OPM announces new long-term care insurance plan option

The Office of Personnel Management has launched Federal Long-Term Care Insurance Program 3.0, a new plan option and rate structure designed to keep premium rates...

Federal employees and annuitants now have a new long term care insurance option.

The Office of Personnel Management earlier this week launched a new plan and rate structure under the Federal Long Term Care Insurance Program.

The new plan, called FLTCIP 3.0, is available to federal and Postal Service employees, annuitants, active and retired military members and qualified relatives who apply for coverage on or after Oct. 21, 2019.

Current long-term care insurance participants aren’t impacted by the new plan or rate structure, Long Term Care Partners, the company that administers the FLTCIP on behalf of the John Hancock Life and Health Insurance Company, said.

FLTCIP 3.0 emphasizes home and community care services.

Notably, the new plan includes what Long Term Care Partners have described as a “premium stabilization feature” (PSF). The feature is supposed to reduce the need for future premium increases, which, as current FLTCIP participants can attest to, have risen dramatically in recent years.

Under this feature, the premium stabilization amount will be calculated as a percentage of premiums paid under the FLTCIP 3.0 group policy.

This amount can be used to offset an enrollee’s future premium payments under specific conditions or will provide a refund of a premium death benefit. This amount can be changed at any time, and OPM must change the PSF percentage. Enrollees will be notified of these changes, according to Long Term Care Partners.

Premium payments may be offset by as much as 50% when the participant has reached age 85 and has been enrolled in 3.0 for at least 10 years.

In addition, the participant must have enough PSF available to pay 50% of his or her monthly premium. Participants can ask to stop the premium offset by contacting the program in writing.

Long-term care insurance premiums rose as much as 126% the last time OPM re-competed its contract for the program back in 2016. The premium hikes affected roughly 264,000 active and retired federal employees, who are paying an average of $111 more per month for the same coverage they had in previous years.

With the current pace of change in the long-term care insurance market, FLTCIP participants could see even higher premiums in the future, the OPM’s inspector general said last year. Premiums rose the previous time OPM re-competed its long-term care contract in 2009, but the increases weren’t as dramatic.

The IG said in 2018 it wanted to see more formal plans and preparations for what it described as “fast-paced change” in the long-term market.

OPM last year said it was considering new product and plan options for the FLTCIP, but Congress would have to authorize more significant changes to the long-term care program in the future.

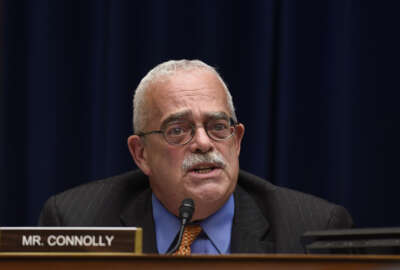

OPM’s premium rate announcement back in 2016 angered members of Congress on both sides aisle. The agency is required by law to issue a new contract for the long term care program every seven years.

The last fixed-price contract award went to John Hancock, the only bidder. John Hancock itself stopped selling group long-term care insurance plans back in 2010 and individual policies in 2016. It only administers the FLTCIP, and its current contract with OPM will expire in 2023.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Nicole Ogrysko is a reporter for Federal News Network focusing on the federal workforce and federal pay and benefits.

Follow @nogryskoWFED