TSP millionaires club: Up, up and away!

Despite a deadly worldwide pandemic, the number of active and retired feds with million-dollar-plus Thrift Savings Plan accounts more than doubled in the last year.

Thanks to a booming stock market, and despite a deadly worldwide pandemic, the number of active and retired feds with million-dollar-plus Thrift Savings Plan accounts more than doubled — up to 98,879 from 45,219 — in the last year.

The largest account balance has gone from $9.3 million in March of this year, to $10 million at the end of June.

When the TSP started, there were only a handful of millionaires who brought their money with them into the federal 401(k). Nearly all were either members of Congress or political appointees who brought their private retirement plan balances with them. A large number were also high-paid private sector attorneys who had been appointed federal judges.

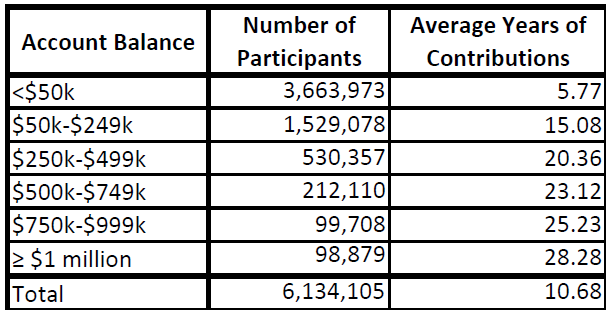

More than 6.1 million active and retired civil servants have money in the federal version of a 401(k) plan. Most retired federal workers are under the old Civil Service Retirement System (CSRS). But most current workers are under the Federal Employees Retirement System (FERS), which is more like a generous private sector retirement package. FERS includes Social Security and a reduced (compared to CSRS) federal annuity. Both groups can contribute to the TSP. FERS workers are eligible for a 5% match from the government.

While the focus is usually on the 7-figure balances, the real story, many believe, is the large number of workers who participate and how their accounts have been growing.

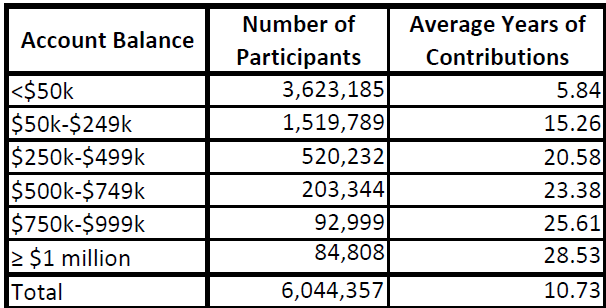

One year ago, there were over 480,000 people with account balances between $250,000 and $499,000. Today that number is more than 530,000.

Most of those with million dollar accounts have been investing an average of almost 30 years. The vast majority have invested in the TSP’s stock indexed funds (the C, S and I funds) through good, and especially bad, times. During the Great Recession, which hit in 2008, tens of thousands shifted their money into the super-safe treasury securities G fund. It never has a bad day. Or a very good one. Many also shifted to buying only G fund shares until the markets improved. Some have never returned, missing out since early 2009.

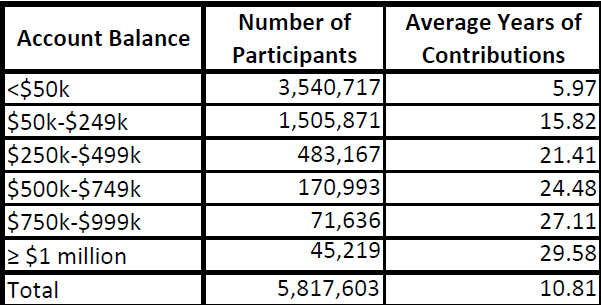

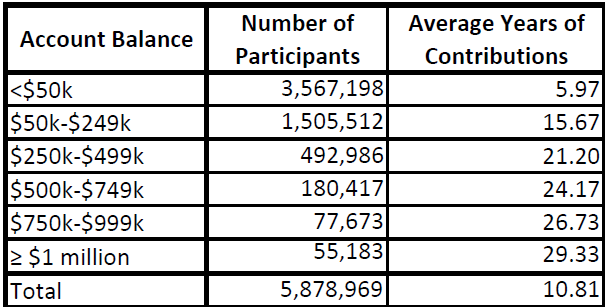

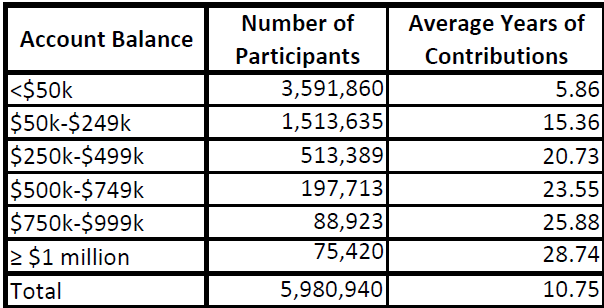

The tables below, courtesy of the Federal Retirement Thrift Investment Board, tell the story of the last year.

TSP Millionaires as of June 30, 2020:

TSP Millionaires as of September 30, 2020:

TSP Millionaires as of December 31, 2020:

TSP Millionaires as of March 31, 2021:

TSP Millionaires as of June 30, 2021:

Nearly Useless Factoid

By Alazar Moges

The United States has the most Summer Olympic medals with over 2,500, more than a thousand of which are gold. The Soviet Union comes in second with over 1,110 medals, but even when combined with the Russian Federation and the Russian Empire, they still fall short of the United States by almost a thousand medals.

Source: Statista

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED