Is securing a new federal locality pay area worth it?

Federal employees in the six newly established locality pay areas may be disappointed with the payout from their 2019 retroactive raises.

The payout for federal employees who have been waiting — for years in some cases — to secure their own locality pay areas and separate rates may be getting a little less sweet.

Some 72,000 federal employees in Birmingham, Alabama; Burlington, Vermont; Corpus Christi, Texas; Omaha, Nebraska; San Antonio, Texas; and Virginia Beach/Norfolk, Virginia, broke free this year of the “rest of U.S.” designation. Employees in these areas now have their own, separate locality pay rates starting in 2019.

But for many of these employees in these areas, a shiny new location pay area may amount to a few hundred additional dollars in 2019 over the previous year.

The rates for 2019 and a comparison with 2018’s rates are listed below.

If employees in these areas hadn’t gotten their own locality pay designation this year, they would have seen a 15.67 percent adjustment, the “Rest of U.S.” rate for 2019. For employees in San Antonio, their new locality rate is less than half a percentage point from the “Rest of U.S. rate in 2019. For Birmingham, employees there will get locality boost that’s 0.1 percent higher than the rest of the country.

Employees in Omaha, Nebraska, will see a 0.2 percent bump over the rest of the U.S. Burlington, Vermont, will see the largest increase out of the six, with a 0.51 percent bump.

Several Federal News Network readers in one of the six, newly established locality pay areas had expressed their disappointment with the 2019 increases that for them, seemed small in comparison with the new adjustments that the rest of the country had received this year.

They questioned, via emails and Tweets to Federal News Network, whether the long, complex process the colleagues had gone through to secure a new locality pay area was worth the 0.1-to-0.5 percent bump.

But there are several reasons for the minimal locality pay rate adjustments this year.

2019 locality pay adjustment was minimal

First, locality pay increases in 2019 made up a relatively small slice of the average federal employee pay raise.

This year, the President approved an across-the-board raise of 1.4 percent, with just an additional 0.5 percent adjusted in locality pay rates, for a total average of 1.9 percent.

Of course, the announced federal pay raise during any given year reflects an average increase, meaning some federal employees may receive an adjustment that’s higher than the announced number, while others may see total salary adjustments that are lower.

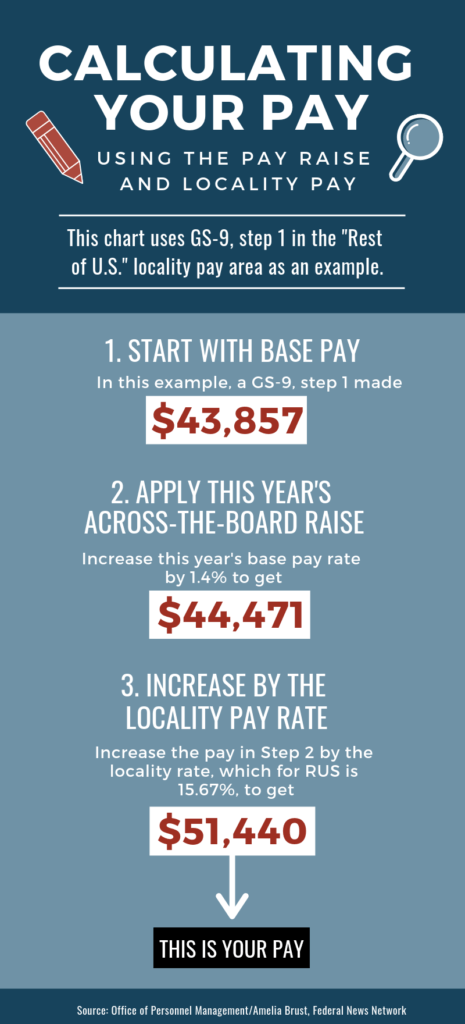

Let’s use an example.

Let’s say you’re GS 9, step 1, and you live in the “Rest of U.S.” locality pay area.

In 2018, your GS base rate equaled $43,857. To calculate your 2019 base raise, increase $43,857 (your 2018 base pay rate) by the 2019 across-the-board base pay raise of 1.4 percent.

Next, increase $44,471 (your salary adjusted for the 2018 base pay raise) by your locality pay percentage for 2018. In this case, the 2019 locality pay increase for the “Rest of U.S.” is 15.67 percent.

The final total equals $51,440, meaning in total, your salary has increased 1.66 percent in 2019.

Locality pay adjustments, in this example for a “rest of U.S.” employee, accounted for $6,969 in 2019.

Using this same formula, a GS-9, step 1 employee in Virginia Beach will receive $51,546 in 2019, compared with the $50,598 an employee at the same GS level received in 2018 under “rest of U.S.” This employee would receive an additional $948 over the prior year’s salary.

Using this same formula, a GS-9, step 1 employee in Virginia Beach will receive $51,546 in 2019, compared with the $50,598 an employee at the same GS level received in 2018 under “rest of U.S.” This employee would receive an additional $948 over the prior year’s salary.

A GS-9, step 1 in Birmingham will receive $51,484 in 2019, compared with $50,598 last year, a difference of $866 for the year.

It’s up to the President to set these locality pay adjustments for any given year.

These adjustments are based on the disparity between General Schedule pay and non-federal pay as determined by the Bureau of Labor Statistics. Despite common misconceptions, living costs or specific price levels like the Consumer Price Index aren’t factors when setting locality pay.

Instead, the BLS uses the National Compensation Survey to measure non-federal compensation in a particular labor market and compare it to federal pay for GS employees who perform similar work in the same region.

Pay disparities vary based on the region, and those variations matter when the President sets locality pay rates for each of the 53 areas.

“While the six new locality pay areas have pay disparities exceeding the RUS, it’s only been recently that BLS salary surveys have estimated pay disparities for those six locales that meet the criteria established by the pay agent for designation as separate locality pay areas,” a federal pay expert, who didn’t receive permission to speak with the press, told Federal News Network. “By contrast, the BLS data currently used in the locality pay program show considerably larger pay disparities for some larger metropolitan areas — like Los Angeles and New York City — and the President provided larger locality pay increases for those areas.”

Too many locality pay areas?

Second, the low locality rate adjustments for employees in the six new areas are also a result of the sheer number of locality pay areas, which has been steadily growing.

With the addition of the six new areas in 2019, there are now 53 distinct locality pay areas, a total that includes the “rest of U.S.” area that encompasses the other federal employees who don’t work within one of the 52 separate areas.

But additional locality pay areas doesn’t translate into more funding to spend on federal employee pay raises, the pay expert said. Locality pay accounts for a portion of the total General Schedule payroll. The more locality pay areas there are, the smaller the slices from the locality pay funding pool become.

“Allocating a locality pay increase among previously existing locality pay areas reduces the dollar amount that can be allocated to provide locality pay increases for new locality pay areas,” the pay expert said.

Changes ahead for the federal pay and locality system?

The process to establish a new locality pay area is long. Federal employees travel often long distances to Washington, D.C. once or twice a year to make their case to the Federal Salary Council, which hears stories and often alarming statistics about recruitment and retention difficulties at some agencies.

The council had, for example, first approved Burlington and Virginia Beach as separate locality pay areas back in November 2015. The pay agent approved them a year later before the regulatory process languished for nearly two more years. OPM finalized the creation of the two new areas in December 2018.

Employees in these areas before that had traveled to Washington, D.C. to make their case to the Salary Council for years. Some employees have gotten their local congressmen and union representatives involved.

Ron Sanders, chairman of the Federal Salary Council, has said during past council meetings that these stories from employees show the existing system isn’t working in their favor.

Council members are set to to release a report in the coming month or so that will outline a variety of options for potential changes to the existing federal pay system and the methodology the council uses to make decisions about locality pay.

Members representing federal employee unions, however, have already expressed their dissenting views and adamantly defended the existing locality pay methodology. Federal Salary Council Chairman Ron Sanders has said it plans to submit all the council’s views, including the unions’ opinions.

The President’s Pay Agent, a body composed of the Labor Secretary and directors of the Office of Personnel Management and Office of Management and Budget, has signaled it’s ready to seriously consider changes to the existing system.

Related Stories

underlying model used to estimate the pay gaps cited in this report. We share those concerns,” the pay agent wrote in its most recent report, dated Nov. 30, 2018. “The comparisons of federal vs. non federal wages and salaries fail to reflect the reality of labor market shortages and excesses. They also require the calculation of a single average pay gap in each locality area, without regard to, for example, the differing labor markets for major occupational groups.”

According to BLS, private sector workers are paid, on average, 30.91 percent more than their counterparts in the federal government, but several organizations have questioned this assessment.

The Congressional Budget Office, for example, said federal employees are compensated at a rate that’s 17 percent higher than private sector workers. The Cato Institute put the gap in favor of the federal workforce even higher.

To learn more about the statute-based formulas that typically set across-the-board federal pay raise during many years, visit Federal News Network’s explainer on the topic here.

For those who are keeping track, the 2020 federal pay raise, should, on average, total 2.5 percent, according to the Employment Cost Index formula. This total doesn’t include any locality pay adjustments.

To learn more about how locality pay, what it is, what it means for your and your paycheck and how it differs across the country, find Federal News Network’s second explainer here.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED