GSA releases new IT modernization RFI in post-shutdown procurement deluge

Agencies impacted and not impacted by the partial government shutdown released up to eight times more RFPs, RFIs and awards on FedBizOpps.gov last week as compa...

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

The General Services Administration released two pre-cursors to major acquisitions last week with the release of the draft solicitation for the $8 billion back-office cloud procurement and a request for information to expand the Centers of Excellence initiative.

The Customs and Border Protection, U.S. Citizenship and Immigration Services, Immigration and Customs Enforcement, and GSA launched a major cloud and IT modernization effort by announcing an industry day on Feb. 26 in Washington, D.C.

And the Office of Personnel Management is exploring how to create a central portal for the Federal Employee Health Benefits Program.

These are just a few of the more than 4,700 requests for proposals, RFIs and awards released on FedBizOpps.gov in the week after the partial government shutdown ended, opening up the acquisition floodgates.

By comparison, the last week of January in 2018 and 2017 saw seven to eight times fewer RFPs, RFIs and awards — 689 in 2018 and 528 in 2017 — than last week.

So even with 75 percent of the government still open for business during the 35-day funding lapse, every agency had pent up demand to move out with an assortment of procurement actions.

The Defense Logistics Agency alone released more than 700 solicitations last week for everything from nonchargeable batteries to liquid nitrogen and liquid oxygen to grenade launcher barrels, according to research by U.S. Federal Contractor Registration, a third-party which helps contractors register to do business with the government.

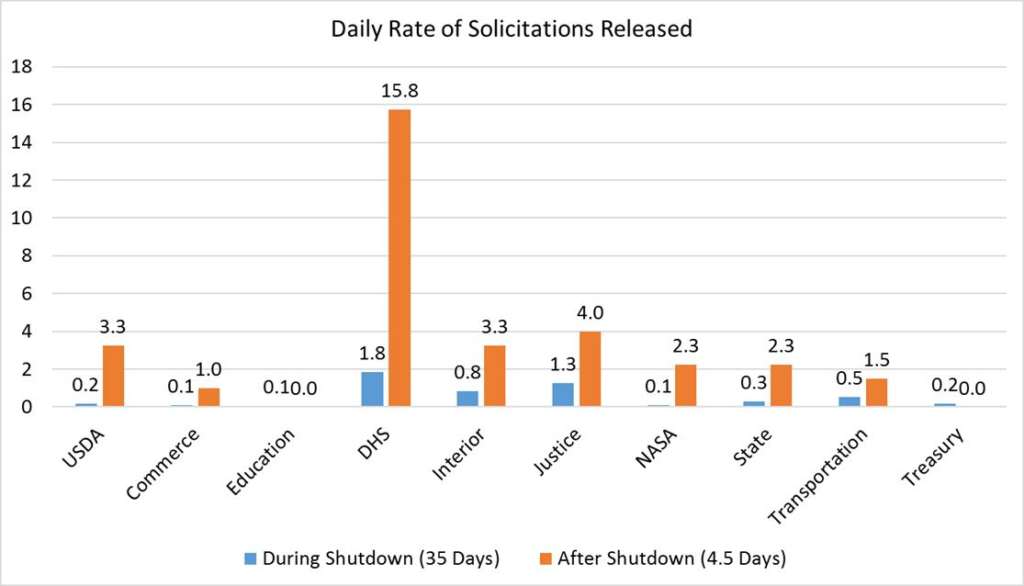

Kevin Plexico, senior vice president for information solutions at Deltek, said the volume of FedBizOpps notices posted during the shutdown by agencies that were impacted was about 19 per day.

“In the four full days since the shutdown ended, the pace has picked up to nearly 100 per day,” he said. “In terms of solicitations, DHS has been the most active. They posted 64 solicitations during the entire 35 day shutdown. They’ve posted 63 in the four days since reopening — a rate of 16 solicitations per day.”

The departments of Agriculture, Interior and Justice also have been playing catch up, posting 3-to-4 RFPs per day over the last week.

Among all the procurement actions that came out this week, GSA released two that many in the federal IT community are watching closely.

The first was a RFI released on e-Buy for the Centers of Excellence IT modernization initiative for a new blanket purchase agreement so every agency can take advantage of phase 1 services.

“The desired outcome of the Discovery BPA is to emphasize repeatability and scalability. We want to give every agency that works with CoEs access to private sector partners who can provide the expertise and technological know-how to successfully implement IT modernization agencywide,” said Bob De Luca, executive director of CoE, in a statement on Github. “It will also serve to reduce the total cost associated with the CoE efforts, allowing agencies to allocate more of their budget towards deliverables rather than on administrative procurement work.”

As an aside — and let me get on my soapbox for a second — while GSA was smart in issuing some of these details of the RFI on a public Github site, obtaining a copy of the actual RFI was way too difficult. In fact, several Federal Acquisition Service executives I talked to in contracting didn’t have access to the RFI under eBuy. There was no reason for GSA not to release the RFI publicly on FedBizOpps or through the Github site. The lack of transparency, once again, is bewildering.

Related Stories

Back to the details of the RFI, under phase 1 of the CoE, agencies work with a vendor to identify modernization priorities across seven task areas. GSA added information security and workforce reskilling and transformation to the existing five of cloud adoption, IT infrastructure optimization, contact center, customer experience and data analytics.

“This blanket purchase agreement is intended to account for each future partner CoE agency by offering a means of initial and continuous discovery work, by center need, considering the various different factors, influences, and context that applies to each agency’s organizational transformation needs,” the RFI states. “The contractor shall provide discovery and assessment support to lay the foundation for successful implementations of modernized shared services across the (agency).”

GSA is seeking industry input on how they would provide assessment services. Comments on the RFI are due Feb. 8th.

Draft DEOS RFP open for comment

The other big procurement is the draft RFP for the $8 billion Defense Enterprise Office Solutions (DEOS) procurement.

GSA, and its partner the Defense Information Systems Agency, said the procurement will be a single award, firm fixed price BPA “with a contractor who will provide a widely used/widely available, and non-developmental and fully integrated collaboration solution.”

The BPA will have a five-year base with two two-year options and one one-year option for a total of 10 years.

“The 10-year period of performance will provide the department with the flexibility to transition users based on user demand, migration schedules and legacy contracts or service end-of-life terms,” the draft RFP states. “For the Non-classified Internet Protocol Router Network (NIPRNet) and Secret IP Router Network (SIPRNet) implementations in United States territories and possessions, the government expects to leverage DoD approved commercially hosted facilities to meet the DEOS requirements. However, due to DoD data sovereignty requirements, the contractor must implement their NIPRNet and SIPRNet cloud service offerings within DoD data centers (e.g., Stuttgart, Wiesbaden, Capodichino) for locations outside of the United States territories and possessions. For locations outside of the United States territories and possessions, the contractor must provide a standalone environment within a DoD data center. The solution must be self-contained and must include the required infrastructure, hardware, software and auxiliary components required to implement, manage and maintain the CSO environment within the DoD data center.”

Latest Technology News

Comments on the draft RFP are due Feb. 15.

OPM, CBP, ICE issue notices

Two other interesting procurement actions worth noting are from OPM, and from CBP, ICE, USCIS and GSA.

OPM released an RFI looking for a cloud system to host a central enrollment program that is a one-stop-shop within an account-based portal where enrollees can compare and learn about FEHB plan options, including benefits, cost-sharing, and total out-of-pocket expenses, select a plan that fits the unique needs of their family and complete the enrollment process, all with customer service assistance.

“The CEP will include a web-based portal for self-service enrollment transactions, robust decision support tools and a customer support center to assist enrollees via phone, email or online chat,” the RFI states. “The CEP user experience will be supported by a data warehouse, enrollment transaction processing, and ongoing reconciliation of enrollment and premiums.”

Finally, CBP, ICE, USCIS and GSA are holding an IT modernization and cloud migration industry day on Feb. 26 in Washington, D.C.

The RFI states the industry day will cover a range of topics from multi-cloud to analytics to current and future opportunities.

Read more of the Reporter’s Notebook

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED