Too late to join the bull market party?

Financial planner Arthur Stein said investors who stuck with the stock market during the Great Recession and the rebound that followed have seen their account...

Thrift Savings Plan investors have been enjoying the longest bull market in U.S. stock market history. And while all good things must come to an end, nobody knows when that will be, how big the correction(s) will be and for how long. Financial planner Arthur Stein said investors who stuck with the stock market during the Great Recession and the rebound that followed have seen their account balances soar. Some of his long-time clients are now TSP millionaires.

Stein is today’s guest on the Your Turn radio show at 10 a.m. EDT at www.federalnewsradio.com and 1500 AM in the D.C. area. He’s going to talk about bull and bear markets, and what people should and should not be doing when investing for the long haul. He discusses when playing it “safe” can actually be dangerous to your long-term financial health.

If you have questions for him email mcausey@federalnewsradio.com before the show. For his take on the record long bull market, Stein said “If you hate to miss a party, then you really hate missing a bull market:”

”On August 22, US stocks (measured by the S&P 500 Index, the C Fund in the TSP) set a record — the longest ‘Bull Market’ in US history. The market has been increasing for 9.5 years without another 20% decline.”

“’Bull market’ and ‘bear market’ are common financial terms. A bull market is a 20% or greater gain from a previous stock market low. A bear market is a 20% or greater loss from a previous stock market high.”

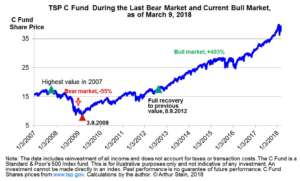

“The table below illustrates the share price value for the TSP C Fund (the S&P 500 stock fund) during the previous bear market and current bull market.”

The bear market began Oct. 10, 2007 and ended March 9, 2009, when stocks began increasing. The length of the bull market will continue to increase until there is a 20% decline from a previous high.

The 2007-2009 bear market was the worst since the end of World War II. Stock markets were down more than 50 percent from previous highs! Full recovery for a S&P 500 Index Fund (includes reinvested dividends) did not occur until Aug. 9 of 2012, almost 3.5 years after hitting bottom.

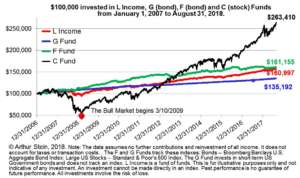

The chart below shows dollar returns for four TSP funds: G, F, C and the L Income Fund.

Note that the worst performing fund was G but it had no volatility, and the L Income and F (bond) funds had the same returns, outperforming the G Fund by 19 percent and had low volatility. The C (stock) Fund was the best performing but also the most volatile with the largest bear market decline.

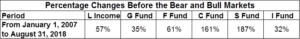

The table below details the increases from the beginning of 2007, not just from the lowest point.

If you withdrew your investments from the C and S funds before the declines began but did not reinvest at the right time, you were worse off than if you just left your funds invested. The exception being the I (international stock) fund, which was the worst performer over this longer period.

Nearly Useless Factoid

By Amelia Brust

The town of Santa Claus, Indiana, changed its name in 1856 from Santa Fe, which was already taken , to get its own post office. As a result many of the town’s street names are Christmas-themed, including Sled Run, Blitzen Lane and Melchior Drive.

Source: Wikipedia

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED