The long and short of TSP investing

Are you a federal employee worried about your mix of TSP funds and retirement nest egg? If so, financial planner Arthur Stein has a couple of simple,...

Do the ups and downs of your Thrift Savings Plan account balance keep you up at night? Are you financially nervous in the civil service, or do you think you have the wrong mix of funds in your retirement nest egg?

If so, financial planner Arthur Stein has a couple of simple, ulcer-preventive tips:

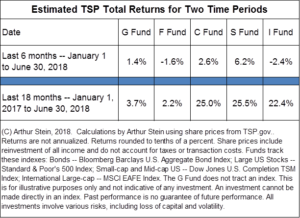

For the first half of 2018, TSP fund returns ranged from the good, such as the S Fund, to the mediocre, such as the G and C funds, and finally to the bad, namely the F and I funds. In addition, the stock market volatility missing in 2017 returned.

If the returns are keeping you up at night, here are two possible solutions: Look at the past 18 months instead of the past six, and don’t look as often.

Using a longer time period generates much different results. F and I fund returns turn from positive to negative. The stock fund — C, S and I — returns are now a robust 22 percent to 25 percent.

Is picking a longer time period fair? Am I cherry picking a period to make the returns look better? I don’t think so, because short-term returns are not useful for investments needed 10 years and more in the future.

Except for the G Fund, stocks and bonds are good long-term investments but not always the best short-term investments. The F, C, S and I funds are not good choices for money you will need to withdraw and spend in the next 1-5 years — bonds — and 1-10 years — stocks.

How often you review your accounts also has an effect. Many investors constantly review long-term investments by looking at short-term returns daily, weekly or monthly. In some cases — hourly, but that can cause unnecessary despair or euphoria when investments are volatile.

C Fund returns were extremely volatile during the first half of 2018 but ended with a 2.6 percent gain. This graph traces C Fund values and lists some of the changes, measured from highest highs to lowest lows.

Consider the cases of two hypothetical retirees, both of whom started this year with $100,000 in the C Fund and then made no contributions or withdrawals.

- Ned Nervous looked at his account every day. He saw constant volatility and it scared him, so he may be thinking about transferring his C Fund balance into G.

- Nellie Not-Nervous did not look at her account until the end of the six-month period. She doesn’t see any volatility, only a slight increase in value. She doesn’t understand why Ned is so upset.

So, how often do you look at your TSP balances, and does it affect your investment decisions?

Stein will discuss these and other TSP investing topics on the Your Turn radio show Wednesday at 10 a.m. Questions for him or Mike Causey can be sent before the show to mcausey@federalnewsradio.com Listen at www.federalnewsradio.com or 1500 AM in the Washington, D.C. area.

Nearly Useless Factoid

By Amelia Brust

While the white wedding dress trend dates to Queen Victoria, the tradition of diamond engagement rings began even earlier with Maximilian I of Austria, Holy Roman emperor from 1508 to 1519. In 1477, he gave his new wife Mary of Burgundy — whom he married by proxy — a gold band set with diamonds in the shape of an M.

Source: The New York Times

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED