Maryland Democrat wants to bring retirement contribution back to 2012 levels for all feds

Rep. Anthony Brown (D-Md.) introduced the Federal Employee Pension Act of 2017 to reduce the mandatory 4.4 percent pension contributions by new federal employees.

Another local congressman is trying another approach to convince his colleagues to give some federal employees more money in fiscal 2018.

Rep. Anthony Brown (D-Md.) introduced the Federal Employee Pension Act of 2017 that would repeal sections of the Middle-Class Tax Relief and Job Creation Act of 2012 and the Bipartisan Budget Act of 2013 that raised mandatory pension contributions of new federal employees to 4.4 percent.

By repealing specific provisions, federal employee pension contributions would roll back to 2012 levels, which set a mandatory contribution amount to 0.8 percent.

Brown said this would expand the net take-home pay for federal workers.

“Congress cannot continue to squeeze these middle-class, hardworking public servants to try and balance the budget,” Brown said in a release. “These workers are not the drivers of our debt, and targeting them for benefit and pay cuts is wrong. If we continue to treat them unfairly, it will become more and more difficult to recruit and retain a 21st century workforce. The American people deserve and need the best and brightest working for them.”

Twenty lawmakers are co-sponsoring the bill, including Reps. Elijah Cummings (D-Md.), ranking member of the Oversight and Government Reform Committee, Stephen Lynch (D-Mass.) and Jose Serrano (D-N.Y.).

As expected, federal employee unions strongly support Brown’s bill.

National Treasury Employees Union National President Tony Reardon said in a statement that employees hired since 2012 are paying more for the same benefits.

“This is blatantly unfair and essentially amounts to a selective tax on certain federal employees, and complicates federal agency recruitment,” he said in a statement. “We encourage Congress to pass this legislation and restore fairness to the system.”

“The federal retirement systems play no role whatsoever in the creation of the deficit,” J. David Cox, national president of the American Federation of Government Employees, said in a statement. “AFGE rejects the notion that there should be a trade-off between funding the agency programs to which federal employees have devoted their lives, and their own livelihoods.”

Richard Thissen, national president of the National Active and Retired Federal Employees Association (NARFE), added rolling back these provisions would be an important step toward stopping the practice of paying for other congressional priorities by reducing federal benefits.

“Our country needs a talented and experienced civil service to ensure the faithful execution of our laws and the delivery of services critical to hardworking taxpayers. Providing our public servants adequate compensation is about more than just fairness; it is about maintaining an efficient and effective federal government,” he said.

Brown’s bill comes as House Republican lawmakers on the Budget Committee proposed in its 2018 budget plan to increase how much federal employees are asked to contribute toward their retirement as a way to find hundreds of billions of dollars in mandatory spending cuts next year.

The committee’s resolution charges the Oversight and Government Reform Committee to develop legislative proposals that reduce the federal deficit by $32 billion over 10 years through reforms to civil service pensions.

Those proposals will call for higher contributions to their federal pensions and the removal of supplemental Social Security payments to employees who retire before age 62.

Brown’s bill builds on efforts by fellow Democratic lawmakers to give federal employees more money.

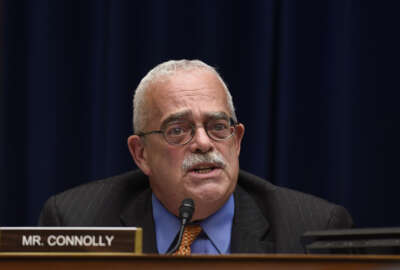

Earlier this year, Reps. Gerry Connolly (D-Va.) and Brian Schatz (D-Hawaii) introduced a bill to give federal employees a 3.2 percent pay raise in 2018 — a 2 percent pay increase plus a locality pay adjustment of 1.2 percent in 2018.

President Donald Trump proposed a 1.9 percent pay raise for 2018, and Congress, so far, has been silent on the request.

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED