Growing your TSP nest egg: Stocks or bonds?

Most investors in the Thrift Savings Plan know they are in it for the long haul. So what's the best route for your endgame?

Most investors in the Thrift Savings Plan know they are in it for the long haul. When Congress setup the federal 401k plan, which includes members and employees of the House, Senate and Supreme Court, as well as rank-and-file civil servants, it projected it would supply anywhere from 33 to 50 cents of every dollar people have to spend in retirement. Because the Federal Employees Retirement System program provides a less generous civil service annuity, FERS retirees will need all the income they can get from Social Security and the TSP.

Backers of the buy-and-hold system, like multi-millionaire Warren Buffet, say stock funds — like the TSP’s C, S and I Funds — are the way to go. They have dramatic ups and horrifying downs — like the great recession — but their trajectory over time, so far, is up. People who stuck with the stock funds during the 2008-2009 downturn saw much better long-term returns than those who moved into the treasury securities G Fund or the bond-indexed F Fund, which generally outperforms the treasury returns. People who continued to buy the TSP’s stock index funds during the recession did what many pros recommend. They bought low when share prices were depressed.

Some TSP investors who retreated to the G Fund still haven’t come back to stocks. And with talk of a long overdue correction of at least 20%, trade wars, and trouble in the Middle East, it is hard for many investors to find a window when it is safe to return to stocks. Last week’s Your Turn radio show featured D.C. area financial planner Arthur Stein. Many of his clients are active or retired feds. Several are self-made TSP millionaires who invested in the C and S large and small cap stocks, through good times and bad. You can hear that show, in which he talked about other financial options, by clicking here.

After the show a listener e-mailed a question asking how the C Fund stocks compared with the F Fund bonds over a specific period. Between October 2018, when the market started a downturn, vs. now, Stein said there “is always a time period where an investment will look good or bad. Markets peaked at the end of September, then declined. You can see on graph. So judging from October probably does show negative returns. So what? Was he only investing for a seven month period?”

He said that from January 1 of this year May 15 the G Fund was up 1.0%, the F Fund return was 3.6%, the C Fund up 14.6%, the S Fund return 16.9% and the international stock I Fund return was 10.1%.

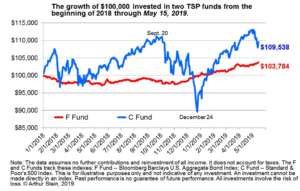

To illustrate the ups and downs of the market, Stein supplied this chart which shows the growth of a $100k TSP investment during that period in both the stock and the bond funds. During that period, he says, the $100k investment would have grown to $109,538 in the up-and-down C Fund, while hitting “only” $103,784 in the steadier bond fund. Your call, of course, but worth considering:

Nearly Useless Factoid

By Alazar Moges

You would be hard pressed to find anyone who doesn’t enjoy sleeping. Not only is it important for your health, it feels great. But what is too much sleep? Snails can sleep for three years uninterrupted. Three years. Imagine how much your world would change if you fell asleep for just one week. Snails live longer than most people think, with a lifespan that can last up to fifteen years, and in some cases, even twenty-five years. Luckily, snails don’t have too much to do and can get away with taking a couple years to get some unearned rest.

Source: Daily Treasure

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED