Timing, technology converge to better attack improper payments

Over the last three years, agencies understood the problem better, improved how they tracked the information and used advanced data analysis tools to lower the...

wfedstaff | April 17, 2015 4:08 pm

Sometimes the timing of an initiative makes all the difference. The Obama administration’s decision and approach to tackling improper payments came when agency maturity, data and technology all converged.

Over the last three years, agencies took advantage of all three of these — understanding the problem, better tracking of the information and advanced data analysis tools — to lower the governmentwide rate to 4.69 percent from 5.42 percent in 2009. While the amount of money improperly paid out hit a high of $125 billion in 2010, Danny Werfel, the Office of Management and Budget’s controller, expects it to drop for a second consecutive year, below the $115 billion mark in 2011.

“We are at a place now where we are leveraging technology to address improper payments that we didn’t and couldn’t do before,” Werfel said in an interview with Federal News Radio. “We are pulling better data. We know what to do with the data and how to ask for it. And we are getting better at forensic analysis, including looking for trends and looking for anomalies.”

For these and other reasons, Federal News Radio is rating the Obama administration’s efforts to address fraud, waste and abuse, and specifically improper payments, as effective as part of our special week-long multimedia series, The Obama Impact: Evaluating the Last Four Years. Throughout the series, Federal News Radio examines 23 different ideas and initiatives instituted by the Obama Administration and ranks them as effective, ineffective and more progress needed.

| Why Reducing Improper Payments was rated effective |

| Reason #1: Recovery.gov established in 2009

Reason #2: Government Accountability and Transparency board formed after success of RAT board. Reason #3: Websites help root out payment inaccuracies (More primary source material available on The Obama Impact Resource Page) |

Two critical steps

The Obama administration took two critical steps to set the tone for reducing governmentwide improper payments.

First, President Obama issued an executive order in November 2009 as the initial piece of the Accountable Government Initiative. The order required agencies to name a political appointee to be in charge of the agency’s efforts to reduce waste fraud and abuse.

Second, with help from Congress, the White House got an updated law to increase the pressure on agencies to fix these long-standing problems.

In 2002, Congress passed the first version of the improper payments act requiring agencies to begin to understand the problem. Agencies only started to report these problems in 2004, Werfel said.

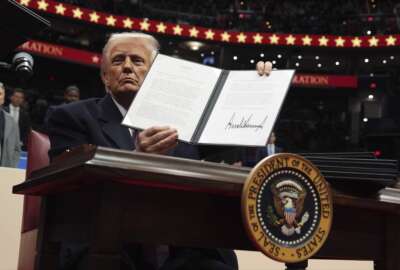

When President Barack Obama signed the 2010 updated improper payments law, he set steep goals for the government.

“I directed our federal agencies to launch rigorous audits conducted by auditors who are paid based on how many abuses or errors they uncover. The more they find, the more money they make. So they are highly incentivized,” said the President when he signed the Improper Payments Elimination and Recovery Act in November 2010. “We also are creating a Do-Not-Pay list, a consolidated database of every individual or company that is ineligible for federal payments. Before checks are mailed, agencies will be required to check this list to make sure that the payment is to the right person, in the right amount and for the right reasons. With these new tools, the challenge I’m making to my team today is to reduce improper payments by $50 billion between now and 2012.”

Since then, Werfel said agencies have reduced improper payments by $20 billion, and he’s hopeful by the end of 2012, will come closer to the President’s goal.

“Those major programs that are making up improper payments, programs like Medicare and Medicaid, Supplemental Nutrition Assistance Program, the Earned Income Tax Credit and the Social Security programs, in almost every single case, those programs errors rates on the decline,” he said. “Obviously, we have more work to do to achieve the President’s bold goal of $50 billion, but the numbers certainly are trending in the right direction.”

Text continues after chart.

|

This chart shows the governmentwide improper payment goal for fiscal years 2009-20014. Source: PaymentAccuracy.gov |

More than just improper payments

The administration’s focus on waste, fraud and abuse wasn’t solely about improper payments. Werfel said progress in getting rid of unused or underutilized real property, reducing unnecessary administrative expenses and limiting the use of high risk contract types also is real.

He said the President set a goal to reduce administrative spending by $8 billion.

“We just reported our second quarter results for the year and that second quarter results showed our spend rate from the second quarter of this year versus the second quarter of 2010 is $2 billion less in those categories,” he said. “The agencies are taking this very seriously, and they are looking for ways to change our behavior.”

Werfel said examples of these efforts are clear from strategic sourcing to renegotiating leases to figuring out how to travel less.

But it was one of the administration’s signature initiatives that really had the biggest impact on its efforts to affect this long-standing problem.

The Recovery Act showed how technology, data and the need for transparency can change the culture.

