TSP funds bounce back in March, though S Fund remains in red

Most of the Thrift Savings Plan funds posted positive returns, bouncing back from a largely negative performance in February. The small cap stock index S fund was...

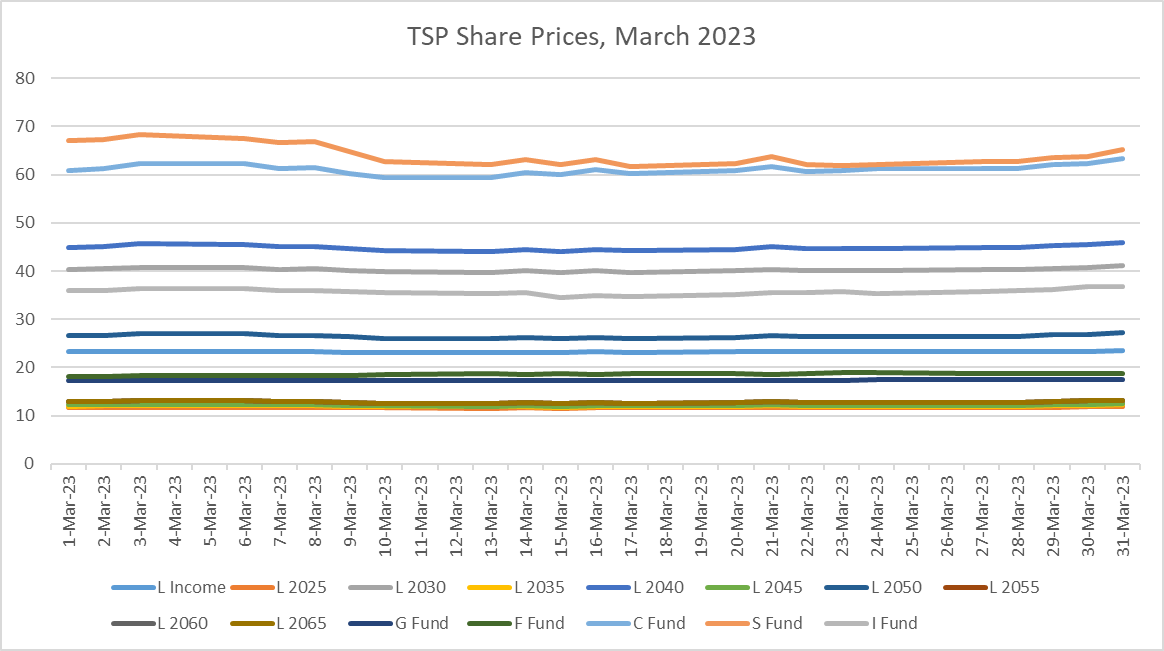

Most of the Thrift Savings Plan funds posted positive returns, bouncing back from a largely negative performance in February. The small cap stock index S fund was the only one to post a negative return in March, coming in at -2.90%. Its share prices dropped from $67.06 to $65.13. That also caused it to lose its status as the fund with the highest returns of 2023 so far, dropping from 9.01% in February to 5.85% in March.

The heir apparent to that title is the international stock index I fund; its March returns of 3.11% propelled it to first place in 2023 with a year-to-date return of 8.63%. It’s also the only fund besides the government securities investment G fund to post positive returns over the last 12 months, at 0.28%. The slow-but-steady G fund has returned 3.52% in the last twelve months, and in March its 0.35% returns placed it at 0.97% for the year so far.

The common stock index C fund turned in the highest returns in March, at 3.67%, with share prices rising from $60.79 to $63.32. That drove its year-to-date returns up to 7.49%.

The Lifestyle income funds all showed positive returns in March as well, though they’re all still in the red across the last 12 months.

| Thrift Savings Plan — March 2023 Returns | |||

|---|---|---|---|

| Fund | March | Year-to-Date | Last 12 Months |

| G fund | 0.35% | 0.97% | 3.52% |

| F fund | 2.55% | 3.14% | -4.56% |

| C fund | 3.67% | 7.49% | -7.76% |

| S fund | -2.90% | 5.85% | -14.00% |

| I fund | 3.11% | 8.63% | 0.28% |

| L Income | 1.05% | 2.76% | -0.73% |

| L 2025 | 1.38% | 3.72% | -0.73% |

| L 2030 | 1.87% | 5.19% | -2.09% |

| L 2035 | 2.01% | 5.60% | -2.73% |

| L 2040 | 2.14% | 6.00% | -3.34% |

| L 2045 | 2.24% | 6.34% | -3.91% |

| L 2050 | 2.34% | 6.67% | -4.42% |

| L 2055 | 2.54% | 7.67% | -5.68% |

| L 2060 | 2.55% | 7.67% | -5.69% |

| L 2065 | 2.55% | 7.68% | -5.69% |

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Daisy Thornton is Federal News Network’s digital managing editor. In addition to her editing responsibilities, she covers federal management, workforce and technology issues. She is also the commentary editor; email her your letters to the editor and pitches for contributed bylines.

Follow @dthorntonWFED