The Office of Personnel Management took a step to address more immediate concerns from retiring federal employees, ahead of the agency’s long-term efforts to...

The Office of Personnel Management took a step to address more immediate concerns from retiring federal employees, ahead of the agency’s long-term efforts to modernize retirement services.

A new “retirement quick guide,” which OPM published Monday, aims to help federal employees and recent retirees better understand and navigate the current federal retirement process.

“This is a need right now,” Lori Amos, OPM’s deputy associate director for retirement services, told reporters Monday. “This is our current state — we’re paper-based. We need to manage expectations, we need to get information to our customers, because we don’t want them worried about their annuity payments. This is for today.”

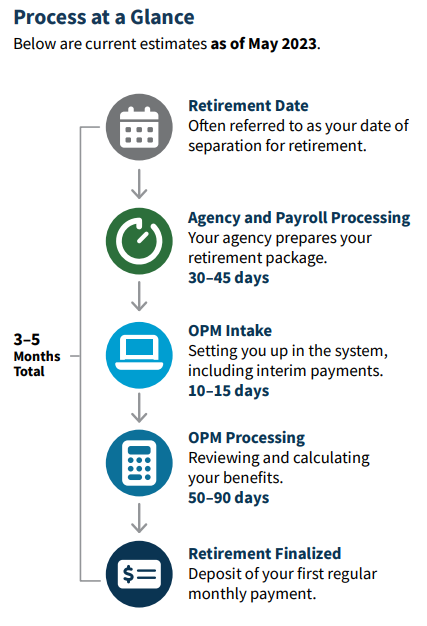

OPM’s retirement services division, the office through which all federal employees must eventually apply for retirement, has often received criticism for long wait periods to process retirement applications and clunky IT systems. Currently, it takes between three and five months, on average, for OPM to process a retirement claim — measuring from an employee’s official retirement date, to the date of the first retirement deposit into the individual’s bank account. In more extreme cases, federal employees may have to wait a year or more before receiving their first retirement deposit.

While not offering a definitive improvement to the processing time itself, OPM’s new guide aims to help feds get a clearer picture and timeline of the process, to help ease their transition to retirement. With the new guide, OPM said it hopes to proactively answer some of the more common questions about federal retirement, most notably, “what is the status of my retirement application?” Amos said.

Amos said the end goal for the new retirement guide is to reduce errors in applications, and by extension reduce the timeline to process retirement applications, as well as the backlog of pending retirement claims at OPM. The retirement backlog at OPM is on the decline, but still sits more than 7,000 cases above the agency’s steady-state goal of 13,000 pending claims.

“The guide explains to applicants exactly what’s needed. Or it gives them links to information so that they’ll know what’s needed. They’ll know the forms that they need to complete. They’ll know the forms that require a digital signature,” Amos said. “What we’re trying to do is pull together information that we’ve made available on the website. It’s critical information that’s needed, so that we have a complete package when [the application] gets to OPM.”

In the guide, federal employees can see an outline of the steps they should take prior to retirement, as well as links to more information about different benefits options and factors that may delay retirement processing. Some of the most common reasons for a delay are missing signatures or missing forms, especially if a retirement applicant worked at multiple different agencies during their career.

The guide also explains each step of the process from OPM’s perspective, and what happens to an application during each step. Federal employees will also find a list of links to more information, including a BENEFEDS overview, handbooks for CSRS and FERS retirement and a phone number to contact OPM’s Retirement Support Center. The guide combines and condenses information that previously sat on multiple different pages on OPM’s website. OPM developed the guide by considering the most frequently asked questions from prospective retirees, conducting focus groups and gathering feedback from recent retirees and benefits officers about retirement processing.

“What we learned in developing the guide is that most applicants don’t understand where their case is in the process or who has the case. They think that the case is here with OPM, but in the first 30 or 45 days, it’s still with their agency and the payroll centers,” Amos said. “By the time we were getting the applications, we recognized that there was a need for federal employees, those that are planning for retirement, so that they can plan ahead. This is information that they need to know before submitting that application.”

Amos said she hopes the guide will help employees understand at a more granular level who to reach out to with questions, based on the timeline for their application.

“What I’m hopeful for is that now, we have connected the dots between the three primary leads in this process — the agency, the employee and OPM,” Amos said.

The National Active and Retired Federal Employees (NARFE) Association, an advocacy group focused in part on retirement services for federal employees, said OPM’s new guide is a step in the right direction. It will likely help reduce confusion and uncertainty for retirement applicants, and may also reduce the number of calls into OPM from applicants seeking answers about the status of their claims, said John Hatton, NARFE’s staff vice president for policy and programs.

With extra time and resources likely becoming available, Hatton said he hopes OPM will turn its attention to the larger problems with retirement services, and go beyond just improving the communication around the current situation. Beyond an overview of the retirement process, Hatton said OPM should develop case tracking systems to communicate progress as it occurs — an effort that would prove more useful in the long-run.

“Rather than accept long processing times, we encourage process improvements and modernization, such as the use of an online retirement application integrated with OPM processing systems, to lessen them,” Hatton told Federal News Network.

OPM plans to update the new guide monthly. But to be able to provide real-time updates on the status of retirement applications, the agency would need to overhaul and modernize the retirement services system.

“We don’t have the system to be able to provide real-time status of individual cases — we’re still a paper-based process,” Amos said. “Until we’ve modernized and we have a case management system where we can track electronically where cases are located, we won’t be able to provide a unique real-time status for each case.”

Beyond this more immediate response to some of the common pain points for retiring federal employees, there are more long-term efforts at OPM to modernize retirement services as a whole. OPM’s budget request for fiscal 2024 includes increased funding for retirement services, to address legacy IT and make some large-scale changes.

OPM Chief Information Officer Guy Cavallo is planning to approach IT modernization in small bites. He said there will be a clearer plan for retirement services in the agency’s upcoming IT strategy for fiscal 2023 through 2026.

In the meantime, OPM has made other recent updates for retirement services to try to reduce the retirement backlog. The agency added a chatbot for users to ask and get answers to common questions, and increased staff in its retirement services call centers.

Once more modernization efforts begin to take effect, OPM can update the guide to reflect the changes — but the details of that are still up in the air.

“Once we start to embark on this IT modernization effort, we don’t know what this guide may look like. If it’s automated, this form itself could be digitized,” Amos said. “That’s to be determined, but I would hope that once our customers get accustomed to using this guide, and the information that’s on the guide, that we somehow can incorporate that into our future state.”

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Drew Friedman is a workforce, pay and benefits reporter for Federal News Network.

Follow @dfriedmanWFED