TSP fees: Don’t make a $78,000 mistake

Senior Correspondent Mike Causey says low TSP fees may actually save federal workers money in the long run.

When they retire or leave government for another job, 60 percent of TSP account holders leave their money in Uncle Sam’s in-house 401(k) plan. That means that 40 percent take their money with them when they leave government.

Most move their retirement nest egg to an IRA or investment option that often gives them more fund choices, easier access to their money and in some cases, a more actively managed account. And that’s a good thing, right?

Depends. What many people are aware of, but overlook, is the fact that the TSP has the lowest administrative fees in the 401(k) business. Even lower than Vanguard, which prides itself on minimal fees.

For lots of math-challenged people (like me), low fees are less important than performance. But it turns out that over time low fees, like those in the TSP’s funds, can save you a ton of money.

For example: Last week benefits expert Tammy Flanagan did a TSP webinar for the National Active and Retired Federal Employees. It is chock full of information about the TSP answering questions you probably never asked, but wished you had.

NARFE members can view it anytime by clicking here: Federal Benefits Institute.

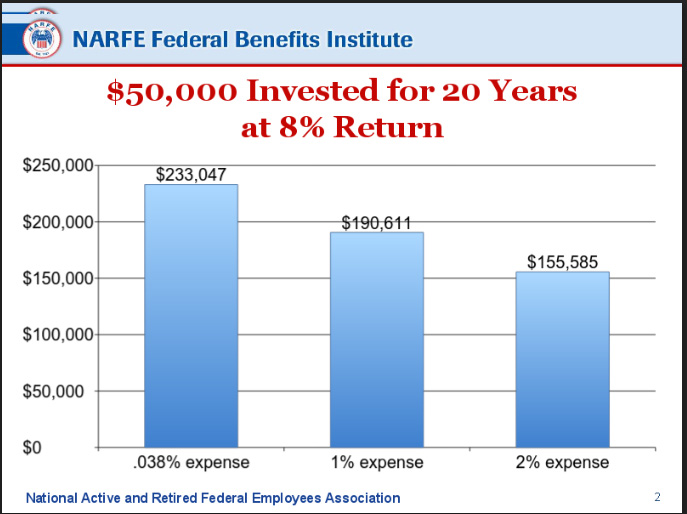

As part of her presentation, she introduced a chart showing what impact fees would have on a hypothetical $50,000 investment over a 20 year period.

The result is mind-boggling.

- If it had been invested in the TSP, with a .038 expense rate, and the rate of return averaged 8 percent, it would be worth $233,047 after 20 years.

- If that expense charge was 1 percent, the same $50,000 bundle after 20 years would be worth $190,611.

- And if you put the same amount, earning the same return, into an actively managed account charging you a 2 percent fee, it would be worth only $155,585 after 20 years.

Paying 1 or 2 percent (or more) doesn’t seem like much, especially if you get excellent returns. Excellent being the operative word. But paying a higher fee means you have to earn the amount of that fee (1 or 2 percent, or more) BEFORE you start seeing your account balance grow.

Check out this email from a long-time State Department worker who’s about to retire:

“Thanks for your column — I’m a longtime reader who is retiring on 3/31/17, and your daily insight has been useful over the years. Last year, I transferred most of my TSP ($590,000) to Fisher Investments. What are the rules regarding returning to TSP — as long as I am employed, or as long as I have a TSP account, which I do since I still contribute and take advantage of the matching funds?

“Although I’m okay with the results so far, I’m bothered by charges of $1.29 vs. the .29 with TSP. These charges are not visible with TSP and just ‘happen,’ while each quarter I am writing a check for approx. $2,000. The easier access to funds through Fisher is a plus — will TSP ever change from the declare your draw once a year, regardless of an unplanned need. Since I am five weeks away from separating, any last minute advice would be appreciated.”

Excellent and very important question: Last week Kim Weaver, director of external affairs for the Federal Retirement Thrift Investment Board, was our guest on our Your Turn with Mike Causey radio show.

She answered lots of questions, including how much you need to leave in the TSP to be able to return if you leave or retire.

Short answer: $200. That’s not much but it could be one of the best investments you ever made if you plan to leave the TSP then discover, once you’ve gone, that it was a pretty good deal.

To listen to that show, click here: Your Turn

Nearly Useless Factoid

By Michael O’Connell

1907 was the year that New Years Eve ball was first dropped in Times Square in New York City.

Source: Times Square NYC

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED

Related Stories