Will the latest deadline begin to change the trajectory of GSA’s EIS program?

Five of the nine EIS vendors raised concerns about the delays in releasing task orders under EIS, about what the solicitations are asking for and the quality of...

March 31 is another one of those deadlines under the Enterprise Infrastructure Solutions contract that will come and go with little fanfare.

Sure, the General Services Administration is taking a harder line with this one than with previous mandates under this $50 billion telecommunications modernization contract.

Bill Zielinski, the assistant commissioner for the Office of Information Technology Category GSA’s Federal Acquisition Service, said starting on April 1, agencies which have not claimed responsibility or have been non-responsive to his office’s outreach will no longer be able to extend or modify services under the current contracts called Networx, Washington Interagency Telecommunications System (WITS 3) and Local Service Telecommunications.

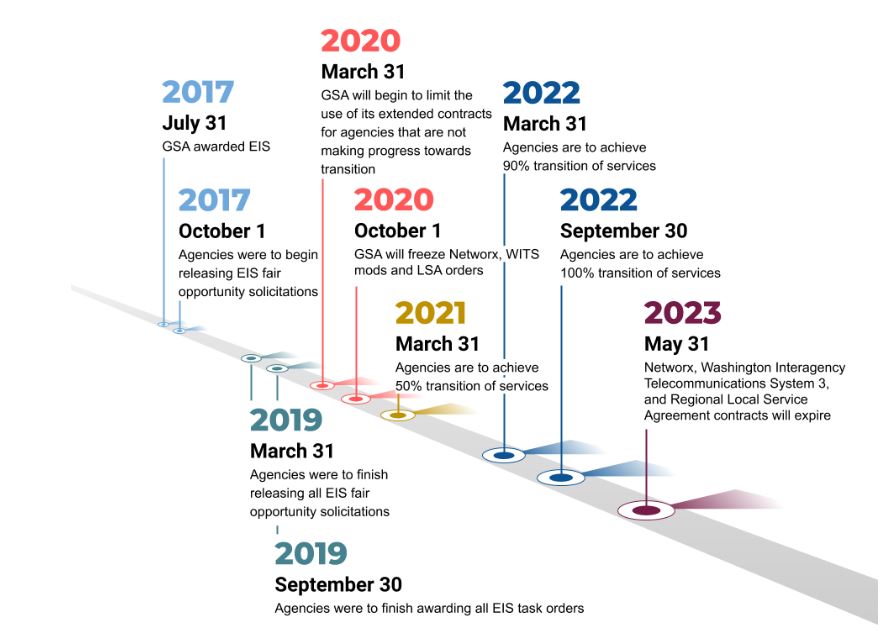

Then, by Oct. 1 GSA will begin freezing all future growth under these contracts to help accelerate the pace of transition to EIS and not repeat the mistakes it made during the transition from FTS 2001 to Networx.

As we’ve heard many times and just as a reminder, the Government Accountability Office estimated the 33-month delay during the Networx transition cost the government more than $395 million.

“The intent there is to disincentivize, not just to request that agencies move forward, but actually put mechanisms in place so they cannot continue to utilize the old contracts as a mechanism to force more transition progress,” Zielinski said in an interview with Federal News Network. “The first phase of that is services for which no agency have claimed responsibility and for small agencies who were non-responsive to the transition outreach. In future phases, it will be based on each agency’s status at that time and the individual circumstances impacting the transition, like, for example, any potential protest, a lapse in appropriations or pending contracting modifications.”

Zielinski said GSA didn’t create these disincentives under the transition to Networx and force the transition.

“There were instances in the last transition where agencies were ordering wholly new services on the old even as we were in the midst of the transition,” he said. “In this case, if you are looking to add new services above and beyond the set you have today, they really need to go on EIS. Now as you move through EIS and put your solicitations out and move toward award, you can continue to use the old contracts for operating what you have in place, but it’s the substantially new services that will not be allowed under Networx and the associated contracts as we move into these next phases.”

It very much still to be determined if this disincentive will work and encourage a faster transition. So far, vendors and other experts say EIS is following a similar transition path as Networx, and that’s not a good thing.

To their credit, GSA implemented some of the lessons learned from the Networx transition. GAO even highlighted that fact at a recent House Oversight and Reform Subcommittee on Government Operations hearing. But GAO also told lawmakers, the onus is on the agencies to switch to EIS.

But that’s also why the March 31 deadline and the previous three others that agencies have all but ignored leaves EIS vendors with little confidence that the current contract will not fall into similar traps as Networx.

“We are seeing same problems as the FTS to Networx transition. The requirements are slow to come out and the amount of agency requirements in the addressable market are smaller than expected,” said Tony Wellen, the president and CEO of BT federal, in an interview. “What we are seeing is agencies are going back to their old ways of procurements where they are putting something out that is ‘winner take all.’ There are other ways agencies can do this with multiple awardees that lets them migrate to services like managed security services. It gives them a different way of looking at things and allows them to take advantage of EIS savings.”

Quality and quantity suffering

Interviews with five of the nine EIS vendors found similar concerns about the transition taking on too much of a Networx-like flavor.

Vendors, both large and small, raised concerns not just about the delays in releasing task orders under EIS, but what the solicitations are asking for and the quality of the requirements detailed in the documents.

Read more: Reporter’s Notebook

“The quality the task orders haven’t improved since the early days of EIS and I think that is unfortunate,” said Diana Gowen, general manager and senior vice president of federal programs at MetTel. “We are still seeing a lot of like-for-like contracts. A lot of agencies are finalizing their solicitations and don’t feel like they have time to write a complex, innovative request for proposals.”

David Young, senior vice president for public sector for CenturyLink, said while agencies are talking a lot about IT modernization and transformation, the amount of like-for-like requirements is disappointing.

“There are agencies hell bent to do something by March 31, but some of those statements of work aren’t clear so it becomes challenging to put together a bid when people are so focused on March 31,” he said. “There are conflicts of information inside the statement of work. One page says one thing and another page says something else and you try to get clarification and it becomes more challenging. If you are trying to modernize in that environment, it’s too hard especially with the time constraints so we are seeing more and more like-for-like.”

Chris Smith, the vice president for civilian and shared services at AT&T global public sector, said he too has seen consistent errors in agency solicitations, which also delays the timeline to award.

GSA’s Zielinski said the agency is aware of the concerns from vendors about the lack of transformation or modernization requirements in solicitations. He said the data shows something different:

- Of the 109 solicitations GSA has received so far, 79 included the move or expansion of Ethernet or voice over IP capabilities and away from the traditional telephone technologies over copper wires.

- Of the 109 solicitations, 27 are calling for the use of software-defined wide area network (SD-WAN) capabilities.

“In many other instances, we are seeing that agencies have a mindful, thoughtful plan for how they will move forward,” Zielinski said. “When we take a look at the solicitations that are being put out, there may be a specific set of business services that an agency will need more time in order to support that change so they will move forward with a more of a like-for-like in that area. But they also are putting out solicitations that will substantially transform their underlying technology today. So it’s mixed and it’s really based upon what best fits the needs of the agency.”

Zielinski said GSA also has encouraged agencies to explore all the vendor choices they have, particularly through the EIS vendor days. The next one is scheduled for June.

AT&T’s Smith said he has seen solicitations with an initial like-for-like strategy and then a longer-term modernization and transformation plan. Smith reminded that EIS has 12 years left on the contract.

“We are seeing organizations ask for the full set of modern capabilities across their network like unified communications to voice capabilities to security around that to mobility, and there is a lot of interest in next generation network extending 5G to the edge,” he said. “The trend is pretty much everyone is looking for that modernization and transformation story and approach, and the question is what is their appetite for quick versus medium versus long term transition?”

‘Winner take all’ overlooks innovation?

But the trend of agencies putting a “winner take all” solicitation given the short timeline also is a growing concern, particularly for new entrants into the market like BT Federal, MetTel and Granite.

Tim Heaps, general manager of Granite government solutions, said as agencies stick with even an initial like-for-like approach, it gives the incumbent contractors—AT&T, CenturyLink and Verizon—an advantage over the newer providers.

“How do we ensure agencies recognize importance of past performance in the commercial sector? It’s not just about size and scope,” he said. “Agencies have to provide as much information about their legacy networks, current usage of data, for instance, to create a more level playing field and then it’s more likely more of primes will bid on the solicitation.”

Vendors say agencies such as the departments of Justice, Labor and the Defense Department, are or have been too focused on the one and done approach to EIS.

“What I am discovering, and we brought this up to GSA, is some agencies have released solicitations and did not included all EIS vendors. That’s problematic and against the Federal Acquisition Regulations,” said MetTel’s Gowen. “If you know about it, then you could file a pre-award protest. But if you don’t know about it, then you can’t.”

Busy summer expected

Vendors say they expect a busy sprint and summer as agencies try to hit the next deadline of March 31, 2021, of transitioning at least 50% of all services to EIS.

“I’m expecting all of those 191 solicitations that we are supposed to eventually see to come out. So far, we know about 106 have been submitted for GSA scope review and about 101 have gone through scope review so we expect to see an onslaught,” Gowen said. “As you could imagine that’s a big deal for industry. We have to carefully pick and choose what we think we have a good shot at winning especially when you end up with 30 or 40 coming out at once. That is unfortunate. By waiting to the end, industry does have limited resources to bid and agencies will miss an opportunity.”

BT Federal’s Wellen added because the penalties for not transitioning quickly or to modern technologies are minimal or non-existent, the only taxpayers are truly impacted because costs continue to be high.

“Maybe there needs to be a serious discussion to perhaps to give GSA some tools to hold agencies accountable,” he said.

Or as other vendors suggested having Congress create a transition scorecard and hold hearings more often.

No matter the plan, it’s clear GSA can only do so much pleading, begging and convincing. Until lawmakers or the Office of Management and Budget truly bring down the accountability hammer, EIS, like Networx and like FTS-2001 before it, will continue to be just another soft, unfunded mandate on an agency’s to-do list.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED

Related Stories

Agencies likely to miss March 31 deadline to release RFPs under new telecom contract

Move to new telecom contract requires agencies to modernize without breaking the mission