New report recommends executive order to deal with DoD supply chain vulnerabilities

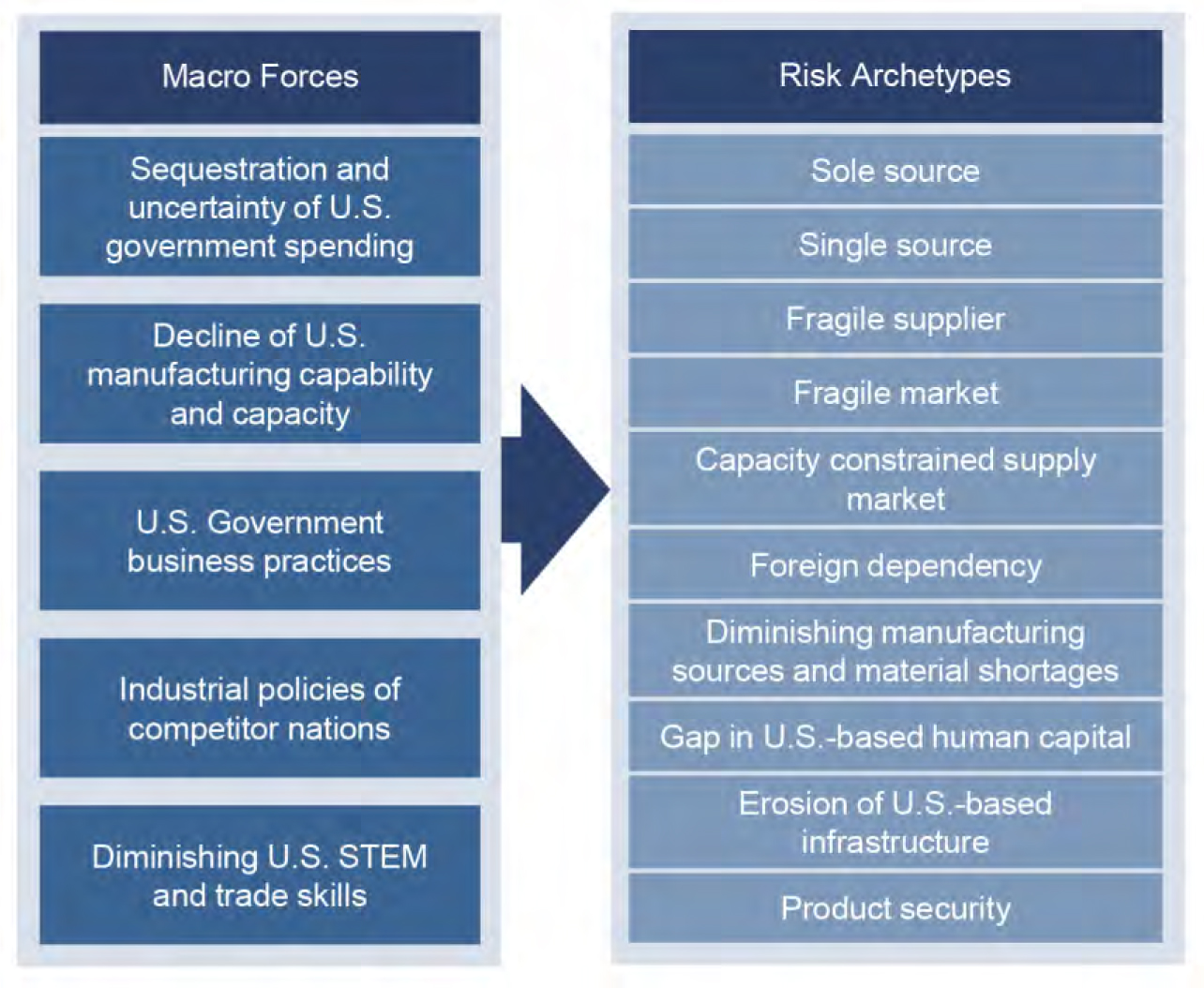

The report identifies five macro forces that influence 10 risk archetypes, each of which represents a threat to the stability and security of the defense industrial...

The secretary of Defense is calling for a new executive order to help shore up vulnerabilities in the Defense Department’s supply chain, a new report says. The report identifies five macro forces that influence 10 risk archetypes, each of which represents a threat to the stability and security of the defense industrial base.

“What we have, at the end of the day, is a situation where we’ve identified a number of vulnerabilities which demand immediate action,” said a senior administration official speaking with reporters on background. “With this report there’s also a blueprint for actions that will be launched immediately. Some of them we’ve already begun to do during the course of this report.”

A working group of more than 300 subject matter experts examined 16 sectors of the defense industrial base to identify these vulnerabilities. The macro forces they identified are major trends that affect the entire manufacturing and defense industry sectors, while the risk archetypes are specific ways those macro forces represent challenges to the supply chain.

Efforts are already under way to mitigate some of these threats. For the first time in 10 years, DoD is operating under a complete budget that was passed on time, not a continuing resolution. Budget uncertainty has made it extremely difficult for the defense industry to make large investments in upgrading capabilities, which means they’ve been unable to meet higher program capacities.

The report said DoD found 75 new programs it couldn’t execute in 2017 alone because of continuing resolutions.

“This is something that’s low hanging for our government and policymakers,” Corbin Evans, director of regulatory policy at the National Defense Industrial Association, a group that contributed to the report, told Federal News Network. “That they’re able to ensure that the department has a stable and predictable budget going forward, and that money comes in at a stable and predictable time, it really makes doing business throughout the defense industrial base so much easier because of the predictability involved with capital outlays, investment in research and development, in a way that you know you can get return on those investments, and that’s really important on the business side of the defense industrial base.”

Another issue laid out in the report that has already been receiving some attention is the dependency on foreign manufacturing for certain defense components coupled with the overall decline in American manufacturing capabilities.

For example, certain proprietary carbon fibers necessary for use in missiles, satellites and other space launches are only produced in Japan and Europe. Certain specialty chemicals used in rockets and other munitions are only produced in China. U.S. industry currently does not have the means to provide these components, and the time and money involved in duplicating these manufacturing capabilities would be considerable, if it’s even possible. So if DoD loses access to these markets for any reason, it loses the ability to field the capabilities that rely on these components.

In addition, dependency on foreign sources for critical components can open up the possibility for espionage, counterfeits and insufficient quality controls.

In other cases, certain critical components are available domestically from single or sole sources. Single sources are when multiple companies could provide a capability, but only one is qualified. Sole sources are when only one company can provide a capability. In either case, should that company fail, DoD would again lose the ability to field these capabilities.

The senior administration official told reporters that certain small investments are already underway to help address these vulnerabilities. The administration is using Defense Production Act Title III money, existing funds that haven’t seen use in previous administrations, to improve gaps in industrial spaces and expand manufacturing capabilities.

For example, a $1 million investment facilitated the opening of a new facility capable of producing a certain component for the Abrams tank, eliminating a single source vulnerability.

“That’s an example of doing something small that has a big payoff,” the official said. “Again, our focus is on the sub-tiers of our supply chain which is occupied by much smaller firms than you’re probably used to talking or thinking about.”

Another way to help mitigate this issue is by eliminating barriers for vendors to work with the government.

Latest Defense News

“Something that we really harp on is making it easier to do business across the board,” Corbin said. “Some of the procurement and acquisition policies that are suggested within this [report], streamlining those processes, removing regulation which makes it cumbersome or time intensive to do business with the government, removing some of those would certainly go a long way to achieve some of the goals of strengthening the defense industrial base that this report lays out.”

But one of the biggest issues that the report details that the government has yet to address is the gap in skilled labor. This takes two forms. First, the defense industry is competing with commercial industry for STEM talent, and the educational system simply isn’t producing enough science, technology, engineering and mathematics experts to fully meet the demand. Second, trade skills, such as machinists and welders, are increasingly in short supply.

The report includes a number of recommendations to deal with these and other vulnerabilities. In the report, the defense secretary recommends the use an executive order to direct DoD and the secretaries of Energy and Labor to implement all of these recommendations as soon as possible, and report on their progress within 180 days of the EO.

Industry experts like David Berteau, president and CEO of the Professional Services Council, called the report timely and agreed with both the findings and recommendations.

“Here we are in week two of a fiscal year in which the Defense Department and a number of other federal agencies are actually operating for the first time in a decade or more with a full appropriation having been passed rather than a continuing resolution. So if there’s any time to take action, this is it,” Berteau said.

But the report is also incomplete, Berteau said. It only looks at the manufacturing side; it doesn’t look at services. These could be anything from engineering and technical services to support, logistics and sustainment.

“One of the questions that would be important to answer is do the services side of contract support have the same vulnerabilities to the product side that the report does look at?” Berteau said. “Particularly, if you look at it from the point of view of competition with great powers, and you’re measuring either in terms of deterrence or your ability to actually execute military operations if that were to come to pass, you find that the short comings and the inadequate surge capacity, whether it be workforce or whether it be capacity or capabilities of the company or sustainment, you will run into trouble in any deterrence level or any actual execution of an operation far sooner from weaknesses on the services side than you would from an inadequate provision of components for major platforms. So both of those issues need to be wrestled with going forward.”

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Daisy Thornton is Federal News Network’s digital managing editor. In addition to her editing responsibilities, she covers federal management, workforce and technology issues. She is also the commentary editor; email her your letters to the editor and pitches for contributed bylines.

Follow @dthorntonWFED

Related Stories