More than ever, contractors need a vehicle strategy to capitalize on a growing federal market

Federal spending on contracts for goods and services continues to grow in many categories. But according to research by Deltek, there's increasing consolidation of...

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

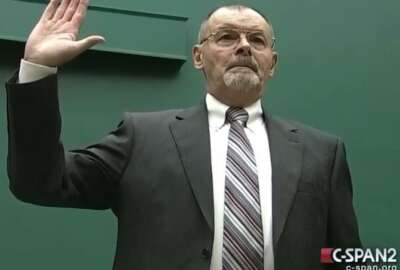

Federal spending on contracts for goods and services continues to grow in many categories. But according to research by Deltek, there’s increasing consolidation of contracting vehicles by the government. And that means companies more than ever need to understand what Deltek calls best fit opportunities. Deltek Senior Vice President Kevin Plexico spoke with the Federal Drive with Tom Temin .

Interview transcript:

Tom Temin: Give us the macro picture here, because Congress keeps appropriating trillions of dollars for this program and that program. And even though we’re under a CR, you know, for Lord knows how long, the market is basically growing. Give us some of the numbers you see.

Kevin Plexico: Yeah, I mean, I think it’s a really interesting market. And a lot of diverse activities taking place between the economic challenges and the risks of inflation, great recession, but at the same time, the federal government is as healthy as ever, in terms of spending increases in the administration’,s in the Congress’s commitment to investing in government operations. So we see a pretty vibrant market on the defense side, but in particular, on civilian agencies with a lot more focus on civilian agency growth, while the continuing resolution is in place until December and holds spending at the same levels for for FY 2022, for a couple months anyway. What Congress is negotiating around in terms of appropriations for 2023 is pretty solid growth almost as high as double digits. So I think it’s going to be a good year for 2023 for contractors, just by virtue of the fact that budgets are going to be increasing for most agencies.

Tom Temin: And the information technology piece of this that we tend to concentrate on and I know you do, is hovering around $100 billion, aside from the technology modernization fund, what do you see happening in the addressable portion here, any top line numbers that are emerging?

Kevin Plexico: Is definitely looking to be north of $100 billion in IT spent, and I think it’s going to be growing commensurate with the growth in the discretionary budget. I mean, you could almost literally plot a line of IT spending that follows the same trajectory as discretionary spending. So as discretionary spending goes so to does IT spend and, frankly, spending on contracts they’re totally linear relationships. IT generally tends to do a little bit better sort of like, has a lot of utility components into it. So even if government spending goes down, it doesn’t mean that the government can stop spending on telecom and networking and equipment, software, things like that. So it’s relatively insulated from even budget ups and downs.

Tom Temin: And talk about the consolidation of the specially in the full and open or unrestricted set of contracts, what’s going on there that would mitigate in favor of having a really good vehicle strategy, as well as just an overall product and marketing strategy?

Kevin Plexico: I mean, there’s some initiatives going on in government that completely run at odds with increasing participation in the government market. The emphasis on what they call category management, or better buying practices is essentially an initiative to drive agencies to reduce the duplicative contracts and adopt contracts that are already in place, which you know, gives the government better buying power, but at the same time, it reduces the number of prime contract positions in the market, we’ve seen, despite the fact that contracting growth has been growing 20 to 30%, over the last seven years, the number of unique prime contractors participating in the market has dropped about 20 to 25%. So it’s this sort of inverse relationship. Yet at the same time, the administration is putting a lot of pressure on agencies to increase their use of small business. And what we’ve seen is that that has translated into the small businesses that are winning the prime contracts doing extremely well, but it leaves out a lot of other participants that would otherwise like to be participating.

Tom Temin: And even in the small business and in disadvantaged business category, the numbers show fewer participating companies, but the ones remaining getting more of that market, too.

Kevin Plexico: Yeah, it doesn’t just affect small, or, I guess, unrestricted as synonymous with large, but it seems to affect everybody.

Tom Temin: All right. So Deltek has taken look at various opportunities in different categories of types of contract, unrestricted is the the main one, and just what are some of the highlights of the best opportunities for 2023 in the unrestricted opportunity?

Kevin Plexico: Sure. So we’ve been we’ve been producing these reports for about 18 years now. And just as a way of kind of getting a sense for the top opportunities, mainly bellwether opportunities that sort of give us an indication of some of the trends in the market. And I can remember when we started doing this, most of the contracts were, you know, procurements for a discrete piece of work where a vendor would win it, and they would do the work. What that’s evolved into is is pretty significant, large contracts that are awarded to a lot of vendors, where the competition really, you know, ensues after the award is made, and the task orders and discrete pieces of work sort of come later. What’s interesting about this year is it’s by far the largest combined value at $500 billion, so almost half a trillion dollars in ceiling value across the 20 unrestricted opportunities that we’re looking at, and that represents about a 50 to 60% increase over the next largest year. So very large GWAC, IDIQ type of contracts. GSA has the dominant portion of them with the recompete of the Oasis contracts with the Oasis Plus, they’re on the third iteration of Alliant three, which is planned for next year. And then the Department of Veterans Affairs also has some really large deals, I think the two of theirs combined to about 125 billion, but they’re more for health services and medical product type purchases that you’d expect out of the VA.

Tom Temin: We’re speaking with Kevin Plexico, he’s senior vice president for information solutions at Deltek. And moving down to the set aside opportunities, what are some of the highlights of the best ones there and give us a you know, a sense of the numbers?

