Average January retirement surge falls short of alarmist predictions

The latest data released by the Office of Personnel Management shows that in 2017, 15,317 federal employees filed to retire in January, historically the month when...

In defiance of doomsayers who proclaimed the 2016 election and presidential transition the latest heralds of impending ruin, the apocalyptic federal “retirement tsunami” has once again failed to materialize. The latest data released by the Office of Personnel Management showed that in the first month of 2017, 15,317 federal employees filed to retire.

January is historically the month when the most feds file for retirement. But that number, while large, is about 100 fewer than in 2016, and falls short of 2015’s numbers by more than 3,300.

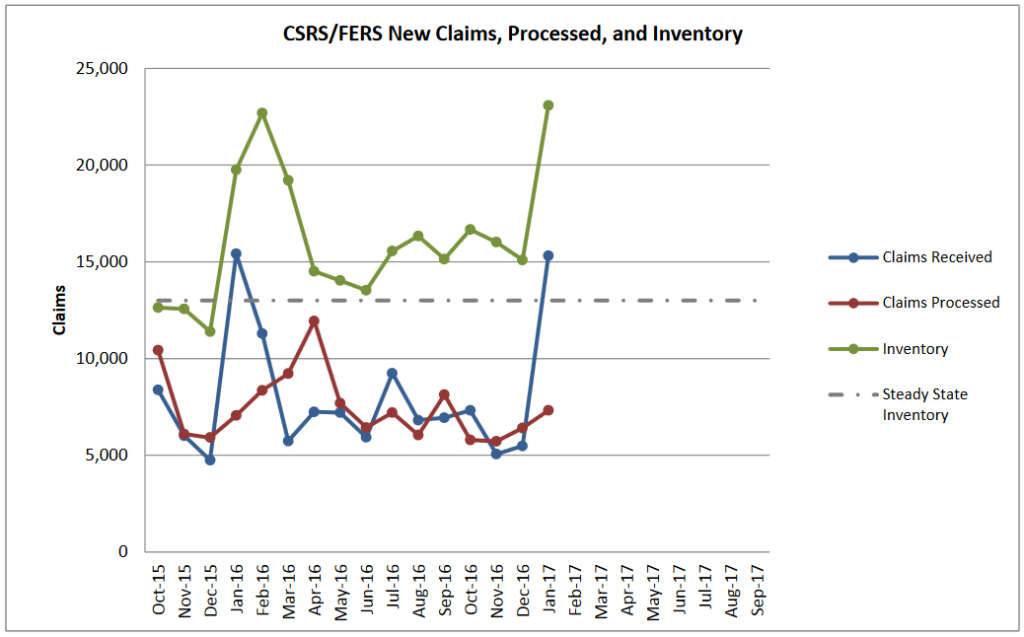

The January surge in retirement does launch OPM’s retirement backlog to more than 23,000 claims, the highest it’s been since February 2015, when it topped 24,000. February usually sees the second highest number of claims; this smaller surge usually produces the highest backlog of the year.

Currently, the backlog inventory stands at more than 10,000 claims higher than what OPM refers to as its “steady state inventory” of 13,000.

OPM did manage to process more than 7,000 retirement claims in January, its highest number since September, but lackluster progress in the last months of 2016 did little to improve the agency’s position ahead of January’s surge.

Meanwhile, the percentage of retirement claims processed in 60 days or less fell to 51 percent this year to date, an all-time low, at least since OPM started tracking this statistic in May 2014. Similarly, the monthly rate of claims processed in less than 60 days fell to 39 percent.

The average number of days it took to process a case in 60 days or less rose to 53, a 16-month high. However, OPM did make progress in reducing the average number of days it took to process a case in more than 60 days. That number actually fell to 89, the lowest since October 2015.

In 2016, 93,713 federal employees retired.

In 2014, the Government Accountability Office predicted that by September 2017, around 600,000 federal employees — about 31 percent of the federal workforce — would be eligible to retire.

Some experts suggested that the presidential transition could lead to higher turnover in the federal workforce, perhaps even triggering the “retirement tsunami,” a sudden surge in retirements that would drain federal agencies of institutional knowledge and a majority of their workforce. It was first predicted in the 1990s as the first of the baby boomers began approaching retirement age simultaneously as federal hiring of younger people slowed down.

In the months leading up to the election, many feds were uncertain about retirement plans. In a survey conducted by Federal News Radio, about 35 percent of respondents said the transition would play a role in their retirement plans, while another 18 percent were waiting on the outcome of the election to make any decisions.

As of September 2015, the latest data available from OPM, more than 45 percent of federal employees are over the age of 50, while less than seven percent are younger than 30. The average age of the federal employee is 47.4 years old.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Daisy Thornton is Federal News Network’s digital managing editor. In addition to her editing responsibilities, she covers federal management, workforce and technology issues. She is also the commentary editor; email her your letters to the editor and pitches for contributed bylines.

Follow @dthorntonWFED

Related Stories