Insight By Bloomberg Government

What IBM’s $34B Red Hat Deal Means for Federal IT

Buying Red Hat will make IBM “the world’s #1 hybrid cloud provider,” according to a statement from chair and chief executive officer Ginni Rometty.

International Business Machines Corp. shook up the technology world Oct. 28 when it announced its $34 billion acquisition of open-source software leader Red Hat Inc. The deal – the largest in IBM’s 107-year history – has the potential to reshape the cloud computing market and could affect federal agencies’ plans for modernizing their IT infrastructure.

IBM may be positioning itself to compete against cloud heavyweights Amazon Web Services LLC, Microsoft Corp., and Google Inc. IBM, a longtime leader in mainframe computing, was arguably a late entrant to the commercial cloud market and has struggled to match the market leaders’ investments in infrastructure and new tools for IT professionals.

In Red Hat, IBM believes it’s found a foothold into a cloud market that remains largely up for grabs: “hybrid” cloud computing, which involves maintaining on-site control of data and sensitive assets while using the cloud for cheap, scalable computing resources. Buying Red Hat will make IBM “the world’s #1 hybrid cloud provider,” according to a statement from chair and chief executive officer Ginni Rometty.

The deal is, in essence, a $34 billion bet that IBM’s legacy customers – federal agencies among them – aren’t ready to fully outsource their IT infrastructure and cede administrative control of their data to “public” cloud providers like AWS. Its success will depend on whether IBM can sell its customers on Red Hat’s cloud management tools, or whether its competitors can pivot there faster.

IT’S ALL ABOUT CONTAINERS

At the heart of the acquisition is a Red Hat software tool called OpenShift. OpenShift is Red Hat’s version of a popular open-source tool called Kubernetes used to deploy and manage software applications in flexible packages known as “containers.”

Containers bundle an application along with the code libraries and other resources they need to run, while decoupling them from the need to run on a specific operating system. They’re a major innovation, because they enable software developers to build applications that can plug into on-premises data centers or cloud environments interchangeably (a concept known as “portability”) rather than forcing developers to write two versions of the same application – a key barrier to cloud adoption.

The challenge is that containers are difficult to maintain and secure, requiring organizations to invest in tools like OpenShift. By acquiring Red Hat, IBM becomes the de facto gatekeeper to one of the world’s most popular container management platforms.

THE DEAL’S IMPACT ON FEDERAL CLOUD

It’s hard to argue that the federal cloud market was at the forefront of IBM’s strategy, compared to the exponentially larger enterprise cloud market, but the deal could prove especially profitable in the federal space.

That’s because agencies tend to be good fits for hybrid cloud solutions: they’re not only risk-averse with their data, they’re often working with legacy systems that are decades old, making them more challenging to update for a cloud environment.

With most agencies in the midst of multiyear digital transformations, IBM’s ability to deliver on-premises or cloud infrastructure optimized for Red Hat platform-as-a-service (PaaS) could help it attract interest from existing Red Hat users and capture federal contracts that might otherwise be destined for AWS.

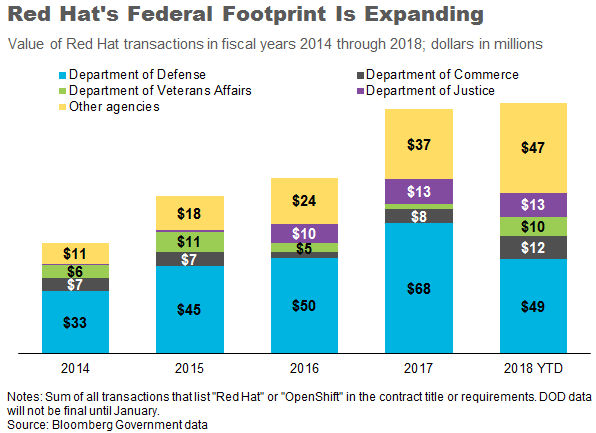

Red Hat’s presence in the federal marketplace has ballooned in recent years as federal agencies have shifted gears to embrace open-source software development. It’s difficult to determine Red Hat’s footprint in the federal government since it is a software provider, rather than a prime contractor. Bloomberg Government aggregated all government transactions that list “Red Hat” or “OpenShift” the contract title or requirements to provide a rough estimate.

The data indicates that fiscal 2018 was Red Hat’s biggest year in federal sales, at $131 million to date, with the Defense Department yet to report the majority of its fourth-quarter obligations. The Pentagon has been Red Hat’s largest government customer by far, accounting for 50 percent of its revenue over a five-year period.

Certainly the Pentagon, and its $36 billion annual IT budget, represents a prime target for IBM. The Armonk, New York-based IT giant has generated at least $300 million in Pentagon revenue in each of the last three fiscal years. Based on its experience building an on-premises cloud for the Army, a contract that has generated $23.8 millionsince fiscal 2016, IBM set its sights on bigger prizes, including the Pentagon’s highly coveted $10 billion Joint Enterprise Defense Infrastructure, or JEDI, cloud contract.

Does the Red Hat deal give IBM a better chance of winning JEDI? Almost certainly not, given that the deadline to submit bids has come and gone. In the race for JEDI, IBM appears to be clinging to the hope that the Government Accountability Office (GAO) will sustain its bid protest, or those filed by Oracle Corp., and the Pentagon will agree to reverse course in favor of a hybrid cloud or multi-cloud strategy. Even then, IBM would face stiff competition for a limited number of spots.

But with dozens of cloud contracts currently under development across the federal government, and hundreds more systems likely to shift to the cloud over the next decade, IBM is at least giving itself a fighting chance.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Related Stories