Kathleen Tighe, the Recovery Accountability and Transparency (RAT) Board’s chairwoman, said several efforts by the Recovery Board laid a new path for not just recovering, but stopping improper payments.

|

“The area we are most known for clearly is our recovery operations center, which is a data analytics function that we’ve developed that takes open source data, government databases and other sorts of databases and we have mashed them up with the Recovery data,” she said. “We’ve been able to do some interesting work looking at areas that would lead to looking at areas for improper payments and general fraud issues.”

Oversight, training just as important as IT

Along with using data and technology innovatively, the RAT Board got ahead of the oversight curve too.

“The IGs who are members of the board plus all the Inspectors Generals whose agencies got recovery money got boots on the ground at the start of Recovery to look at controls agencies had in place before much Recovery money went out,” Tighe said. “I think they were pretty successful in helping agencies fine tune those controls before a lot of money went out.”

She added training by IGs on reporting requirements, and detecting and preventing fraud of 150,000 federal and state officials has made a huge difference.

Tighe, who also is the Education’s Department’s IG, said training of grant officers on fraud detection and prevention paid off almost immediately at her agency.

“Within a couple of days after our training, a grant officer went back to their desk and was looking at a grant application and thought, based on their training, that it looked funny and brought it to us,” she said. “Two years after that we had a successful prosecution of person for a phone grant fraud application that saved $3.5 million.”

Earl Devaney, the former board chairman of the Recovery Board and a former Interior Department inspector general, said the board’s success has opened the door for a broad discussion on not just recovering improper payments, but around prevention.

Lessons learned being applied by the GAT Board

The White House expanded the concept of the Recovery Board to create the Government Accountability and Transparency (GAT) Board.

Led by Richard Ginman, the Defense Department’s director of procurement policy, the board will focus on non-recovery act spending.

DeVaney said the GAT Board needs to follow in the steps of the Recovery Board when it comes to the tools and techniques.

“We learned transparency is a force multiplier of accountability. What I mean by that is the rather low fraud, waste and abuse, in my opinion, has a lot to do with the transparency of that money,” DeVaney said. “There was so much sunshine on that money the bad guys stayed away and spent their time stealing, let’s say, Medicare money, which they’ve always been successful at.”

He added moving forward whenever there is an accountability platform, it needs to be accompanied by a transparency platform at the same time.

“I think whatever platform the government builds, whether it keeps the Recovery platform or builds another one somewhere else, it should provide equal access to both the enforcers and the agencies,” Devaney said. “I think our move to preventing fraud, waste and abuse as opposed to our old paradigm of simply detecting fraud, waste and abuse is the way to go in the future.”

Devaney said the most telling factor in just how committed the administration is to making a more than just a dent in the fraud, waste and abuse is how quickly and how much the GAT Board adopts the Recovery’s Boards technology and builds on their experience.

Werfel, who is a member of the GAT Board, recognizes the board’s role in keeping the momentum moving forward. He said the GAT Board will try to solve some of the most pressing problems exposed by the Recovery Board.

“We are realizing there are discrete steps we can take to standardize our award process and the business rules surrounding out award processes that will have major return on investment for transparency. That is part of what we are doing right now,” he said. “We also are doing a lot of work in terms of fraud detection because the Recovery Board had such great success in developing sophisticated fraud technology, which we are learning a lot of lessons from.”

New tools for available

That fraud technology is part of the Do Not Pay list OMB launched in April.

Werfel said agencies are using the tool, and he said the GAT Board will have a more concrete timeline to standardize data and spending transparency in the coming months.

Werfel, the Government Accountability Office and lawmakers fully recognize there still is a ways to go to reduce improper payments.

But GAO has testified several times over the last two years about the administration’s efforts and says there are positive signs.

Beryl Davis, GAO’s director of financial management and assurance issues, told Federal News Radio in February that the use of preventive controls, data matching and data sharing have been very important to reduce improper payments.

Auditors say there has been no independent verification of OMB’s claims of reductions in or recover of improper payments. But GAO has said many times the steps agencies are taking are among the best practices for rooting out waste fraud and abuse.

Devaney said he’d give the administration an “A” or “B” and overall they have done a good job in reducing improper payments.

“The tools that are available today, if I had the opportunity to use some of the tools we have in the Recovery operations center, I could have saved myself an awful lot of knocking on doors and pounding the beat in the old days,” he said. “It’s a brave new world for investigators. We were handing investigators out of the Recovery Operations Center the cases on a platter. They didn’t have to do any of the preliminary work or have to do any of the link analysis, we did it for them, and the speed at which it’s done today with the new technologies is mind boggling. When we initially started the Recovery program, it used to take an analyst, after it was first flagged, five days. When I left three years later, we cut that down to five hours. It is remarkable.”

More from the special report, The Obama Impact: Evaluating the Last Four Years

Part 1: Evaluating the Obama administration’s management initiatives

Part 2: Evaluating Obama’s technology reforms

Part 3: Evaluating Obama’s workforce initiatives

Part 4: Evaluating Obama’s acquisition efforts

Part 5A: What would a second-term for President Obama mean for feds?

Part 5B: What would a Romney presidency mean for federal workers?

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED