Industry pressure forces NASA to press pause on SEWP VI

A public letter writing campaign from vendors detailing concerns about the lack of clarity of the SEWP VI solicitation pushed NASA's decision.

Increasing pressure from the industry about the lack of clarity of the SEWP VI solicitation has forced NASA to hit a pause on its governmentwide acquisition contract.

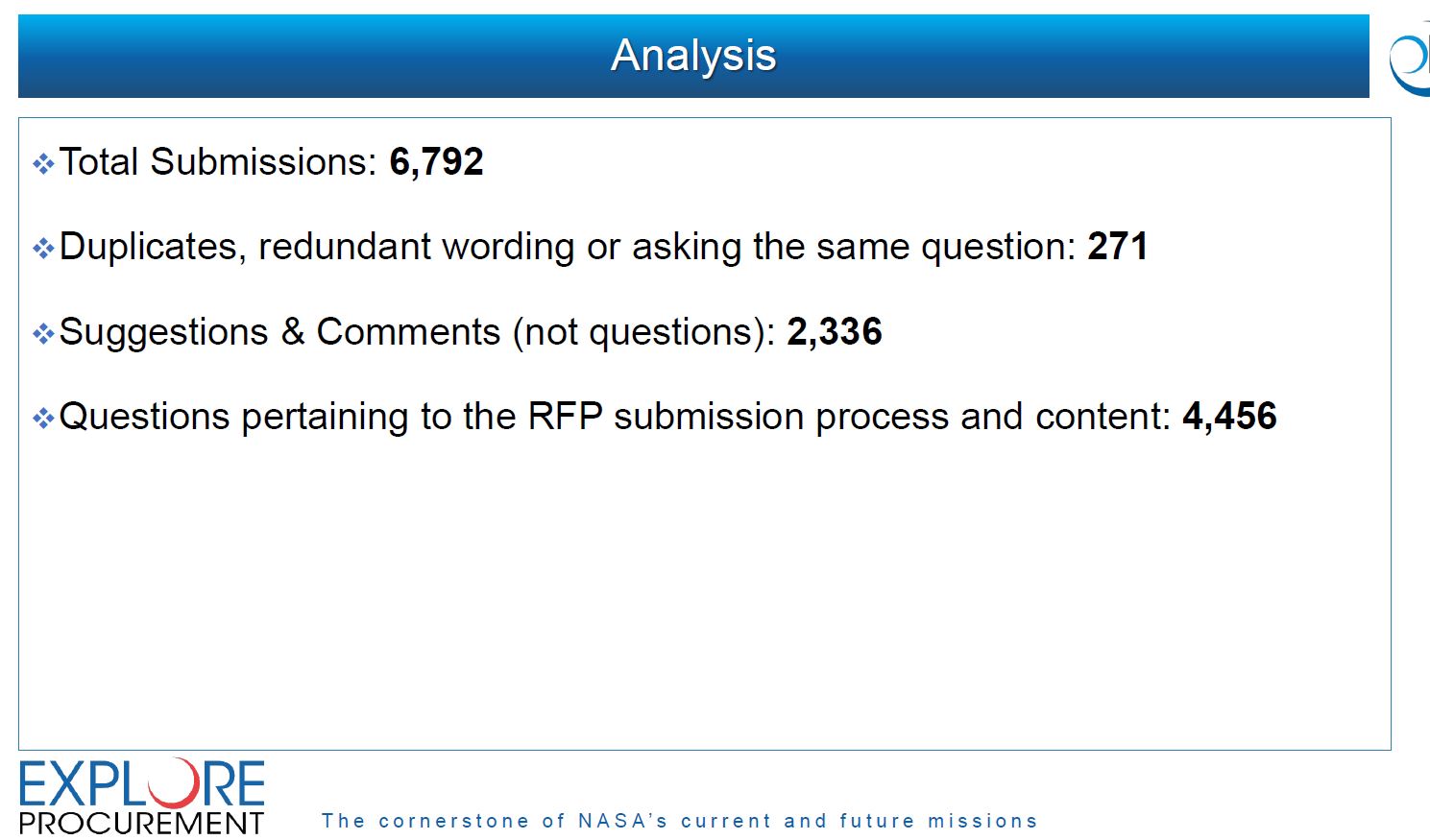

Vendors are unhappy that the SEWP VI program office chose not to answer more than 4,500 questions submitted about the solicitation, and with bids due later this month, a letter-writing campaign spurred NASA’s decision.

“There is a lot of ambiguity in this procurement in a number of areas. That lack of clarity is concerning to a lot of people, and it resulted in more than 6,700 questions,” said Robert Turner, president of RTurner Consulting, who is helping companies put together their proposals to bid on SEWP VI. “I have never seen in my career a contract or IDIQ have this many questions. It’s not that the industry is trying to gang up on NASA and flood them with meaningless work, and while I’m sure there are a bunch of duplicative questions and some that the vendor should just go back and read RFP, there are still 4,500 or so questions that need to be answered.”

NASA issued an update late Thursday night on SAM.gov initiating the pause.

“NASA appreciates industry interest in the SEWP VI request for proposal and the submitted questions. We value collaboration, and we strive to ensure a transparent process for our industry partners. In consideration of this, NASA is implementing a strategic pause on the SEWP VI request for proposals,” NASA wrote. “The due date for proposals will be extended at a future date.”

NASA’s decision to put SEWP VI on hold for the time being comes after Turner and some clients sent a letter outlining their concerns about the current solicitation to the SEWP program management office. Additionally, Turner posted the open letter on LinkedIn, garnering the attention of Karla Smith Jackson, NASA’s assistant administrator for procurement and deputy chief acquisition officer.

