New data shines brighter light on merits, impacts of SBIR, STTR programs

Raj Sharma, the founder and CEO of the Public Spend Forum, said agencies are more willing to provide Phase 2 SBIR funding to promising technologies over the last...

When Congress renewed the Small Business Innovation Research (SBIR) program and the Small Business Technology Transfer (STTR) program last fall, a collective sigh of relief could be heard across the federal community.

While many experts expounded on the importance and value of SBIR and STTR, governmentwide data to drive home that point was difficult to find.

Raj Sharma, the founder and CEO of the Public Spend Forum, said there is new data that shines a brighter light on the SBIR and STTR programs maybe like never before.

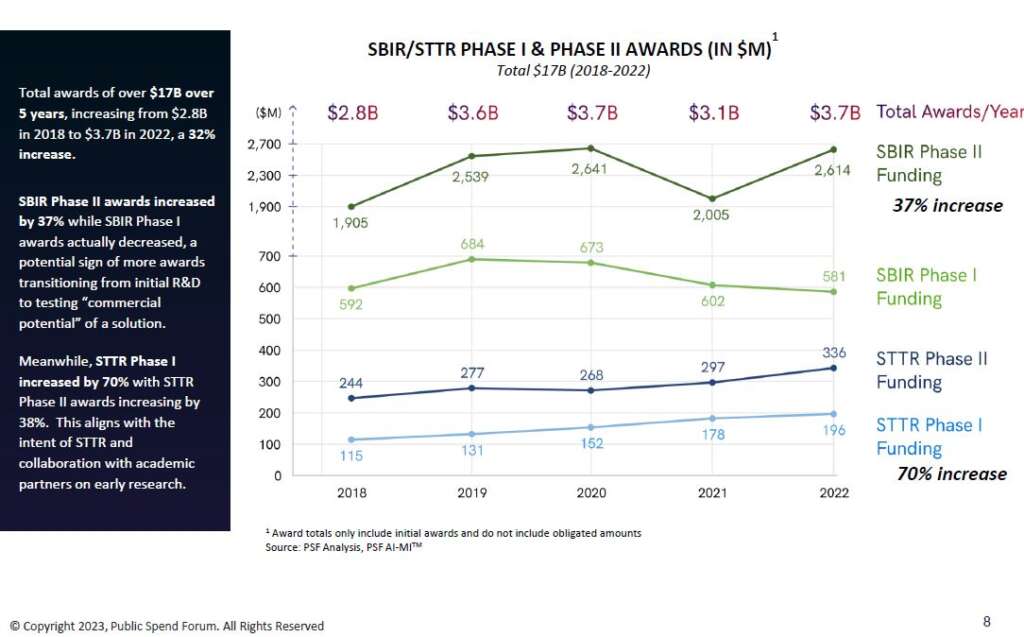

“The program has grown over the past few years from approximately $2.8 billion in 2018 to $3.7 billion now, which is great,” Sharma said in an interview with Federal News Network. “One interesting finding was that we’re seeing SBIR Phase 2 funding has increased 37%, while SBIR Phase 1 funding has stayed about the same. Why that matters? If you don’t know, the SBIR Phase 1 awards are smaller investments, a lot like what venture capital makes on experiments and prototyping and initial research, and then from Phase 1, you take in technologies or those experiments and say, ‘Okay, can we actually further develop them into Phase 2.’ I think that’s a good sign that phase 2 has grown by 37%, that means more of those technologies are being funded to grow and to further develop.”

It’s not just total funding, but where that funding is going. Sharma said the new report breaks down the data by category or sector, by agency and by location of where agencies are investing in companies.

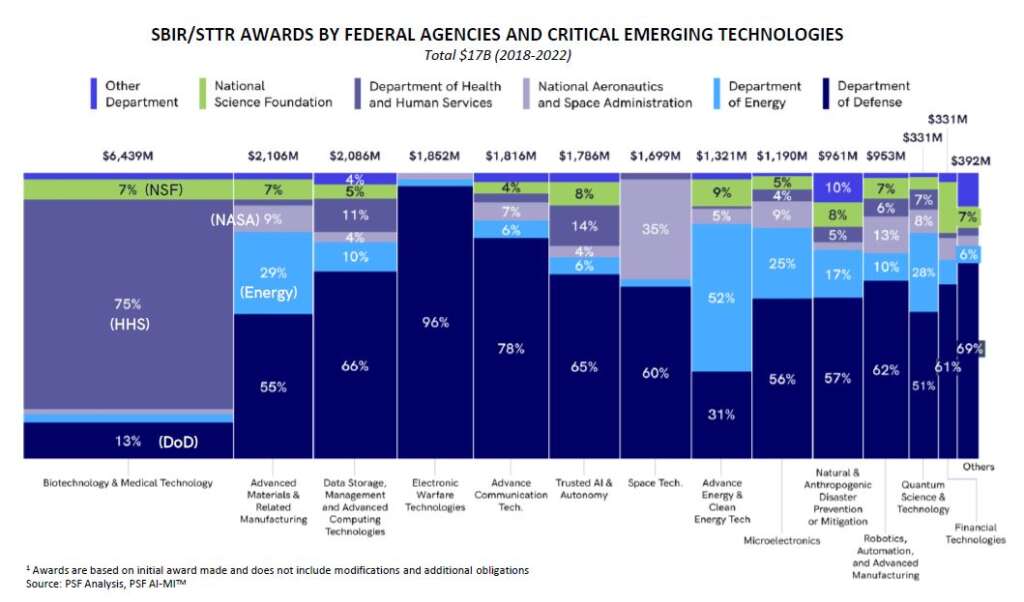

For example, Sharma said he was surprised by how much money agencies invested in biotechnology and medical technology, about $6.5 billion from 2018 to 2022.

