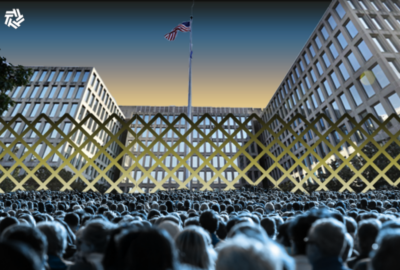

Government shutdown will put federal employees at risk far beyond D.C., union warns Congress

Recent federal data underscores the fact that most federal employees live outside D.C., and that at least several thousand civilian federal workers live in every...

A government shutdown, set to happen at the end of this week, if Congress fails to act, will put a toll on federal employees far beyond the Washington, D.C. metro area.

Recent federal data underscores the fact that most federal employees live outside D.C., and that at least several thousand civilian federal workers live in every congressional district across the U.S.

The Congressional Research Service in a recent report, using data from the Census Bureau and the Office of Personnel Management, found that at least 2,600 civilian federal employees live in every congressional district across the country.

The report, which reflects data gathered by the Census Bureau’s American Community Survey, includes employees from dozens of different federal agencies, but does not include military service members.

The National Treasury Employees Union, which represents federal employees across 35 agencies — including the IRS — said the CRS report demonstrates how a government shutdown’s impact extend far beyond the Beltway.

“Now is a good time to remind Congress that their constituents back home are the ones who will suffer the most in a shutdown,” NTEU National President Doreen Greenwald said in a statement Monday. “While some members of Congress seem to downplay, or even welcome, a government shutdown, it is a serious situation with real consequences for families in their districts.”

NTEU, in its own review of the data, found that the vast majority — 96% of congressional districts —have more than 4,000 civilian federal employees. Several states – California, Texas, Maryland and Virginia – plus the District of Columbia, are each home to more than 100,000 federal employees.

“Every single member of Congress has thousands of constituents whose paychecks would stop during a government shutdown, impacting federal employee families and local economies across the country,” NTEU wrote in a press release Monday.

Meanwhile, another group representing IRS managers is warning lawmakers that the looming threat of a government shutdown may halt IRS progress on its customer service improvements, and may have long-term consequences on how easily taxpayers can call the IRS for tax help.

Greenwald said that much of the country would feel the impact of a government shutdown, considering that 85% of federal employees work outside of D.C.

“A government shutdown is not a harmless, D.C. drama,” Greenwald said. “Federal employees in every American community will lose income, through no fault of their own, and in many cases, they will be locked out of doing the work they were hired to do for the American people.”

NTEU told bargaining unit members last week that the IRS expects to “partially close” if Congress triggers a government shutdown.

The union was previously told that the IRS would keep its doors open, in the event of a shutdown, using roughly $60 billion in multi-year funds from the Inflation Reduction Act to continue normal operations.

Aside from the IRS, NTEU said bargaining unit employees at the following agencies would be impacted by a government shutdown:

- Customs and Border Protection

- Bureau of Land Management

- Federal Law Enforcement Training Center

- Commodity Futures Trading Commission

- Environmental Protection Agency

- Federal Communications Commission

- Food and Drug Administration

- Federal Election Commission

- National Park Service

- Patent and Trademark Office

- Securities and Exchange Commission

- Agriculture Department

Greenwald said most federal employees live paycheck to paycheck, and “do not deserve to have their financial security shattered by political dysfunction.”

During the record 35-day government shutdown in 2018-2019, NTEU said about 800,000 federal employees missed paychecks, inflicting financial stress on their families and economic distress in their communities.

Some were required to keep working throughout the shutdown, while others were furloughed.

“We had thousands of members across the country who missed a mortgage payment, took out short-term loans and ran up their credit card debt because they had no paychecks for a month,” Greenwald said. “They stood in line at food banks, pulled their children from childcare, begged creditors for grace and were unable to put gas in their cars to report to work for an IOU. This is not how the United States of America should treat its own employees.”

Congress has until Sept. 30 to avert a government shutdown, by either passing a comprehensive spending bill for fiscal 2024 or a continuing resolution that temporarily keeps the government funded at current spending levels.

The IRS answered millions more taxpayer calls during this year’s filing season, compared to recent years, with the added promise of more customer service improvements to come.

But the Professional Managers Association, which represents IRS managers, is warning lawmakers that the looming threat of a government shutdown may halt IRS progress on these initiatives, making it harder to keep momentum in rebuilding its workforce and modernizing its legacy IT systems.

PMA said in a statement Monday that a government shutdown would be “wasteful and destructive to the American people,” and make it harder for IRS employees to serve taxpayers.

“Members of Congress often criticize the IRS for low service levels and response times,” the PMA wrote. “A government shutdown is the single simplest way for Congress to ensure taxpayers cannot get the tax services they need — not just during the shutdown, but far into the future when workers leave the IRS because of the financial instability shutdowns cause.”

PMA said the IRS saw a much more successful tax season this year, because it had the funding to hire and train the staff needed to answer calls and answer taxpayers’ questions.

“This season was a small testament to what the IRS can achieve with the resources to do its job. A government shutdown, particularly if followed by funding cuts, would eviscerate much of the progress made,” PMA stated.

The association also warned against lawmakers pushing additional IRS cuts. Congress and the White House already agreed to cut about $20 billion from the IRS modernization initiatives as part of a debt ceiling compromise earlier this year.

“Further cuts to the IRS budget will seriously undermine modernization initiatives that will save taxpayer funds in the long term,” PMA stated.

PMA said it has a strong preference for full-year appropriations, but said it’s clear lawmakers will need more time to reach a comprehensive spending deal for the rest of FY 2024.

“Therefore, Congress must put partisan politics aside and act now to pass a short-term continuing resolution that averts a shutdown while negotiations are ongoing.”

A government shutdown would also hamper the IRS’s preparations for next year’s filing season.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jory Heckman is a reporter at Federal News Network covering U.S. Postal Service, IRS, big data and technology issues.

Follow @jheckmanWFED