraws the same dollar amount annually to buy 2,000 first-class stamps, after paying taxes of 30 percent on the withdrawals.

Why first-class stamps in this example? First-class stamps are unique in one respect; the value (service provided) is the same year after year. Thirty years ago, one first-class stamp was sufficient to mail a letter anywhere in the U.S. The same is true today. So first-class stamps are a good proxy for inflation.

Result: Even though an equal dollar amount is withdrawn from each fund each year, the G fund is exhausted in 2009 and the F fund in 2010. But the C fund still had a positive balance in December 2016. In fact, the C fund balance was 37 percent higher.

Yes, fluctuations in value (volatility) are much lower for the G and F funds. Unfortunately, the low volatility occurs while the G and F fund values decline to zero.

Few FERS retirees will be able to live on “guaranteed income” (Social Security and annuity) until they die. At some point, expenditures will exceed guaranteed income. Retirees then need to start withdrawing from their investments to supplement permanent income. The investment withdrawals need to last as long as the retiree is alive. That will be difficult to achieve if the purchasing power of the investments is declining.

“Past performance is no guarantee of future performance,” Stein said. “But tell me why the G fund is considered ‘safe?’”

Nearly Useless Factoid

The founding members of Marvel Comics’ super-hero team the Avengers were: Iron Man, the Hulk, Ant-Man, The Wasp and Thor.

Source: Wikipedia

Go to Mike Causey’s Federal Report

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED