Better data, analysis gives SBA new optimism to recoup smaller COVID loans

SBA Administrator Isabel Guzman told House and Senate small business committee lawmakers recently the agency would reverse course and do more to force borrowers of...

The Small Business Administration handed out over a trillion dollars in loans during the pandemic. But it was only recently that SBA’s data gave them the full picture about how many of those loans under a $100,000 could be repaid.

Like with any challenge, the further SBA got away from the initial event, the better its data became.

And it was that data analysis that led SBA to reverse course and be more aggressive in collecting unpaid COVID loans for under $100,000.

“After an updated December 2023 data analysis determined that referring COVID Economic Injury Disaster Loans (EIDL) and Paycheck Protection Program (PPP) loans less than $100,000 to IRS and Treasury will be cost effective for the government, the SBA took swift action to incorporate this into our collection process,” an SBA spokesperson said in an email to Federal News Network. “The SBA will continue to pursue every legal, cost-effective method to collect on all loans and help small business borrowers come into compliance by either securing forgiveness for or repaying their pandemic loans as required by law.”

SBA Administrator Isabel Guzman told House and Senate small business committee lawmakers in December about the agency’s decision to do more to collect defaulted loans under $100,000.

“Nothing about that 2022 process on $100,000 and under loans changed SBA’s fundamental position that every borrower who takes a loan from SBA should pay it back or comply with the requirements for forgiveness, in the case of PPP. That is why SBA has always continued to collect on all loans and communicate the consequences from nonpayment,” Guzman wrote in a letter to the committees. “To date, SBA has made more than 75.2 million phone calls to support repayment and collection. SBA has sent a letter to every active COVID EIDL borrower the month before the end of their deferment to remind them of their payment obligation. SBA has sent more than 9 million collection letters in addition to 1.4 million due process letters and other borrower communication. SBA has worked intently with its lending partners to ensure compliance with PPP forgiveness protocols and/or loan performance without forgiveness.”

During the pandemic, the SBA handed out two types of loans: Paycheck Protection Program and COVID Economic Injury Disaster Loans (EIDL). The COVID-19 EIDL program provided loans of up to $2 million to help businesses pay for expenses that could have been met had the pandemic not occurred, including working capital needs such as fixed debt payments and operating expenses such as payroll.

PPP loans were distributed by third party lenders and focused on keeping people paid during the pandemic.

SBA disbursed over $400 billion in COVID-19 EIDL funds and borrowers obtained nearly $800 billion in PPP funds through third-party lending partners.

SBA has focused a lot of its efforts to recover loans worth more than $100,000 and those loans deemed fraudulent. SBA’s inspector general estimated in June that about $200 billion, or 17 percent, of all COVID-19 EIDL and PPP funds went to potential fraudsters.

SBA, however, pushed back against the IG’s assessment, saying instances of “likely” fraud occurred at a “drastically lower rate. SBA says its own subject matter experts released their own analysis which estimated $36 billion in likely fraud in SBA pandemic relief programs – $30 billion of which has already been recovered.

Fourth analysis was the charm

The government already is forgiving millions of these loans, but also going after fraudsters and legitimate companies who are on the hook to pay these back.

SBA says so far, 73.6% of the COVID EIDL portfolio is current on their loan payments, paid in full, still in deferment, or just slightly past due. The government projection for the program included an estimated 37% default rate.

Additionally, SBA says 96% of the total PPP loan portfolio has been forgiven, in full or in part, representing nearly $761 billion. Borrowers have up to 5 years from origination to request forgiveness.

SBA says data it didn’t have in three other analyses in April and September 2022 and in February 2023 showed the cost to collect defaulted loans under $100,000 would be higher than the amount of money the government would receive back.

But a fourth analysis in December demonstrated a much different answer.

During the third analysis, the SBA says it looked at two big factors to estimate the value of collectability of these loans. Those two factors were private sector debt collector data and how a portfolio with these characteristics would perform in the private debt collection market.

SBA added that the collection costs remain roughly the same as the amount available to collect increased. SBA says the costs do scale up a bit as the population gets bigger, especially around staffing and legal, but it doesn’t scale the same way to make it inefficient to collect on the debts.

SBA says the default population is now about 439,000 loans worth about $7.2 billion, which is up from prior analyses that estimated the initial projected default population of 80,000 loans worth $1.4 billion.

SBA says as the denominator grew to $7.2 billion, in this case, the cost to collect the money didn’t rise similarly so it now is much more cost effective for SBA to go after those defaulted loans.

“The outcome rests on updated data that was not available in early 2022,” Guzman wrote. “SBA manages our programs through data-driven decision making, acting in the best interest of America’s small businesses and the prudent use of federal resources from American taxpayers. With this updated analysis, SBA is implementing step 14 for all COVID EIDLs and Step 9 for all PPP loans.”

SBA estimates that for PPP and COVID EIDL loans under $100,000 that have defaulted and been charged off, it’s approximately $30 billion, or about 2.5% of the entire $1.2 trillion PPP and COVID EIDL portfolios.

