The TSP in troubled times: Go long!

It's easy to talk about long-haul, no-panic investing during good times, like we’ve just experienced for an unnaturally long time. But when the going gets tough...

It’s hard to think about next summer’s vacation at the beach in February when there is a blizzard outside and your roof is groaning under the weight of all that ice and snow. There are times when it is important to live in the moment and focus on how to minimize your losses. But that is not always the best plan for ordinary people who are investing for a retirement that could last 10, 20 or 30-plus years. Like now!

After decades of mostly good — often great — news, the stock market is wobbling. For good reason. Thrift Savings Plan investors have grown accustomed to big returns with hiccups replacing bear markets. Generally speaking, things have been good-to-excellent since May 2009, the end of the Great Recession. The TSP is critical to federal/postal workers under the FERS program. It could provide anywhere from one-third to one-half of their total income-for-life in retirement. Their federal retirement annuity and Social Security are the other parts of that three-legged system Congress designed in the 1980s. The changes, while excellent in many respects, mean that FERS employees must work harder/plan smarter and show more discipline in order to match what they would have gotten under the CSRS program. They need to invest smarter and harder (as in more) to match or exceed what they would have gotten under CSRS. But it can be done. Most of the current TSP millionaires are FERS employees/retirees who maxed out on their contributions (ensuring the 5% government match) and who continued to invest in the stock indexed C, S and I funds during the Great Recession when the market tanked, producing a scary buyer’s market for investors.

It’s easy to talk about long-haul, no-panic investing during good times, like we’ve just experienced for an unnaturally long time. But when the going gets tough, and markets decline — sometimes rapidly — it is harder to stay the course and sleep at night.

Now we’ve got Russia in Ukraine, China and the Taiwan problem, a seriously divided nation here at home, big-time inflation and record high gasoline prices. Oh, and a continuing pandemic that has altered the world and killed at least one million Americans. And a critical shortage of life-or-death infant formula. What next, monkeypox?

So what if this period, right now, turns out to be the good old days?! What if things get much worse before they get a little better? So who did we call for advice? How about Arthur Stein, a well-known Washington-area financial planner. Most of his clients are active or retired feds. Several are TSP millionaires, in some cases because-not-in-spite-of the Great Recession. He’ll be my guest today on our Your Turn radio show (10 a.m. EDT) on federanewsnetwork.com or 1500 AM in the Washington-Baltimore area. If you have questions for him, send them to me before showtime at mcausey@federalnewsnetwork.com/alert. Meantime he’s written an introductory column of his own explaining what we’ll be looking at and talking about today.

Longer return periods make everything look better

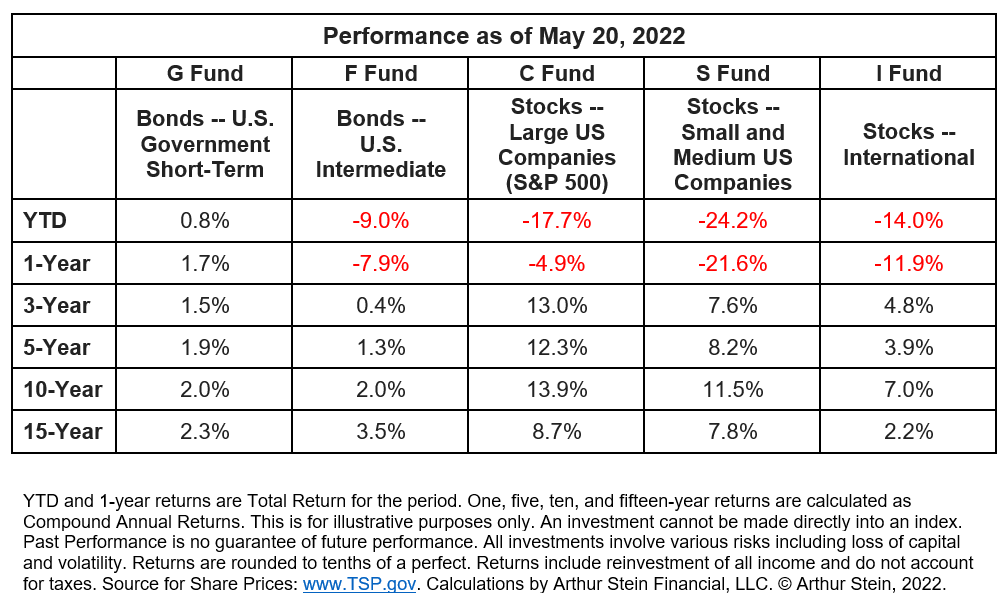

Through May 20, 2022, returns for 14 of the 15 TSP funds were down. Down a lot.

So where can you find some good news? It’s easy, just look a little further back and, like magic, all those negative returns disappear.

And you don’t have to look back too far. Just three years.

The stock funds (C, S and I) all performed well over the last three years, even with the recent declines. Well enough to produce average annual rates of return that were much higher than the bond funds (G and F). And the horrible F fund declines, probably the worst ever, disappeared.This should be a reminder to TSP participants that allocation decisions need to consider when funds will need to be withdrawn to supplement annuities and Social Security. For instance:

- The G fund is an excellent choice for funds that will be withdrawn in the next 1-5 years.

- F is a good choice for funds that will be needed in the next three to ten years.

- The stock funds make sense for funds that won’t be needed for ten years or more.

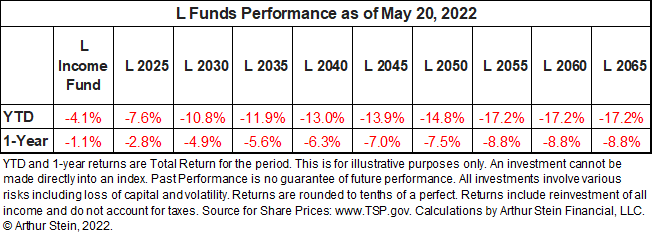

The L funds work differently. They began with 80% to 99% invested in stocks (C, S and I) and the remainder in bonds (F and G). Over time, the percentages in stocks decline as the percentages in bonds increases. When they reach their target dates, L funds close and investments transfer to the L Income fund, which is currently 75% bonds, mostly G.

That doesn’t protect from losses. Current returns are negative for all L funds, including L Income.

Nearly Useless Factoid

There are only about 25 blimps still in existence.

Source: Reader’s Digest

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED

Related Stories