Kevin Plexico: Well, you’ll have to stay tuned for next week, we haven’t released the small business report yet. That one comes out next week. But it’s the next most popular one of the reports we produced, I guess I should level set we produce one that’s focused on unrestricted and then we produce one that’s focused on small business set asides. And then we produce two others, one focused on professional services, opportunities, and another on architecture, engineering, and construction. And those release each over the course of the next three or four weeks.

Tom Temin: All right, but give us a preview since so these webinars will be open to anyone that wants to sign up. But then without giving away all the goodies so you get lots of signups but give us a sense of what the top line is anyhow, and what some of the best ones might be?

Kevin Plexico: Yeah, so the small business ones tend to be a reflection of the unrestricted ones. Because in most cases, these days when the government comes out with a GWAC or recompete of a major IDIQ, they have an unrestricted portion and a small business portion. So as you’d expect, there’s a component for Alliant three, there’s a component for the Oasis procurement, there’s something similar in the State Department has a major consolidation effort for IT services contracts called Evolve, that also has that kind of flavor to it. It’s almost like a sister, a set of sister contracts that go along with the unrestricted that are in the small business category.

Tom Temin: And let me ask you about the interplay between professional services opportunities and the top 20 unrestricted because more and more the government is buying services as a percentage of dollars and products get delivered almost via those contracts. And so when you have the top 10 professional services opportunities, how are they different from what might be in unrestricted, generally in IT?

Kevin Plexico: It gets a transition to professional services and a lot of the largest GWAC contracts in Oasis and Alliant are sort of noteworthy. Alliant has more of a technology bent. But obviously a huge portion of it is professional services. I guess for a little bit of history, the Alliant contracts came first, the Oasis followed as a way for GSA to not only provide a professional services framework for other agencies to buy professional services, but also as a way to get defense agencies a contract vehicle that they could use for a lot of their professional services work. You know, most of what we see in defense agencies is cost-plus type types of contracts. And a lot of the prior, you know, kind of original GWACs. The GSA came out with, didn’t support costs-plus, so that was a major swing to get GSA or to get defense agencies adopting GSA GWACs. I guess the other thing that’s the to your point, we have seen agencies increasingly rely on professional services contractors. And that’s been one of the areas that GSA in their category management kind of emphasis and focus has really been trying to provide vehicles that do support the professional services needs across government agencies, where historically we’ve seen agencies kind of rely on their own vehicle. So it was almost GSA kind of providing their own framework to help agencies acquire these types of services more cost effectively.

Tom Temin: And by the way, have you noticed, in reality, a drop in lowest price, technically acceptable types of contracts? I mean, DoD promised to do that, but it wasn’t necessarily happening last year.

Kevin Plexico: I would say my assessment there is that that ebbs and flows with budget uncertainty and budget tightness, when we had the, you know, the Budget Control Act kind of rearing its head, in its most profound way, when agency budgets were coming down back in the early 2000s, kind of 10 decade, that’s when agencies really turned LPTA as a way of, you know, hey, we don’t have as much money this year, as we did last year. So we have to find a way to cut costs. And we’re going to have to put the screws to contractors to in order to to achieve that. As we’ve kind of emerged from that into an environment where agencies generally expect their budgets to be bigger next year, I think they’re less likely to leverage LPTA unless it’s for a set of services that they feel like quality is less important than then dollar price.

Tom Temin: All right, to sum it all up, then for contractors, what’s your best, one or two pieces of advice to make sure they get their fair share, starting in CR now, and eventually, the 2023 appropriations?

Kevin Plexico: I think one thing I would call out for sure is if you have have aspirations of being a prime contractor, you really need to be focusing on your ability to comply with a lot of the requirements of these contracts. I don’t mean that lightly. But when you look at a lot of the scoring worksheets that they have for some of these large IDIQs, they’re basically building compliance into the scoring. So if you look at the score sheet, I’ve seen some as high as 15 to 20% of the scoring is just your ability to comply with things like do you have an approved accounting system? Do you have a manufacturing system? Do you have a subcontractor management system? Do you have ISO certifications, things of that nature, that are almost more about your certifications, rather than you know, the nature of the quality of your work. And so those are almost antes, in order to be able to bid on these contracts. So getting ahead of that it’s not the kind of thing where the RFP comes out and you say, oh, quick, let me go get these compliance capabilities, you have to really invest in them and decide they’re important to you in advance. And if you don’t have the means to adopt them, you really need to be focusing on a partner strategy that allows you to support somebody who does.

Tom Temin: That could be a business opportunity. Compliance as a cloud service.

Kevin Plexico: That’s correct, though, it has a lot of touch to a lot of different functional organizations. I mean, it touches everything from your HR team, to your finance team, and of course, increasingly to your IT and security team, even facilities and a lot of cases in terms of how you handle information. It’s got a pretty broad reach, it also affects your supply chain. I mean, it’s a lot. It’s definitely an example of where in addition to the category management elements that we’re seeing the increasing compliance requirements are definitely raising the barriers to entry for companies that don’t have the resources to invest in this type of stuff.

Tom Temin: Kevin Plexico is senior vice president for information solutions at Deltek.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Tom Temin is host of the Federal Drive and has been providing insight on federal technology and management issues for more than 30 years.

Follow @tteminWFED

Related Stories

GAO’s Bill Woods: It’s necessary to make sure IDIQ contracts are competitive