Trump’s COLA plan has future federal retirees sweating

Senior Correspondent Mike Causey says current and future federal retirees would lose thousands of dollars in cost-of-living benefits if Congress goes along with the...

Senior Correspondent Mike Causey is on vacation. This “best of” column originally was published on May 30, 2017.

Lots of federal workers, both active and retired, are really sweating the Trump administration’s plan to eliminate cost-of-living adjustments for current and future retirees under the FERS retirement plan. And they are worried for good reason.

Dropping COLAs in the future would save the government lots of money. And it would quickly eat into future benefits for all FERS retirees. Big time.

Financial planner Arthur Stein says that while all federal retirees will have lifetime income in the future, the zero COLA plan would dramatically eat into the money they have to spend in retirement. Big time.

The change is not a sure thing. Congress would have to approve it and over very strong objections from federal and postal unions, management groups and the National Active and Retired Federal Employees Association. Their combined clout on Capitol Hill would be a major factor. Not to mention claw back from federal workers and retirees who represent a lot of votes in key states like Virginia, North Carolina, South Carolina, Wisconsin, Pennsylvania, Texas, Florida and other states where current and former feds live, work and vote. It could also have an impact on local House races in New Jersey, Maryland, Indiana, Illinois and federal hub cities from Ogden, Utah to Huntsville and Anniston, Alabama. Plus lots of fed voters in Oklahoma, including Oklahoma City and Norman, as well as many semi-rural areas where VA hospitals, federal prisons and Army, Navy and Air Force Bases are big, if not the biggest, employers. Retirees who are not bound by the Hatch “no politics” Act could also play a major make-or-break role in the 2018 mid-term elections.

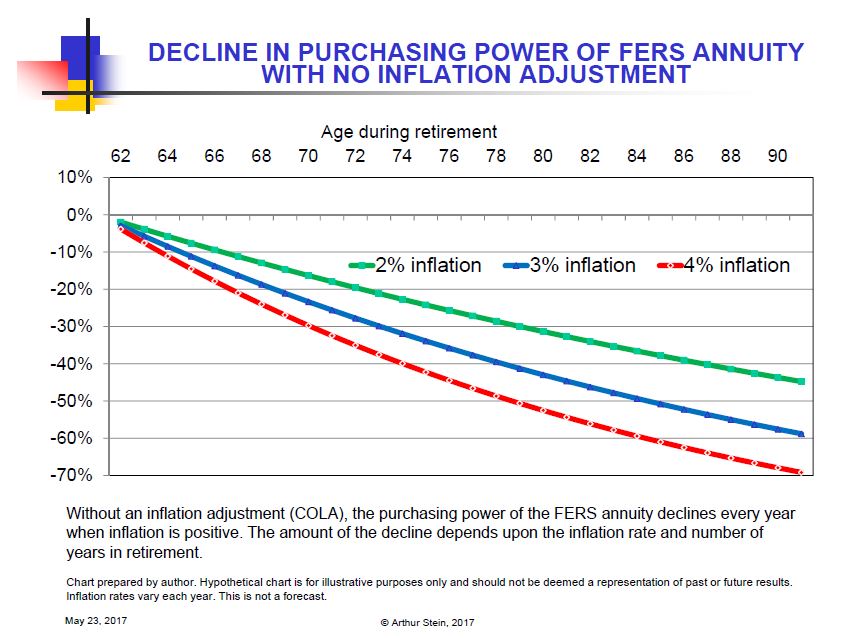

The chart below, worked up by Stein, shows what would happen in the future if the FERS COLA is eliminated. It shows the annual reduction in annuity payments if inflation is either 2 percent, 3 percent or 4 percent. Over as little as 10 years, a 72-year old retiree would “lose” — as in not receive — up to 18 percent in COLA payments if inflation was 3 percent, and lose up to 26 percent if inflation during the period averaged 4 percent.

Nearly Useless Factoid

A portrait of President Ronald Reagan made from 10,000 Jelly Belly beans hangs in the Reagan Presidential Library in Simi Valley, California.

Source: Jelly Belly

Read more of Mike Causey’s Federal Report.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED