SDFM The Business of Defense

-

The technologies that will be groundbreaking 30 years in the future have their roots in decisions being made today. With the right perspective, federal agencies are uniquely equipped to start shaping what that future looks like.

April 19, 2021 -

Hosted by Dr. Richard Shurtz and Jim Russ. Sponsored by Stratford University. Why you should no longer use Windows 7. And we meet the Egyptian scientist who helped make Wi-Fi possible.

April 19, 2021 -

The FLTCIP features international benefits that provide coverage for enrollees who live or may require care outside the United States.

April 16, 2021 -

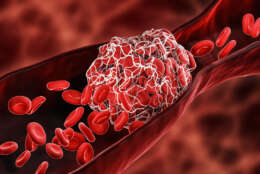

This week hosts Mark Masselli and Margaret Flinter welcome Dr. Ashish Jha, Dean of the Brown University School of Public Health. Dr. Jha is a world renowned expert on pandemic preparedness and addresses concerns around the rare blood clot risk with the J&J vaccine, saying the brief pause in distribution is further evidence our scientific surveillance is working. He addresses the challenges of vaccine hesitancy and global supply chain. And also talks about the pandemic's impact on propelling meaningful change in public health in the U.S. as well as in the global health infrastructure.

April 16, 2021 -

When it comes to the cloud, state governments, like the one in Maryland, are combining commercial-cloud providers with their own data centers for mission delivery, backup and recovery.

April 15, 2021 -

Bryan Rosensteel, a cybersecurity architect for the public sector at Cisco’s Duo Security, said if cybersecurity tools make technology difficult to use, employees will not use them.

April 15, 2021 -

As the global leader in mobile security, Zimperium protects thousands of enterprises and government agencies worldwide. It is no surprise that100 percent of our customers have detected mobile threats including compromised and jailbroken devices, mobile phishing campaigns, malicious/risky apps, and network attacks.

April 15, 2021 -

On FEDtalk this week, join us for a discussion on elevating the importance of human capital management.

April 13, 2021 -

The collective impact of the looming retirement tsunami, the “Great Resignation” and Workplace 2030 is making for a perfect storm that could fundamentally reimagine the role of relocation benefits in a modern federal workforce.

April 12, 2021 -

Join host Michael Keegan as he explores these and more with Sherri Greenberg, contributor to the IBM Center Special Report, COVID-19 and its Impact on a Special Edition of The Business of Government Hour...

April 12, 2021 -

Hosted by Dr. Richard Shurtz and Jim Russ. Sponsored by Stratford University. Humanity is about to send a drone into space -- to spy on the Martians for a change. And we meet the Hungarian biochemist whose research has formed the basis for two of the COVID vaccines.

April 12, 2021 -

The United States Agency for International Development has more than 80 overseas mission locations, and nearly all of its storage is in the cloud.

April 08, 2021 -

This week, hosts Mark Masselli and Margaret Flinter speak with Dr. Bechara Choucair, White House Vaccinations Coordinator. Dr. Choucair discusses the remarkable pace of vaccine distribution in recent weeks, and the Biden Administration’s plans to deliver 200 million vaccines in 100 days. He addresses the challenges at vaccine production facilities, the impact of the American Rescue Plan on efforts to scale up vaccine production and delivery, as well as the important role played by community health centers to address the health needs the most vulnerable populations impacted by the pandemic.

April 08, 2021 -

The title program manager can be pretty abstract, but when done correctly, it can make serious changes.

April 07, 2021 -

Watch the videos of the Federal News Network and AT&T 5G Summit, in which defense leaders share their stories, lessons-learned, and enthusiasm for the transformational new technology.

April 06, 2021