The TSP stock funds and the coming bear market

The current bull market is more than a decade old and is long overdue for a major correction. Financial planner Arthur Stein has plenty of federal clients and...

The Thrift Savings Plan’s 5.6 million investors come in all shapes, sizes and locations, and tolerance levels.

Some work for NASA, the IRS or CIA, some are staffers on Capitol Hill, some are senators or representatives. Others are retired from the Department of Homeland Security or the Federal Deposit Insurance Corporation. Some are uniformed members of the Army, Navy and Air Force. Many live in California, Florida, Maryland and Virginia while others are retired to Mexico, Greece or Ecuador.

Whatever their situation, the TSP — for those under the Federal Employees Retirement System — is expected to supply anywhere from 30%-50% of their income in retirement. Many are aware that the current bull market is more than a decade old and is long overdue for a major correction of 20%-30%, based on past precedent — maybe more. So what should people be doing, and not doing, with their TSP investments?

We asked Arthur Stein, a financial planner in the Washington, D.C. area with a lot of federal clients, for his thoughts. He joins me today on our Your Turn radio show at 10 a.m. EDT. Here’s what he said, and what we’ll be talking about today:

“’Keep on keeping on’ has been a frequently-used phrase in songs, from Len Chandler in 1964 to Bob Dylan in 1975 and others. It means continue doing what you were doing and perhaps do more. It is also a viable investment strategy: Sticking with a plan or goal, even when short-term results are poor.

“We are currently in the longest bull market in US history. Based upon historical averages, we are way overdue for a bear market, defined as a 20% or greater stock market decline — about six years overdue.

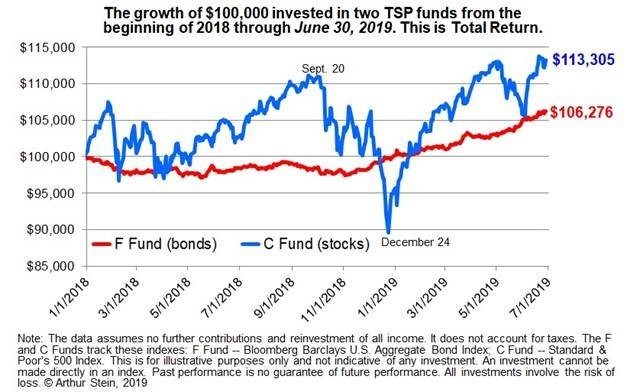

“Last December looked like the beginning of a bear market. The TSP C fund (S&P 500 Index stocks) hit a low on Dec. 24, a decline of 19% from the previous high. Merry Christmas! But then the C fund rebounded 26% and share prices are now 13% higher than Jan. 1, 2018. Other US stock markets showed similar patterns. TSP investors who staid invested in the stock funds (C, S and I), who kept on keeping on, were rewarded for their persistence.

“This graph is also illustrates bond market volatility. Over the last 18 months, F fund share prices fluctuated in value but the volatility was much less than for stocks. Also, the F fund declined for most of 2018. It then increased enough at the end of the year to be up 0.15% for 2018 and has continued to increase this year. Note that the G fund has no volatility and never declines.

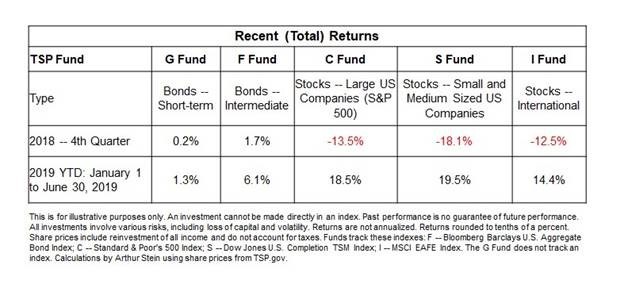

“The table below is another example of a sharp reversal of returns between fourth quarter 2018 and the first six months of 2019. Stocks were down significantly in the fourth quarter of 2018 and for that year. Then they reversed.

“The chart and table illustrate why stocks are not an appropriate investment to fund short-term goals; they are too volatile. Bonds and the TSP bond funds are appropriate to fund short-term goals and stabilize portfolios because they are less volatile. Unfortunately, bonds tend to lose purchasing power over long time periods.

“So ‘keeping on keeping on’ paid off over the last six months. However, we are overdue for a bear market and when it occurs the prices of the stock funds will sharply decline. The F fund may also decline. TSP investors need to be prepared for those declines.”

If you have questions for Art Stein send them before showtime to mcausey@federalnewsnetwork.com. Listen live at www.federalnewsnetwork.com or on 1500 AM in the D.C. area. The episode will be archived online.

Nearly Useless Factoid

By Amelia Brust

With a population of only about 785 people, the town of West Bend, Iowa, is home to The Grotto of Redemption, a shrine constructed by Rev. Paul Dobberstein, a Catholic priest, from materials collected over time. It is considered to be the world’s most complete man-made collection of minerals, fossils, shells, and petrifications in one place. Dobberstein spent the last 42 years of his life building the Grotto and Fr. Louis Greving took over its construction and maintenance until his death in 2002.

Source: West Bend Grotto

Copyright © 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Mike Causey is senior correspondent for Federal News Network and writes his daily Federal Report column on federal employees’ pay, benefits and retirement.

Follow @mcauseyWFED

Related Stories