SBA to end self-certification after watchdogs flag ineligible companies

With one in four dollars spent in federal contracts now going to small businesses, SBA is looking to give more teeth to the verification process for companies that...

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on Apple Podcasts or PodcastOne.

With one in four dollars spent in federal contracts now going to small businesses, the Small Business Administration is looking to give more teeth to the verification process for companies that claim to meet the criteria for this lucrative market.

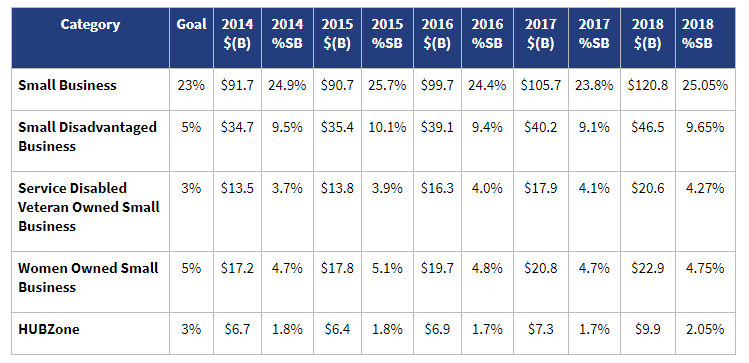

For the sixth year in a row, agencies exceeded SBA’s governmentwide small business contracting goal and spent more than $120 billion on small-business contracts, exceeding last year’s record by nearly $15 billion. Agencies awarded 25 percent of their contract spending to small businesses in fiscal 2018 and earned an overall ‘A’ rating on SBA’s annual small business scorecard.

But next year, SBA expects to have finalized a rule that would close a loophole that allowed for participants in SBA’s Women-Owned Small Business (WOSB) program to self-certify they’re eligible for the program, despite a provision in the 2015 National Defense Authorization Act mandating SBA to put an end to the self-certifications, as well as considerable scrutiny from watchdog offices.

The Government Accountability Office reported in March that about 40% of the WOSB-certified businesses in its audit sample were ineligible for the program. GAO had also expressed concerns about the performance of several third-party WOSB certifiers.

“As a result, SBA cannot provide reasonable assurance that WOSB program requirements are being met and that the program is meeting its goals,” GAO auditors wrote.

GAO’s numbers pale in comparison to what SBA’s Office of Inspector General found in its review of the WOSB program. During its June 2018 audit, the IG office found 50 of 56 sole-source contracts —or 89% — did not meet all of the criteria for the program.

“As a result, there was no assurance that these contracts were eligible to receive sole-source awards under the programs,” SBA OIG wrote.

Other small business set-aside programs have been vulnerable to improper payments as well. In 2013, eight contracting officials pleaded guilty in a scheme to apply for 8(a) contracts, set aside for small, disadvantaged business, valued at more than $153 million.

Robb Wong, SBA’s associate administrator of the Office of Government Contracting and Business Development, said moving to formal certification process will instill greater confidence and integrity into a program that had an “honor system” built in.

“Simply put, the wrong companies were receiving our contracts,” Wong said in an interview Tuesday to announce the scorecard results. “We want to make sure that, if a company receives a contract through these programs, they’re actually eligible to receive it.”

Related Stories

From 120 hours to 34 minutes, SBA transforms small business application processes

With the proposed rule underway, Wong said it would also be the “perfect time” to streamline the vetting processes for other set-aside programs, which each have different sets of eligibility criteria.

“The programs, when I came in, were being operated in a silo. You had that 8(a) program running in its silo and you had the [Historically Underutilized Business Zones] program operating in its silo. You have self-certifications in women-owned, which we’re doing differently than the self-certification for the service-disabled veteran. Now that we’re going to go to three formal certifications, it made sense, to me, to effectively unify all of the formal processes so that they run as similarly and as alike as possible,” Wong said.

GAO said SBA expects to have the change in place by January 2020, but with SBA going back-and-forth with Congress on what the set-aside screening will look like going forward, Wong said it would take about a year for changes in the rule to go into effect.

“We’re still working with them to find a version that they find acceptable,” he said about Congress.

Wong said the new certification process should help agencies meet SBA’s goal of having 5% of small business prime contracting come from women-owned small businesses. Agencies fell just short of that goal, just like last year, having spent only 4.75% on small-business contracts through women-owned companies.

“We’re very, very close in this regard to hitting that goal, so I think just some minor changes will at least allow us to hit the goal,” Wong said, pointing out a continued rise in the contract spending on women-owned small businesses. SBA reported $22.92 billion in contract spending on women-owned small businesses in 2018, $3 billion more than two years ago. “That shows continued steady growth in the program.”

Agencies also missed their prime contracting goals for HUBZone businesses, meeting only 2.05% of its 3% contract spending goal. Agencies did exceed their contracting goals for service-disabled, veteran-owned businesses and small disadvantaged business.

“The mantra that we’ve asked all of our staff to take a look at is we want to make these programs easier and more effective for not only the business owner, but for the government to use. If I had a magic wand, I want to make SBA-certified programs the first option for the contracting officer,” Wong said.

Acting SBA Administrator Chris Pilkerton said the scorecard helps demonstrates SBA’s role in supporting more than a million jobs across the country.

“Every contract that gets in the hands of a small business is a win-win for our nation, the entrepreneurs, their employees and the communities they support all across the country,” Pilkerton said in a statement.

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jory Heckman is a reporter at Federal News Network covering U.S. Postal Service, IRS, big data and technology issues.

Follow @jheckmanWFED