It’s obvious the Department of Health and Human Services, for instance, invested in this area over the last three years for vaccine and drug development. But at the same time, Sharma said the level of funding has stayed fairly consistent.

“Some other categories like manufacturing related investments are a focus of the administration, and growing the manufacturing sector in the Defense Department and other agencies has seen about $3 billion collectively,” he said. “There are a number of other ones like energy, of course. We were surprised with a couple of other ones like microelectronics not being as large. But we see the growth coming in those areas because there’s so much focus on that. One of the most interesting things that we looked at was what investments were being made to solve which problems.”

The report — an executive summary of which is free to the public, but Public Spend Forum will charge a fee for a deeper dives into the information, including dashboards — comes from several different data sources. Sharma said typical federal databases like the Federal Procurement Data System, don’t provide enough detail to understand the breadth and depth of the SBIR and STTR programs.

“There’s been analysis done, but nobody’s looked at it by technology areas in terms of what types of technologies and problem sets are we funding. Nobody’s looking at how we are aligning those investments in a very detailed way. So that to us was the one fundamental question, how is technology and these investments aligned to solve problems and aim our policy objectives?” he said. “The other area we are looking at are success stories. We’re still diving deep into that to look at what are the types of successes and how do we replicate those more?”

The third area of focus in the report was on where are the regional clusters of innovation happening. Sharma said that’s an important data point because through the assortment of bills Congress passed over the last year, including the CHIPS Act, where the Commerce Department is funding a number of innovation hubs, knowing those cities and states where there are current or emerging clusters of innovation will be even more important. He said this is especially important for the Biden administration’s goal of ensuring equitable growth across the country.

For example, the report found California and Massachusetts received the most funding of any states at $3.5 billion and $1.9 billion, respectively, but Colorado is a hub for innovations around space technologies.

“I was pleasantly surprised by out of 10,000 companies, 40% self-identified as disadvantaged businesses. Our definition of underserved is broad, it’s not just minority communities or rural communities. There is a larger breakdown in some of our analysis and in our detailed report. That shows how many women-owned and how many self certified or certified businesses there are, which is one positive sign,” Sharma said. “If we’re going to grow an innovation economy, it can’t be just in four or five power centers or 10 power centers in the country. It has to be equitable growth.”

Sharma said knowing where the power centers are across the country also will help agencies focus on specific technology investments.

The report found agencies have been funding SBIR and STTR efforts in autonomy and artificial intelligence, robotics and advanced manufacturing and space technologies at an accelerated pace. Investments in autonomy and AI, for example, has increased by 248% since 2018 with DoD accounting for about 65% of all dollars.

The Public Spend Forum mapped out the clusters of SBIR investments around the country based on autonomy and AI funding awards with West Virginia and the Boston/New Hampshire areas receiving the most of any states.

“I think one interesting area is investments in natural disaster mitigation technology with what’s happening with climate and all the things you see lately whether it’s storms coming in or other climate events happening. We see some growth there,” Sharma said. “I think that’s one probably not so obvious and not always talked about. There’s some interesting technology, for instance, around natural disasters, whether it’s supply chain risk and technology that helps you predict a possible disaster through sensors or drones.”

Sharma said the next part of their research will focus on how companies are moving to Phase 3 of the SBIR and STTR program, commonly known as the “valley of the death.”

Many companies struggle to commercialize their technologies and the government doesn’t always follow up with contracts after the innovations get through Phase 2.

“It’s a little bit more difficult to understand Phase 3 because sometimes companies may go out and get a contract or they might get a follow on from the work that’s been done through Phase 2, but it’s not easy to find the relationship between the two things. So we’re working on that,” he said. “There are contracts that are clearly labeled Phase 3. But there are fears that we would under count a lot. I think that’s one of the issues when we start criticizing, or making critiques of the SBIR and STTR programs about without real data behind it.”

Sharma added the Public Spend Forum did find some interesting correlations between SBIR/STTR investments from the government and follow-on funding from the private sector.

“We found out of the 10,000 companies, 655 companies received more money by the way private capital. Now is the SBIR program the reason they got private capital? We’re not sure. But I think that’s a good thing to know,” he said. “We think that’s a validation and are among the positive signs that are coming out of these programs.”

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Jason Miller is executive editor of Federal News Network and directs news coverage on the people, policy and programs of the federal government.

Follow @jmillerWFED