Federal employees will pay 7.7% more toward health premiums in 2024

The Office of Personnel Management announced the new health care premium rates ahead of the upcoming Open Season. FEHB participants can make changes to their...

Editor’s note: This story has been corrected with an update from OPM that the FEHB Program will have 158 plan choices and 68 carriers in 2024. An earlier version of the story said the program would have 159 plan choices and 69 carriers.

Participants in the Federal Employees Health Benefits (FEHB) Program will see another sizeable increase in their insurance costs in 2024, although it’s not quite as high as the previous year.

Starting in January, federal employees and retirees will pay an average of 7.7% more toward their health premiums, according to data the Office of Personnel Management released Wednesday.

The announcement of the new premium rates comes ahead of the planned start of Open Season, which will run this year from Nov. 13 to Dec. 11. During Open Season, FEHB participants can make changes to their health, dental and vision enrollments for the upcoming benefit year, which starts Jan. 1.

OPM maintained that the FEHB program is market-based, centered on choice and competition, and that the rise in premium rates for 2024 generally aligns with those in the commercial market.

By comparison, CalPERS, which purchases health insurance for California state government employees, announced even higher premium rate increases for 2024, at an average of 10.77%. CalPERS is the nation’s second-largest public insurance purchaser, only after the federal government.

OPM offers more details about premium rates for FEHB participants on its website.

Notably, the 7.7% increase is an average, so of course, some participants may end up paying slightly more or slightly less toward their premiums, depending on their plan options and enrollments.

Specifically, in 2024, non-postal FEHB participants will pay an average of:

- Self-only coverage: $8.05 more per two-week pay period.

- Self-plus-one coverage: $16.73 more per two-week pay period.

- Family coverage: $21.16 more per two-week pay period.

Overall, the premiums for non-postal employees and annuitants enrolled in FEHB will increase by 5.8%, when accounting for the average increases for both the participant’s and the government’s shares of the cost. The government will contribute 5% more toward FEHB premiums in 2024.

The announcement also comes after President Joe Biden officially planned for a 5.2% pay raise for most civilian federal employees in 2024.

A formula under law defines the breakdown of participant versus government contributions to FEHB premium rates. The government covers about 75% of an FEHB participant’s premium, but only up to a certain cap. That cap amounts to 72% of the weighted average of the previous year’s premiums.

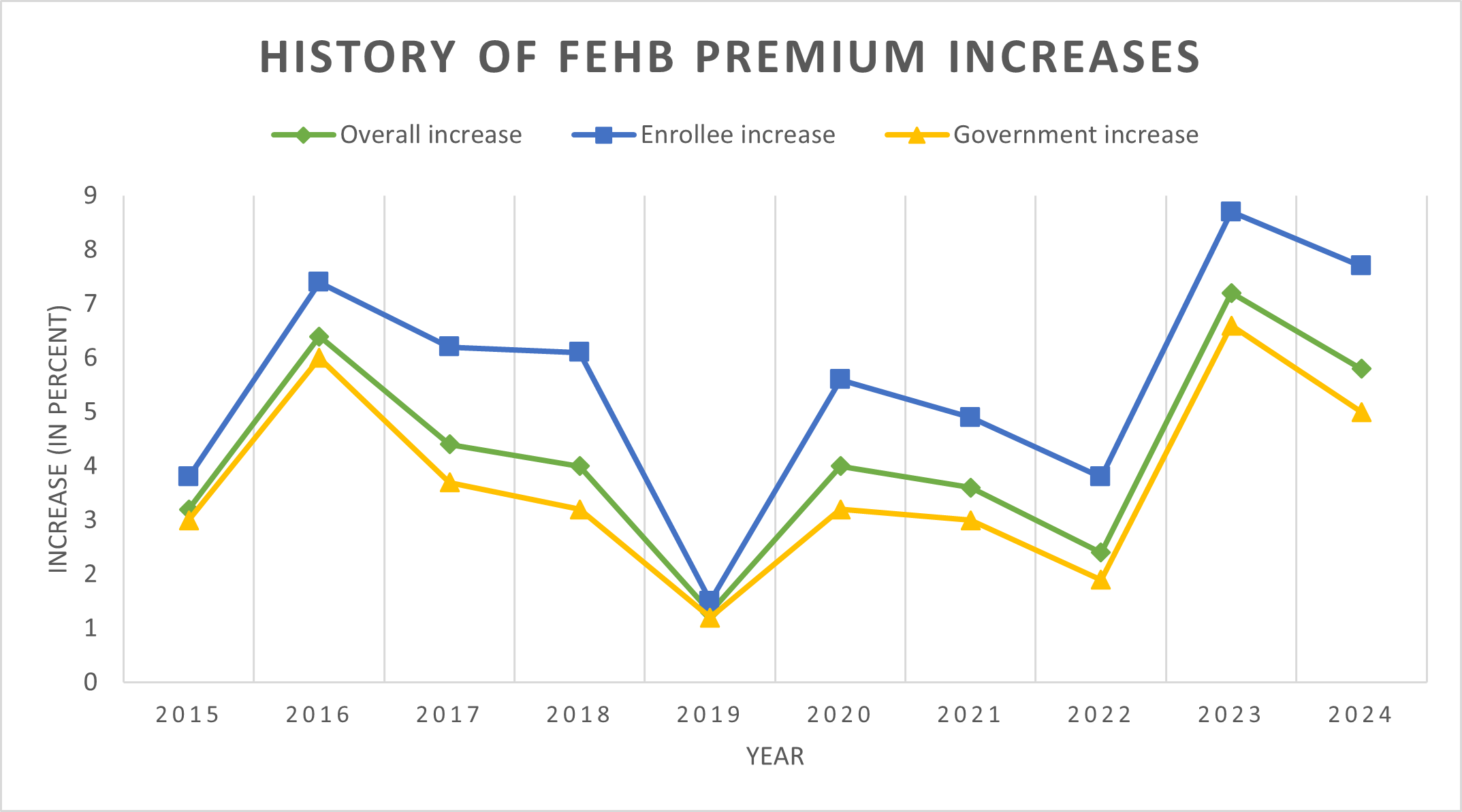

Premium rates for FEHB change every year, but they inevitably increase to some extent. The upcoming increase of 7.7% for 2024 is slightly below the 8.7% premium jump that FEHB participants saw for 2023.

But 2024 premium increases are still well above the rates for 2019, when participants paid just 1.5% more toward their health insurance. That was the smallest rate increase since 1996 and the lowest premium hike for participants since 1995.

“While enrollees may find some relief that the 2024 increase is more modest than last year’s … the increasing costs are unlikely to be greeted with applause,” National Active and Retired Federal Employees Association (NARFE) National President William Shackelford said in a statement. “Every employee or annuitant’s situation is different, and enrollees should be open to comparison shopping. One of the most valuable features of FEHB is its broad array of plan options.”

Doreen Greenwald, national president of the National Treasury Employees Union (NTEU), also pointed to the difficult timing of OPM’s announcement.

“Federal employees, like all Americans, are constantly bombarded by the rising cost of health insurance, but today’s announcement is especially difficult to bear on the eve of a potentially catastrophic government shutdown,” Greenwald said in a statement.

If there is a government shutdown, FEHB participants will still be able to participate in Open Season as normal, OPM has said. Health care coverage through FEHB also continues during a shutdown, but premium payments can be paused until a shutdown ends. After the end of a shutdown, participants will have to pay their premiums that accrued during a shutdown.

Participants have 158 plan options for 2024

FEHB participants will see a total of 158 plan options in 2024, offered across 68 health carriers. That’s far fewer than this year’s total of 271 plan options.

The roughly 42% decrease in plan options is mainly due to the exit of health carrier Humana from the FEHB program. Humana is exiting the program over the next two years.

“It is also disappointing that the number of plan options has dropped since last year, but we encourage our members to do their research and choose a plan that best meets the needs of themselves and their families,” Greenwald said.

Although there are 158 options in total, not every participant will have access to every plan option — some are specific to federal employees and retirees in certain geographical regions.

Within those 158 options, there are 18 fee-for-service plans, all of which are available nationwide.

Participants can use the FEHB plan comparison tool on OPM’s website to compare all of the different plan options.

Coverage, eligibility changes coming in 2024

Starting in 2024, active-duty service members and members of the Active Guard Reserve will also become eligible to start a Dependent Care Flexible Spending Account (DCFSA). These accounts let enrollees make pre-tax contributions for certain dependent care services, such as preschool, summer day camp, before or after school programs and child or adult daycare.

The Defense Department estimates that OPM’s program expansion will make about 400,000 service members eligible for the benefit.

The program expansion is a direct result of a sweeping executive order, which Biden signed in June, aiming to increase the hiring of military and veteran spouses in agencies.

Additionally, OPM said FEHB carriers will begin offering expanded coverage for anti-obesity medications, low or no-cost telehealth options for mental health and substance use disorder services, and expanded gender-affirming care for transgender and gender-diverse individuals.

There will also be more coverage and service options for prenatal and postpartum care, such as childbirth education classes, group prenatal care, home health care during pregnancy and postpartum, and care management for high-risk pregnancies.

And FEHB participants will see more coverage of infertility-related treatments. Starting in 2024, OPM is requiring all FEHB carriers to cover at least two forms of artificial insemination and the drugs associated with those procedures, as well as at least three cycles of drugs related to in-vitro fertilization (IVF) annually.

Dental and vision rates for next year

For the Federal Employees Dental and Vision Insurance Program (FEDVIP), average premium rate increases will be relatively low in 2024.

Premiums will rise for FEDVIP dental plans by 1.4% on average, while vision plans will go up by 1.1%, OPM said.

Overall, there are 23 dental plans, including 14 nationwide options across seven carriers.

Participants will also be able to choose from 10 nationwide vision plans in 2024, from five different carriers.

FEDVIP currently has about 5.4 million enrollees and about 7.3 million covered participants.

But in July, OPM expanded FEDVIP eligibility to tens of thousands of temporary, part-time, seasonal and U.S. Postal Service (USPS) employees. It’s so far unclear how many of the newly eligible feds will actually enroll in FEDVIP and what impact their participation will have on the program.

“There may be significant pent-up demand for services, at least initially, because it is likely that these individuals did not have dental or vision coverage,” OPM said in its final rule published earlier this year.

Participants can find more information about FEDVIP plans ahead of Open Season at Benefeds.com.

As usual, FEHB participants will also have to reenroll in the Federal Flexible Spending Account Program (FSAFEDS) to set aside pre-tax funds for their or their dependents’ health care costs.

By the start of Open Season on Nov. 13, participants will be able to find more information at the following OPM websites:

- FEHB Plan Information

- FEHB Plan Comparison Tool

- FEHB Quality Healthcare Scores

- FEDVIP Plan Information

- FEDVIP Plan Comparison Tool

- Federal Flexible Spending Account Program (FSAFEDS)

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Drew Friedman is a workforce, pay and benefits reporter for Federal News Network.

Follow @dfriedmanWFED