High-5 would slam some high-flyer feds

Federal workers have worried that Congress will base their pensions on a less generous formula. Mike Causey says there's nothing to worry about ... yet.

For years, many federal workers have been fearful Congress would make a simple change in their retirement formula that would have a big impact on their lifetime annuity payments. Many people have said that if Congress actually approved it, they would retire before its effective date. Some were prepared to leave by Sept. 30, although no action has been taken.

The high-three to high-five proposal is back again on the legislative laundry list. And while it is true that it would have relatively little impact on the annuity of most federal workers, it could be a major kick in the benefits of upwardly mobile feds who get frequent promotions, pay and in-grade raises, and who relocate to cities with a higher federal pay scale.

The high-five is back again on the threat list. It’s part of a package from the Trump administration’s budget and House Republicans that would make bigger, longer-lasting cuts in future annuities even while workers would be required to contribute more to their FERS retirement package. One proposal would increase employee retirement contributions by 1 percent each year for six years. Another would have everyone kick in 4.4 percent. Currently, most FERS workers contribute only 0.8 percent to the retirement plan.

They also pay into Social Security.

Future FERS retirees would take their biggest hits under the proposal to eliminate cost-of-living adjustments entirely for FERS retirees, and shave 0.5 percent off future COLAs for CSRS and CSRS Offset retirees. Yet another nightmarish plan would eliminate any federal civil service pension for feds hired in the future. Their retirement benefits, like those of most private-sector workers, would be based on Social Security and Thrift Savings Plan contributions, which might be enhanced by the federal government. FERS workers can now qualify for a government match of up to 5 percent to their TSP accounts.

If past performance is any indicator, none of the changes will be approved as Congress struggles with yet another attempt to derail and replace the Affordable Care Act, come up with tax reform and deal with the Dec. 8 government spending deadline. But if it does take action on federal retirement benefits, and if it involves switching to the high-five formula, here are some numbers to consider.

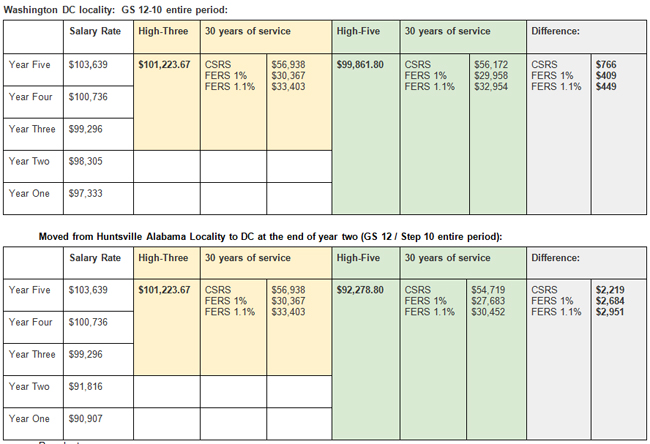

Benefits expert Tammy Flanagan looked at the impact of the high-three to high-five switch on two hypothetical federal workers. One is a D.C.-based fed who has gotten modest pay raises and no promotions in the five years prior to retirement. His/her salary goes from $97,333 to $103,639 during the five years prior to retirement. In her second example, the worker — same grade and step — starts out in Huntsville, Alabama, which has a lower pay scale than the metro Washington area. The Huntsville fed then transfers to D.C. during his/her last five years. The pay level automatically goes up and subsequent raises are higher too. The result: he or she could lose $2,219 per year from their CSRS annuity and between $2,684 and $2,951 if under FERS.

Tammy will be our guest this Wednesday on our Your Turn radio show. She’ll talk about the high-three vs. high-five, best dates to retire, etc. Listen if you can. That’s Wednesday, Sept. 27, at 10 a.m. EDT.

Here’s her high-three vs. high-five chart showing how it could make a big difference for some feds:

(Click here to view a larger version of the chart).

Pay Charts: DC 2017; DC 2016; DC 2014; DC 2015; DC 2013; Huntsville 2014; Huntsville 2013.

Nearly Useless Factoid

The way to make Superman villain Mr. Mxyzptik disappear is to trick him into saying or writing his name backwards.

Source: Wikipedia

Read more of Mike Causey’s Federal Report

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED