Va. congressman puts OPM on notice to find solution to skyrocketing long-term care costs

John Hancock Life & Health Insurance Company, OPM's provider for the Federal Long Term Care Program, said "a confluence of factors" led to the sudden and drasti...

Participants in the Federal Long Term Care program looking for relief from the startling premium increases won’t likely see it soon.

Instead, they’ll hear a lot of anger and confusion from members of the House Oversight and Government Reform Committee, which questioned the Office of Personnel Management and FLTCP vendor John Hancock Life & Health Insurance Company about why their constituents’ premiums went up by so much so quickly.

OPM currently does not have a proposal ready to make major changes to the Federal Long Term Care Program, and Congress offered no concrete solution either.

Yet OPM and John Hancock attributed the premiums to hikes to a few reasons.

First, John Hancock estimates about the program’s expected costs and returns changed twice as the company reviewed the FLTCP. The company’s actuaries and OPM itself reviewed the data.

“We had the confluence of two unfortunate factors,” said Mike Doughty, president and director of John Hancock Insurance. “We had higher long-term projection costs and we had lower long-term projected returns.”

Without a premium change, the long-term care fund itself would be in the red sometime by 2035 to 2040, Doughty said.

Second, older participants were submitting more claims, which lasted longer than John Hancock expected. As the company continued to review the data, it found that more people required long-term care for longer periods of time.

OPM announced in July that premiums could rise for policyholders by as much as 126 percent. The premium hikes were expected to affect 264,000 active and retired federal employees, who are expected to pay an average of $111 more per month for the same coverage they have now.

Yet the committee had a difficult time understanding why OPM chose not to raise premiums incrementally over a few years, or at the very least, why the agency did not better publicize its predictions about the future costs.

John O’Brien, director health care and insurance at OPM, said he stood behind the decision.

“Given the magnitude of the bad facts we had to deal with, it’s different to say, yes, give me [bigger] increases rather than give me 30 percent this year and then follow it up with 40 percent next year,” he said. “Then you have the situation … that people can make the 30 percent increase and they stretch to make their budget, but they can’t make the 40 percent increase. They’re in a circumstance where we have effectively made them pay extra money for a benefit they will not be able to take advantage [of].

Several Virginia-area lawmakers, including Reps. Barbara Comstock (R-Va.) and Don Beyer (D-Va.), were vocal in and perplexed by OPM’s decision to raise premiums all at once.

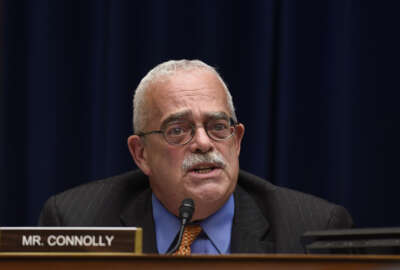

But perhaps the loudest was Rep. Gerry Connolly (D-Va.), the government operations subcommittee ranking member. He wanted to know what OPM plans to do in the future.

“We do not have a position that I can offer in terms of recommendations to this committee as far as what we think we should do to move forward in terms of addressing the problems with long-term care insurance,” O’Brien said. “I have found this hearing very, very helpful. There are a number of ideas and proposals and ways to deal with the challenges of the program, and we are wide open to working with this committee and all of these individuals on how we can come up with solutions.”

O’Brien said OPM did not have a timeline for when it might have a new proposal for the program.

Connolly wasn’t thrilled with that response.

“I’m going to use every influence I [have] to make sure you are summoned back to this subcommittee, and at that point, we will expect specific proposals,” he said. “You owe that to the federal employees and retirees who count on this product. You’re not a passive observer, just respond[ing] to the whims of the market with, ‘Oh my.’ You have an obligation to the people you serve. And you have an obligation to this Congress to come here with concrete ideas about how to ameliorate and resolve this issue, and we will expect that next time we see you, sir.”

The National Active and Retired Federal Employees Association (NARFE) has a few ideas of its own for improving the FLTCP and submitted them to the committee. Richard Thissen, NARFE national president, suggested creating a public-private partnership to study catastrophic protection insurance.

“It looks at ways to encourage more individuals to purchase long-term care insurance, because the wider we can spread the risk, the wider we can spread the pool, it just helps everybody,” he said.

Without more people, particularly young, healthy federal employees enrolled in the program, prices under the FLTCP will likely go up. The baby boomer generation is growing older, and it’s an expensive population to cover, said Marc Cohen, director of the Center for Long Term Care Services and Supports at the University of Massachusetts.

And more companies are also choosing to leave the long-term care business altogether. John Hancock itself decided that it would no longer offer stand-alone long-term care policies for individuals, the because the demand for coverage is dropping.

“The primary issue — because you[‘ll] see sales have come down — is because of pricing,” Doughty said. “I do believe there’s still a reluctance for young people to think about long-term care.”

Cohen said long-term care coverage itself needs to be structured, and organizations need to better educate young people about the benefits of purchasing long-term care.

“It’s a cost issue; they don’t see the value proposition,” he said. “If you don’t believe you’re at risk, if you believe that public programs are going to cover you, then why would you lay out the money? There’s a lot of work that needs to be done in that regard.”

Without a broader pool of people, long-term care prices across the entire space are likely to increase, Doughty acknowledged.

“Premiums will go as the need and cost of long-term go up,” he said. “This is a relatively young product and we started with very little experience. As we gather additional data, we should be able to get better, but not perfect, at predicting what those costs will be.”

As John Hancock insists it will have better data if and when it bids on the next contract from OPM in 2023, lawmakers largely said they wanted to see the agency approach the issue differently in the future.

OPM last awarded a contract for these services to John Hancock in 2009, when premiums rose on average by 17 percent and as much as 25 percent overall. The agency is required by law to issue a new contract every seven years, and Congress held a similar hearing on the topic then as well.

That’s of particular concern for Beyer, who said his office’s phone “was ringing off the hook” with calls from federal employees worried that they’d have to pay $111 more per month — at the very least.

“We really need a commitment from you to do things differently, less the 2016 hearing be like the 2009 hearing, and we’re back here again in 2023 tearing our hair out again,” Beyer said.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED