Lockheed Martin separates with IT unit in Leidos merger deal

Lockheed Martin is spinning off its Information Systems & Global Solutions unit and merging it with engineering company Leidos in order to double down on its...

Lockheed Martin is spinning off its Information Systems & Global Solutions unit and merging it with engineering company Leidos to double down on its defense and aerospace holdings.

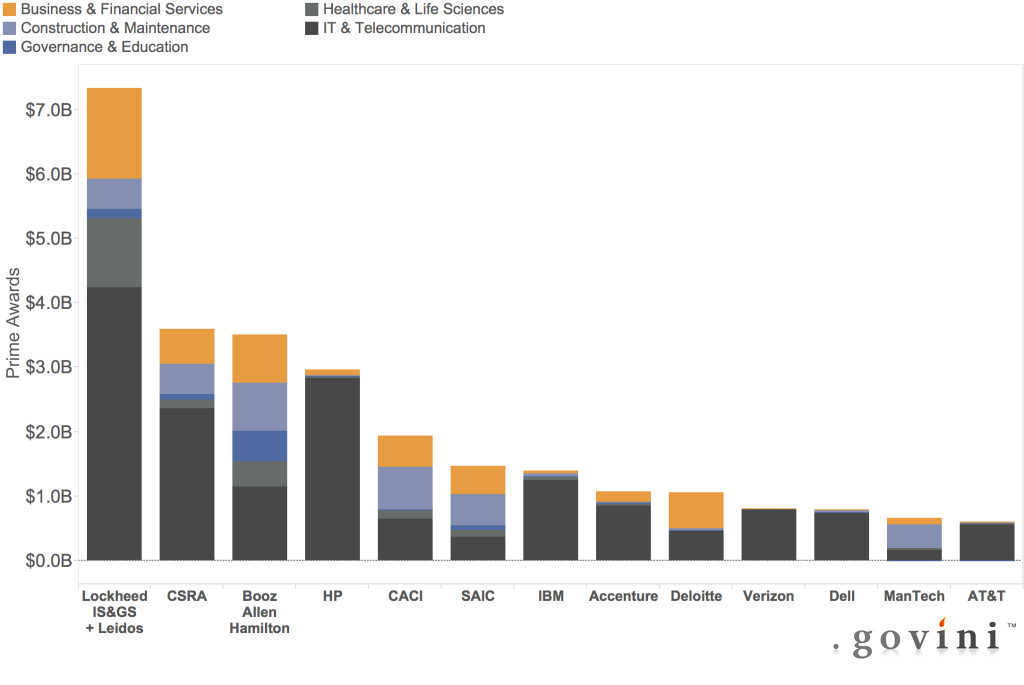

The merger, once it’s approved by regulators, would create the largest government services provider in the United States. Lockheed’s newly separated IS & GS division has about $5 billion in sales and more than 16,000 employees internationally.

“The combination of our proven IT and technical services businesses with Leidos will create a new leader in the government IT sector with a diversified portfolio, greater scale and improved efficiency,” Lockheed Martin President and CEO Marillyn Hewson said in a press release. “This strategic transaction is an important milestone in the portfolio reshaping strategy we announced in July 2015 and allows us to focus on our core business in aerospace and defense.”

The pending deal would give $1.8 billion to Lockheed, which the Bethesda, Maryland-based company says it will use to manage its debt, pay dividends and repurchase its stock. Shareholders will receive approximately 77 million Leidos shares with an estimated value of $3.2 billion.

Shares dropped more than 3 percent in morning trading Tuesday.

Leidos is expected to pay its shareholders a special dividend of about $1 billion. Existing shareholders of Leidos Holdings Inc. will continue to hold the remaining outstanding shares. The deal still needs approval from Leidos shareholders. It is expected to close in the second half of the year.

“If you take two weak companies and merge them, you usually get another weak company. If you take a strong company and a weak company you often get an average company. If you take two strong companies and merge them, you get a colossus. Such is the case I see here with the new IT company created by Lockheed and Leidos,” said Barbara Kinosky, managing partner at Centre Law and Consulting. “This deal may create the largest government IT services provider in the federal space.”

In June 2015, Lockheed bought Black Hawk helicopter manufacturer Sikorsky Aircraft for $9 billion. Sikorsky was previously owned by United Technologies Corp., but was sold in order for the conglomerate to focus on its stake in the aerospace and buildings industries.

“Lockheed’s acquisition of Sikorsky Aircraft in 2015 and this new Leidos deal is sending a message to the industry that Lockheed is heading back to its core competencies of defense weapons systems and aerospace and exiting the lower margin IT industry,” Kinosky said. “If you are a midsize IT company, beware. A colossus like this newly created IT firm can underbid, over-qualify and dominate the competitive field.”

Jonathan Aberman, managing director and chairman of Amplifier Ventures, said the Lockheed-Leidos deal indicates how massive contractors continue to fare well, while midsize IT companies continue to struggle.

“It’s a mature market, and mature markets award scale,” Aberman said. “[Lockheed and Leidos] can be profitable because they’re more efficient.”

While the current state of industry doesn’t bode well for midsized contractors, Aberman said the conditions have been right for startups.

“There’s an enormous advantage in the world of tech to be really, really large and benefit from scale, or be really, really small and be nimble,” he said. “You either win on scale or you win on uniqueness.”

Reston, Virginia-based Leidos outbid rival defense contractor CACI International Inc. for the merger deal.

Shares of Lockheed Martin dropped $6.19 — or 2.9 percent — to $204.82 in morning trading. Its shares have edged up 3 percent throughout the past year.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jory Heckman is a reporter at Federal News Network covering U.S. Postal Service, IRS, big data and technology issues.

Follow @jheckmanWFED