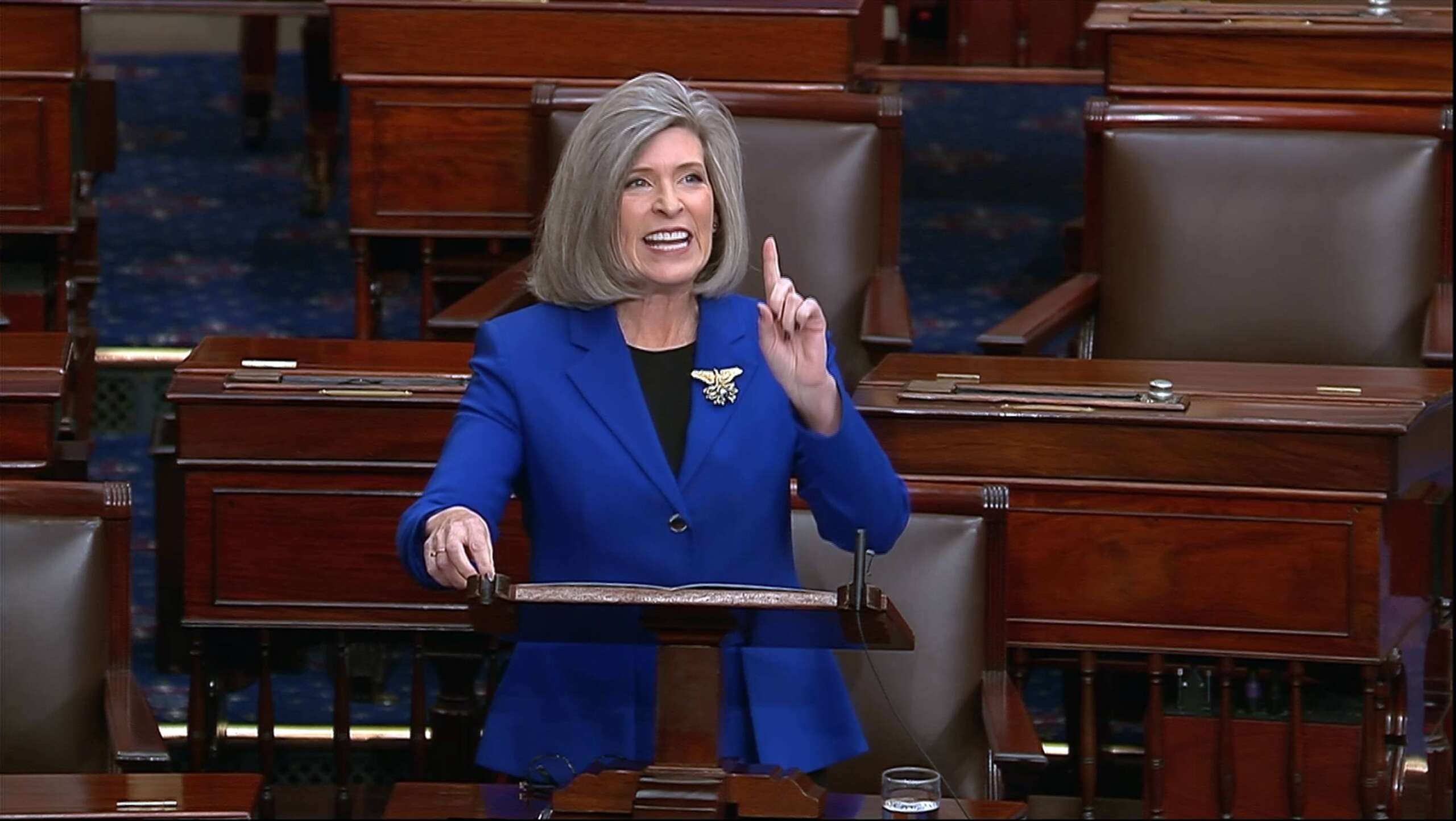

House and Senate small business committee leaders pushed SBA to change its policy and applauded the agency’s decision.

“As Ranking Member of the Senate Small Business Committee, I’m dedicated to protecting our hard-earned tax dollars from waste and abuse. That’s why I’m glad that Biden’s SBA is finally answering my calls to collect on delinquent and fraudulent COVID loans,” said Sen. Joni Ernst (R-Iowa) in a statement to Federal News Network. “I will keep working to ensure the more than $200 billion the agency doled out to fraudsters does not go unpunished or uncollected!”

Rep. Roger Williams (R-Texas), chairman of the Committee on Small Business, echoed Ernst in praising SBA’s decision and pushed the agency to do more.

“It is great to see the committee’s oversight activities culminate in the SBA reversing course to finally do right by the taxpayers,” said Williams said. “However, our work is not done. The committee will continue looking into why the SBA didn’t send these loans to Treasury earlier, the quantitative analysis to justify this decision, and how the government should appropriately handle the remaining pandemic loan portfolio.”

Ernst, Williams and others lawmakers leaned on SBA over the last year to collect on these defaulted loans worth less than $100,000.

SBA, however, pushed back against the criticism it received over its initial decision. It says under section 3711 of the Debt Collection Improvement Act (DCIA) of 1996, SBA can forgo the final step of collections for PPP and COVID EIDLs under $100,000 — which is referring the loans to Treasury — if doing so is not cost effective for the government.

The SBA says it decided to exercise its 3711 authority quietly and did not publicize it because we want all borrowers to repay their loans. The agency added regrettably, members of Congress put out public statements that created confusion that the SBA was forgiving or not collecting on some loans, harming our efforts to collect these loans.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED