Is GSA’s Alliant 3 vehicle tilted too much to small, very large contractors?

A coalition of medium-sized companies offers several recommendations to the Alliant 3 acquisition strategy, including expanding the number of awardees and changing...

Let me riddle you this: When it comes to government contracting, if you are not a small business, what are you?

The answer, of course, is “other than small.”

Not much of a riddle, except if you are a “medium-sized” business in the $34.1 million to $250 million revenue range (feel free to argue for that end range to be closer to $500 million) over the last year, specifically under NAICS Code 541512 — computer systems design services.

Then the riddle clearly is how to compete in a market that favors small and very large firms.

This decades-long challenge is coming to a head with the General Services Administration’s Alliant 3 multiple award contract, currently in the planning phase.

There are growing concerns that based on GSA’s draft request for proposals, these “medium-sized” firms will be locked out of the vehicle, further impacting the industrial base and forcing these firms to sell to the large companies, figure out a way to drop back into the small business size standard, meaning potentially laying off employees, or leaving the federal market altogether. There is no official federal definition for medium-sized businesses. As many of you know, a company is either small or not small. There is nothing in-between.

“There’s a lot of a lot of these indefinite delivery, indefinite quantity (IDIQ) self scoring contracts that are out there that that favor the small business category or the very large businesses. If you are not an Alliant prime in one of the categories, you basically are excluded from a lot of the market, including your existing customers that are moving to best-in-class vehicles,” said Doug Sickler, the chief growth officer for Pyramid Systems, an IT services company with approximately 200 employees, in an interview with Federal News Network. “We did research and wanted to have a fact-based discussion, really regarding some of the key requirements [of Alliant 3] that would exclude companies like ours and others. In our situation, scoring well enough to be one of the 60 companies to receive this contract vehicle will be difficult with things like the past performance, the size of the past performance, which is really incongruent with the average size of the average Alliant task order and having an approved accounting system, which require not only that you have the accounting system but also that you have the contracts that require the audit because you can’t just request an audit out of the blue and have that done from the Defense Contract Audit Agency.”

RFP coming next spring

If you aren’t familiar with Alliant 3, it is the next great battleground for federal contractors. It portends to be one of the most sought-after governmentwide multiple award contracts of 2024.

GSA wrote on its Interact site that it expects to release the final RFP in spring 2024 after issuing a second draft RFP before the end of calendar year 2023.

“We had hoped to issue the RFP in 2023 after a single draft RFP, but as a result of feedback from the first draft, the one-on-one listening sessions, and other factors, changes were made to the solicitation that warrant the release of a full second draft RFP slated for before the end of the calendar year and a subsequent solicitation planned for spring 2024,” said Laura Stanton, the assistant commissioner for the Office of Information Technology Category in GSA’s Federal Acquisition Service, in an email to Federal News Network. “We will be holding a pre-proposal conference and taking other steps to ensure that all companies have equal access to information.”

Pyramid Systems joined with several “medium-sized” businesses to outline the potential challenges with Alliant 3 and develop recommendations for how GSA could improve the final RFP.

Sickler said part of the goal of the medium-sized group white paper is to shine a light on the current state of Alliant 2 and how GSA’s draft requirements do not seem to take them into account. There’s also the need to continue to push back against the “we need the best-of-the-best” type of thinking by agency acquisition leaders and contracting officers.

“That’s our whole argument is that they’re not getting us to the best when they compete these GWACs this way. What they’re getting is the biggest of them. They’re measuring volume, they’re measuring quantity and size. They’re not measuring quality, agility, innovativeness and those things that are more subjective, which are harder to draw concrete lines in the sand,” he said. “The default becomes just pure statistics of dollars, of employees and of size. It’s not necessarily an indication of the best of the best. If you really want the best of the best, then make sure those folks are available to bid on the task orders.”

The group is suggesting several things GSA could do to improve Alliant 3 to address what they see as a playing field tilted to small or very large businesses.

First, the coalition is encouraging GSA to expand the number of awardees from the initial plan of just 60.

“As witnessed during the life span of the Alliant 2 contract, significant (roughly 30%) market consolidation took place due to mergers and acquisitions. Without significant policy changes, the federal government should anticipate the market consolidation trend to continue and address this for Alliant 3. One practical solution would be to create a mandatory, annual on-ramp for new participants, with a goal of adding twenty percent (20%) of new awards over the life of the GWAC,” the white papers stated. “Currently, there is also no plan to allow for an on-ramp to Alliant 3, and there is currently no on-ramp to Alliant 2. Over the 10-year period of performance, this inhibits the government’s flexibility to source additional providers. This could include companies who grew from small to large during that period as well as commercial providers who decided to bring their innovative solutions to the federal sector.”

Kevin Cooley, the CEO of Resource Management Concepts, which also is an IT services company and has about 350 employees, said agencies too often limit the number of awardees because of inaccurate concerns of having too many bids per task orders.

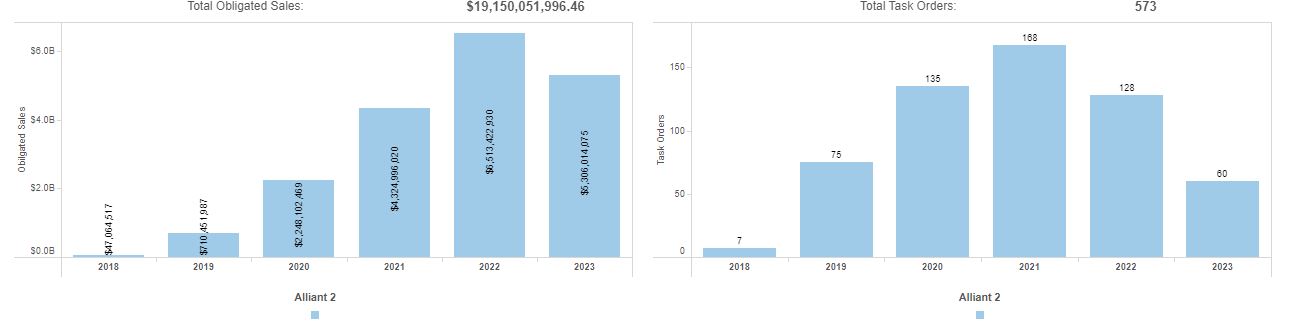

He pointed to how Alliant 2, with initially 61 awardees — now down to 41 because of the aforementioned M&A — averaged only 2.5 bids per task order. GSA’s schedule contracts with tens of thousands of vendors has seen similar numbers over the years.

“GSA probably needs to double the pool size on Alliant 3. They will not end up with 10 bids per task order. That’s not going to happen,” he said. “By doubling the number of awards on this to probably about 120, they get more medium-sized companies in there and it actually wouldn’t corrupt the GSA business model. They really can’t afford to have 2,000 contracts to manage because it drives their cost. But 200 would still be small enough to keep their costs manageable.”

A second suggestion is to change the past performance criteria for other-than-small businesses. The coalition says the current draft requirements do not give medium-sized businesses a chance to compete.

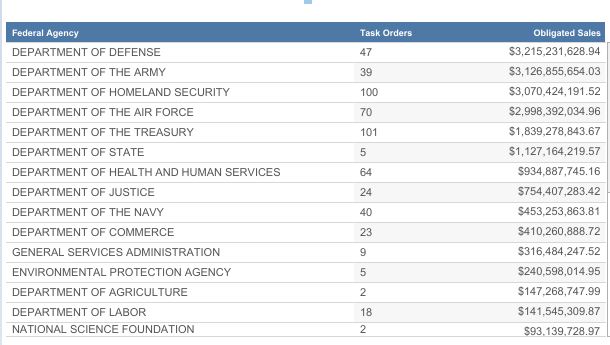

“As currently designed, a successful bidder on Alliant 3 will need a nearly perfect score. There are 10,500 points available if the bidder provides seven past performance examples, each with a $275 million contract value. This requirement effectively limits competition to only very large businesses,” the white paper stated. “[O]f the 517 task orders under Alliant 2, the average contract size is $84.38 million and 80%+ of the task orders are less than $85 million. Another example of the 517 task orders on Alliant 2, only 14% of the task orders are cost-based, yet the requirements for Alliant 3 include an accounting system approved by the Defense Contract Audit Agency (DCAA). Contractors cannot request this audit; it can only be received if the government asks DCAA to audit your system on their behalf.”

Cooley said most of Resource Management Concepts’ work is with the Navy and maybe 1% or 2% of all task orders the Navy puts out are above $200 million, meaning GSA set the past performance bar way too high.

“When you think about winning a spot on Alliant 3, you basically have to max your points, so getting points for all seven of those past performance examples,” he said. “They’re pretty darn rare in the big picture. So the idea that the mid-sized companies are going to go out and clean up six or seven of those, it’s ludicrous. It’s just not going to happen.”

The coalition recommends GSA set the minimum scoring line to 78% of total points and include an on-ramp for companies to earn their way on Alliant 3 in the future.

Additionally, the companies suggest creating pools of awardees based on revenue size:

- Under $50 million;

- $50 million-to-$150 million;

- $150 million-to-$250 million; and

- Over $250 million

Stanton said GSA has been heeding the feedback in the RFI and draft RFPs so far.

While she couldn’t offer too many specifics on the changes to Alliant 3 that are coming, she said they will publish the list of questions, answers and comments received on Alliant 3, and that they expect the changes GSA is making will be welcomed by businesses of various sizes.

“I’ll give you a couple of tangible examples that came out of the listening sessions. One company suggested that we add a technology area to the RFP in climate/environmental technology. We think this is a great suggestion and would distinguish Alliant 3 as the only one that offered something like this. We intend to act on this and to add a technology area to the RFP,” Stanton said. “Many medium-sized companies expressed a concern over the cost of completing a proposal. A number of companies wanted to get a feel for how many points are needed to get on the contract as they consider whether to put forward a proposal to prime, or seek a teaming relationship with a larger prime. To address this, we plan to issue some data in the RFI responses that will help to inform industry of the total available points for Alliant 2, and the lowest number of points earned that resulted in an award. While not an exact reflection of Alliant 3, it should give industry a good idea of the investment needed to get an award.”

It’s clear there are some real concerns about GSA’s current approach to Alliant 3. While everyone recognizes the final acquisition strategy is not set in stone, the signals are clear. It would behoove GSA to increase the number of awardees and relook at the past performance requirements as both seem to predestine Alliant 3 to protest purgatory.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED