Earlier this month we asked readers if their government agency was better or worse than when they started. And one longtime IRS worker said the latter.

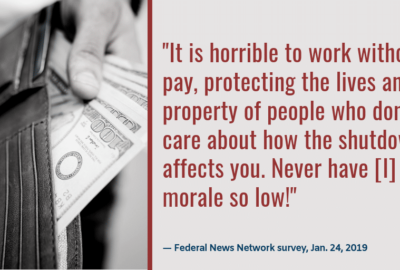

By just about any measure you choose this tax season has been less than a roaring success. The number of refunds and their value are down. Many people realize, a year late, they should have reviewed and revised their deductions. Like with most legislative “reforms” the revised tax rule from the administration’s 2017 Tax Cuts and Jobs Act caught a lot of people by surprise. Oh, and there was the whole “35-day shutdown without pay” thing that made life less merry for many.

On April 9, CNN reported the IRS had disbursed more than $206 billion in refunds through March 29. While that’s a lot of money it is down from the $212.3 billion the IRS returned to many of us last year. The agency said that 79% of processed returns got a refund this year, slightly less than the number of folks getting refunds in 2018.

But the IRS has taken lots of political hits from both parties. Most recently congressional Republicans charged the Obama administration was targeting the tax-exempt status of conservative political groups. Now Democrats, and some Republicans too, are demanding that the IRS release President Donald Trump’s tax returns going back as much as six years. The White House said it will not release them because the president is being audited while critics say that all presidents are automatically audited by the IRS but most have voluntarily made their returns public. Politicians in New York state are seeking to have his state taxes made public. Whatever happens the IRS isn’t likely to get fiscal or physical help from Congress although many employees say they are strained to the breaking point.

Earlier this month we asked readers if their government agency was better or worse than when they started. And whether they as civil servants had improved or declined over time. A lot of thoughtful responses came in, including this one from a long time worker who says he, and the IRS, have definitely seen better days:

“The answer to this question is easy: No! The number of IRS revenue officers conducting collection work fell from around 7,500 when I was hired back in 1987 to around 2,000 in 2019. Scores of delinquent individuals are unable to get their tax balances resolved. A more troubling management aspect is the failure to hire due to continual and severe budget cuts from 2010-2018. We are at a point where there may not be enough veteran, skilled and seasoned revenue officers left to pass their skills on to potential new hires. The iceberg has melted from the top! The damage done by budget cuts will likely take five to 10 years to recover from assuming continuing budget increases continue.

“When I started at the IRS in 1987, it was a ‘family-type’ atmosphere to work in, where employees got together outside of work, enjoyed their work — even if really challenging at times — and were proud of the agency they worked for. All the kids have grown up and moved away. While I’m still proud to serve our country through my work at the IRS, the organization has changed. Morale among revenue officers and others is very low. It’s understandable why for the reasons you cited below.

“Revenue officers used to get together annually for Continuing Professional Education. While learning the latest updates on various job-related topics, they also got to meet [other] revenue officers from different offices. Those connections I made back in the day were invaluable throughout my career. You knew who to call and support staff weren’t just some voice on the phone. Maybe we had too many meetings and conferences but we’re not having enough now to promote connections that will further work productivity and improve the morale and camaraderie of our employees. I know we have budgets and I get it. Hopefully, they may reinstate some of this with the new hires to get them off on the right track.

“I’m hopeful that with the planned hiring of 750 revenue officers — won’t even come close to catching up to the losses and the current attrition — we can begin the process of rebuilding the ranks, developing skills, and returning to a better atmosphere.

“As for me, I have one year, one month and a few days before I’m eligible to retire. I hope our retirement system is left alone long enough to get there. If they don’t mess with retirement, I’ll likely stay longer. It would be great to be part of the turnaround back to a better IRS.”

By Amelia Brust

Despite being landlocked, Nebraska has a Navy which was commissioned in 1931 by Lt. Gov. T.W. Metcalfe so he could give joke admiralships to his friends while the governor was on vacation. In fact all members of the Great Navy of Nebraska are admirals, and among them are performers, queens, athletes, volunteers, writers and even animals.

Source: Lincoln Journal-Star

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED