Happy anniversary, C Fund market peak

If you were like most people invested in the stock market 10 years ago, you were riding high. Then you were in shock and awe as your retirement nest egg began to...

Do you remember where you were, financially, 10 years ago this month? Probably in the dumps! Maybe in a full panic mode. Can you say Great Recession? Looking backward is important, but you must be careful.

Most people don’t make long motor trips driving backward using only the rearview mirror. It just doesn’t work. It’s good to know where you’ve been, but when investing, it is important to keep it in perspective. But there are some anniversaries that all of us should remember.

Arthur Stein, a Washington area financial planner, has lots of federal clients who are in the Thrift Savings Plan, Uncle Sam’s in-house 401k plan. A couple of them have become TSP millionaires by long-term investing in the TSP’s stock index funds through good times and bad. We asked him about the importance of anniversaries. He said:

There are many anniversaries to remember. When you were married is a key one, don’t forget it or you will be in trouble.

Another one is Oct. 9, 2017, the 10-year anniversary of the TSP C Fund (an S&P 500 Index fund) reaching its peak value before huge declines during the ‘great recession.’

That 2007 peak was a cause for celebration. For about one day. After that, the C Fund share price began declining. It was down 55 percent by March 9, 2009, less than 1.5 years later.

The decline and subsequent recovery can be interpreted many ways. I see it as a good example of how well buy-and-hold investing worked for investors in well-diversified portfolios.

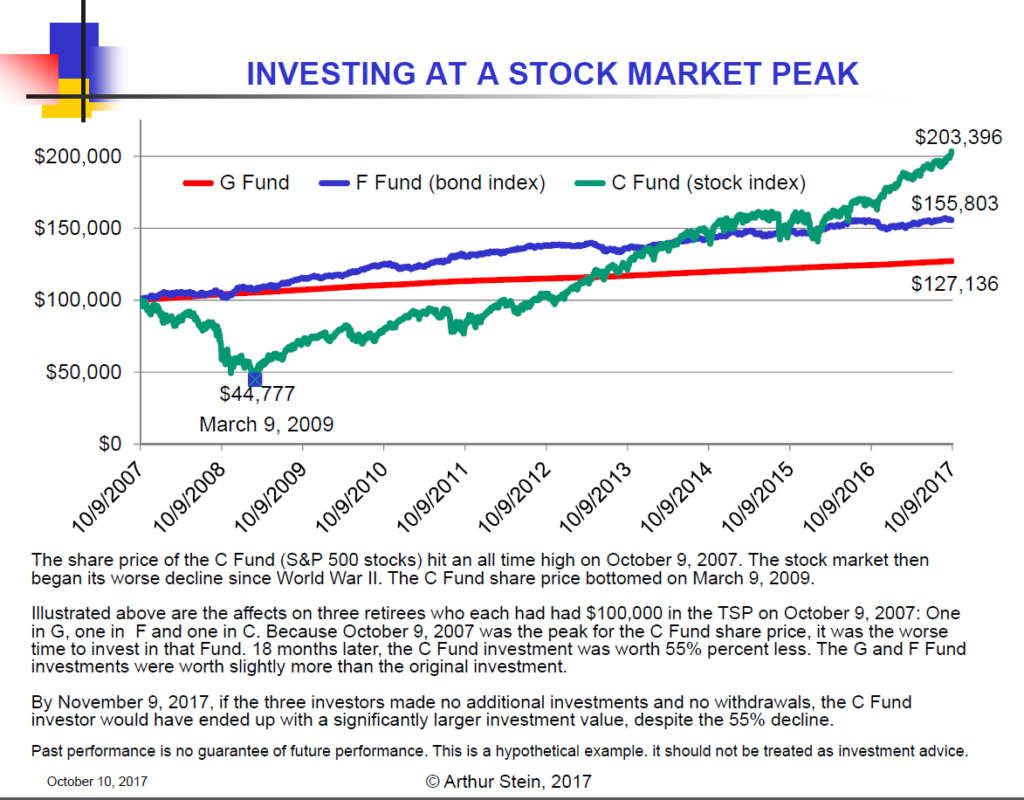

The chart below compares values for the TSP G (government bond), F (U.S. bond index fund) and the C Funds. It assumes $100,000 was invested in each of those on March 9, 2007 with no subsequent investments or withdrawals.

The bond funds were ahead for a long time. It wasn’t until May 2013 that the C Fund investment finally equaled the value of the G Fund investment.

It took until March 2014 before the C Fund investment caught up to the F Fund. It fell behind the F Fund multiple times during the next two years. But 10 years later, the C Fund investment would have been 30.5 percent greater than the F Fund and 60 percent greater than G.

Diversified and well managed U.S.stock portfolios have been a great long-term investment for investors who did not sell during declines, even for those who invested at stock market peaks. Of course, past performance is no guarantee of future performance. — A.S.

TSP Workshop: Arthur Stein will be giving a 3-hour course on Nov. 29, from 6:30-9:30 p.m., at the Montgomery College Campus in Rockville, Maryland. The course is for active and retired feds who are in the TSP and will deal with investment strategies, Roth IRAs, tax considerations and making your retirement money last as long as you do. The fee is $40 for Maryland residents, $70 for non-residents. The class number is CRS#26094.

Nearly Useless Factoid

A goat can eat 8 pounds of weeds in a day.

Source: Philadelphia Inquirer

Read more of Mike Causey’s Federal Report

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED