Number of TSP participants receiving a full match reaches record high

Close to 87% of TSP participants are now contributing enough to their retirement accounts to receive the maximum matching contribution rate from the government.

Leaders on the Federal Retirement Thrift Investment Board saw 2023 as a relatively successful year of progressing toward long-term strategic goals for the Thrift Savings Plan (TSP).

Perhaps most notably, more TSP participants than ever are now contributing enough to their retirement accounts to receive a full match from the government.

Currently, 86.8% of feds in the Federal Employees Retirement System (FERS), as well as 84.9% of active-duty military members in the Blended Retirement System (BRS) are putting at least 5% of their biweekly paychecks into the TSP. Contributing at least 5% to the TSP is the amount required to receive the maximum 5% matching contribution from an employee’s agency or a military member’s branch of service.

Additionally, the TSP now has $845 billion in total assets — another record-high for the government’s 401(k)-esque retirement savings program for federal employees. And setting yet another record, 36% of the now roughly 7 million total TSP participants have Roth balances.

“These numbers tell me that 7 million current and former federal employees in both civilian and uniformed services have trusted us with $845 billion of their hard-earned money,” Ravi Deo, executive director of the FRTIB, said during a board meeting Tuesday. “It is a trust we must continue to earn.”

Jim Courtney, director of FRTIB’s Office of Communications and Education, has credited the growing number of participants who receive the full matching rate to the FRTIB’s switch in 2020 to auto-enroll participants at a 5% contribution rate, rather than the previous 3%.

The improvements during 2023 also show progress in the goals FRTIB set in its strategic plan for fiscal 2022 through 2026. For the past couple of years, the board has been aiming to provide more information to participants to help them make the most informed decisions possible about their investments and retirement savings.

One of the steps toward the strategic goal is encouraging best practices for savings, FRTIB said, including contributing enough to receive a full matching rate.

“TSP funds, when combined with regular savings and an employer match, can improve retirement security for millions of families with a TSP participant in their ranks,” Deo said. “And the $845 billion [in total assets] does have one big benefit — it allows us to provide our services at an extremely low cost, allowing our participants to keep more of their money.”

Over the last year, the FRTIB also learned of slight changes in participants’ views of their own financial wellness, and their confidence in their goals for retirement savings.

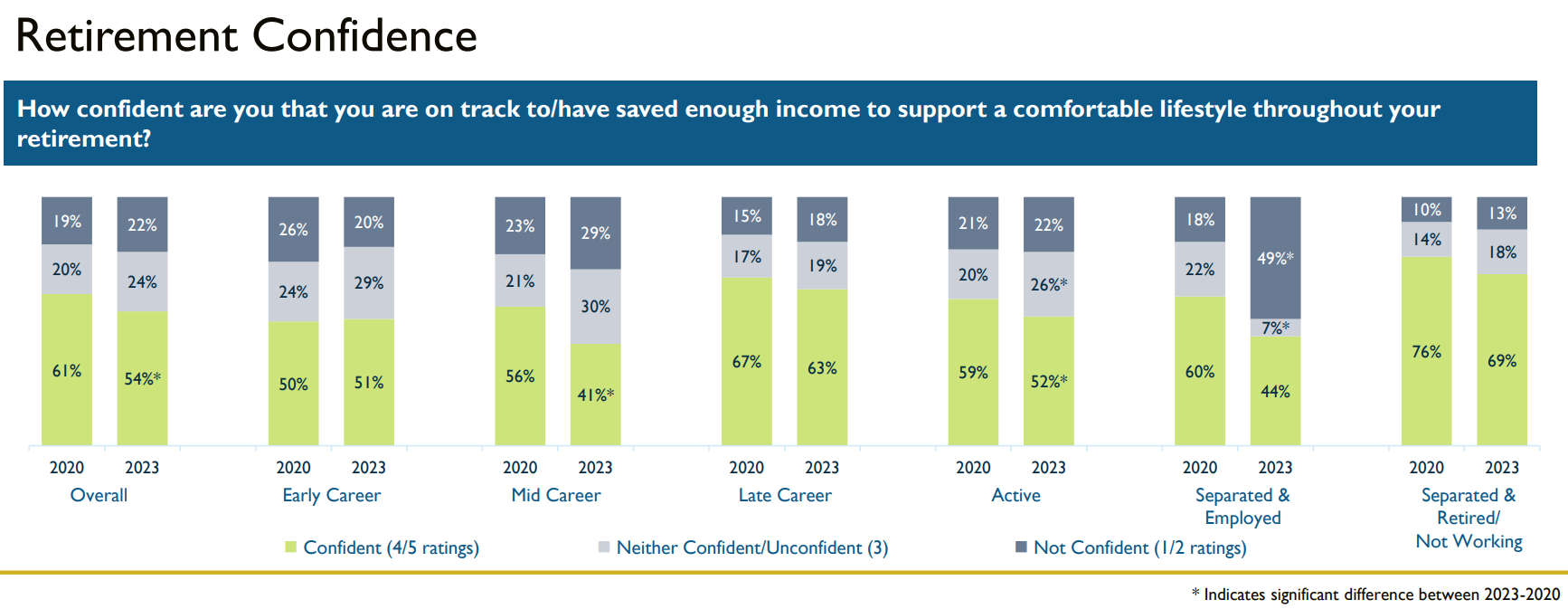

Currently, a little over half of TSP participants are confident they are on track for retirement, according to a survey the FRTIB conducted during June and July 2023.

The last time FRTIB conducted a financial wellness survey was in 2020. In the past couple of years, participants who are still employed but who have separated from public service have become noticeably less confident in their retirement goals.

With the survey now complete, National Association of State Retirement Administrators (NASRA) Executive Director Dana Bilyeu, a TSP board member, turned her attention to what comes next.

“What do we do now that we have this great information from our folks?” Bilyeu said during the board meeting. “What do we do to create action plans in the next year, two years, five years — however we’re going to do it — to address those areas that they feel most vulnerable?”

Tom Brandt, FRTIB’s chief risk officer and director of planning and risk, said the goal is to use the survey and new information when considering any changes, decision-making and communications going forward.

“It’s also used by the training team as they’re looking at what additional training might be appropriate, or perhaps when we want to make some adjustments,” Brandt said. “As we look through this data, we can see some areas where there might be some benefits from making some adjustments, making some enhancements, or perhaps adding some new components to our training and communication elements.”

In addition to improving communications and resources for FERS participants in the TSP, the board is also trying to adjust the way it reaches younger military members who are newly enrolled in BRS.

“They’re young, they’re transient, they’re hard to find,” Brandt said. “They have the hardest time at that age imagining retirement.”

The BRS is a relatively new retirement system, which many military members got access to as part of the fiscal 2016 National Defense Authorization Act. BRS offers a “blend” of two major sources of retirement income: a traditional retirement pension and a TSP account.

In addition to automatic enrollment into the BRS for new military members, TSP ensures that participants are enrolled at the 5% matching rate, and that they’re enrolled in the right lifecycle (L) fund for their age. In September 2023, for the first time since the launch of the BRS program in 2018, the number of BRS participants surpassed the number of participants in the military’s legacy retirement system.

Similar to the FRTIB’s goals for FERS participants, the board tries to communicate and inform BRS enrollees as much as possible.

The Defense Department “has identified 14 milestones in the career of a uniformed services person — touch points where they have to teach them something,” Brandt said. “We make sure that our TSP materials are part of those touch points.”

Deo said while enrollment in the BRS is certainly not the end of military members’ savings toward retirement, it’s a step in the right direction of trying to create good habits early on.

“To the extent that we can take someone who is spending 12 hours a day figuring out how they get really good at something that is completely unrelated to the TSP — whether it’s Army, Navy, Air Force — we stick them in automatically, we give them the match,” Deo said. “If they do nothing, they will reach the age of 22 better off than most 22-year-olds in America … We are — hopefully — pushing the boulder down the hill and we will continue to roll fast.”

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Drew Friedman is a workforce, pay and benefits reporter for Federal News Network.

Follow @dfriedmanWFED