Smith Jackson responded publicly to the letter.

“Mr. Turner — This is one of those ‘happy accidents’ that we are connected on LinkedIn. Thank you for taking the time to post an open letter. I will be happy to personally look into this matter as the NASA senior procurement executive and consult with my team to include the NASA Competition Advocate/Industry Ombudsman and the NASA Director of Small Business Programs,” Smith Jackson wrote. “A written response to your inquiry will be made available to prospective bidders within the next week.”

The NASA SEWP program office declined to comment.

97% of all questions went unanswered

Turner said while there are some specific shortcomings of the RFP that he and his clients would like to see NASA address, the bigger issue is the lack of clarity leading to real challenges in responding to the RFP.

Turner said the NASA SEWP program office provided answers to about 120 questions out of more than 6,700 submitted.

“It’s inconceivable that 97% of questions do not deserve answers,” Turner said. “The primary problem with SEWP VI is it combines IT products with IT services, which makes it the largest GWAC in the federal government with a 10-year lifespan and a ceiling of over $100 billion. So, it’s receiving a flood of attention which creates a flood of questions, yet we are not getting, for whatever reason, transparency back to know where this is going. The ambiguity of the RFP resulted in 6,700 questions, most of which are not being answered so vendors do not know what to expect or how they will be evaluated.”

Turner and other industry experts said that the engagement with the SEWP Program Office needs to improve.

Experts said vendors have submitted new questions to the program office and their response was not only not to answer them, but to tell the companies to stop asking.

“Clients have asked questions about something, even pointing out parts of the RFP that conflict with other parts of the RFP or with existing law or policy, and those questions have been ignored,” said Jeremy Nusbaum, founder and principal consultant with Luminary Consulting Group, who also is helping vendors bid on SEWP VI. “We all know it’s customary to cut off the Q&A period, but if the government comes out with a major amendment and they accidentally break other things in the RFP that they didn’t realize, and most agencies are open to feedback even past the Q&A deadline. Many times the government says ‘thank you’ and they fix it. But in this case, NASA says ‘stop contacting us.’ Technically, they have the right to do that, but it’s a much different tone and behavior and it doesn’t drive toward high-quality end result.”

Evaluation criteria remains unclear

Nusbaum said the pause is a positive development for the program overall. However, he said, about two-thirds of his clients were disappointed given where they were in the bid process.

“There are dozens of unresolved issues right now and hundreds or thousands of questions that need answers because they are important to the industry, which doesn’t know how to structure their proposals or how they will be evaluated. There has been a lack of clarity from the beginning,” Nusbaum said. “The other thing is the lack of engagement from government on what industry considers to be critical issues. This is resulting in extreme behaviors, which the industry doesn’t like to take. The letter writing is an example. Generally, it’s not preferred behavior because the government doesn’t like it. But we’ve seen dozens of companies willing to do that. I also know companies who have engaged attorneys and were drafting letters or preparing pre-award protests. These are not companies who are trigger-happy or whining. I don’t think anyone wants to spend $600 an hour or more with attorneys to whine or complain.”

Nusbaum said one of the biggest unresolved issues he is seeing is around proposal instructions and evaluation criteria. He said in more than 20 years of helping vendors develop proposals, he’s never seen companies take so many different approaches.

“I’ve reviewed seven different proposals that don’t have similarities in their technical outlines. There aren’t many ways to slice most RFPs so to have in this one seven discrete outlines for the technical volume is a sign there is something wrong,” he said. “It’s clear that industry is trying to extrapolate the evaluation criteria and proposal instructions because they are too high level or too ambiguous.”

Potential mentor-protégé challenges

Turner said another area of contention is around the mentor-protégé joint venture requirements. This is the same issue that has hamstrung several other GWACs and large multiple-award contracts like Polaris from the General Services Administration and CIO-SP4 from the National Institutes of Health IT Acquisition and Assessment Center (NITAAC).

“How does NASA plan to evaluate proposal submitted by mentor-protégé joint ventures in a way that complies with 13 CFR 125.8(e) that states that ‘A procuring activity may not require the protégé firm to individually meet the same evaluation or responsibility criteria as that required of other offerors generally,'” Turner wrote in his letter. “Currently, proteges are required to meet the same evaluation and responsibility criteria as other small businesses and other than small business offerors in clear violation of this regulation.”

Turner said this exact issue came up during the Polaris competition and the Court of Federal Claims ruled in the protester’s favor because GSA didn’t align the RFP with the law.

“NASA is ignoring the issue like it doesn’t apply to them. But if vendors protested Polaris, they will protest SEWP because SEWP VI is several times bigger than Polaris,” he said. “What the law means is if you require other offerors to submit two past performances of at least $1 million, for example, you can’t require proteges to submit the same thing. You have to give accommodations to proteges and not hold them to the same evaluation standard as you do other offerors. NASA hasn’t spelled that out.”

Turner added NASA also hasn’t made it clear that if both the mentor and protégé joint venture has two companies that have shared ownership and participate in a single company and are submitting a single bid: Is it acceptable that all past performance and references can come from the mentor?

NASA’s road to get SEWP VI across this first finish line hasn’t been smooth. In January, Reps. Roger Williams (R-Texas) and Nick LaLota (R-N.Y.), chairman and a member of the Small Business Committee, wrote a letter to the space agency detailing concerns about its small business strategy.

Nusbaum said despite these challenges, he’s hopeful the pause and NASA reopening the door to more industry engagement will lead to a good SEWP VI end result. He said it’s just as important to the industry as it is to NASA to get SEWP VI right.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED